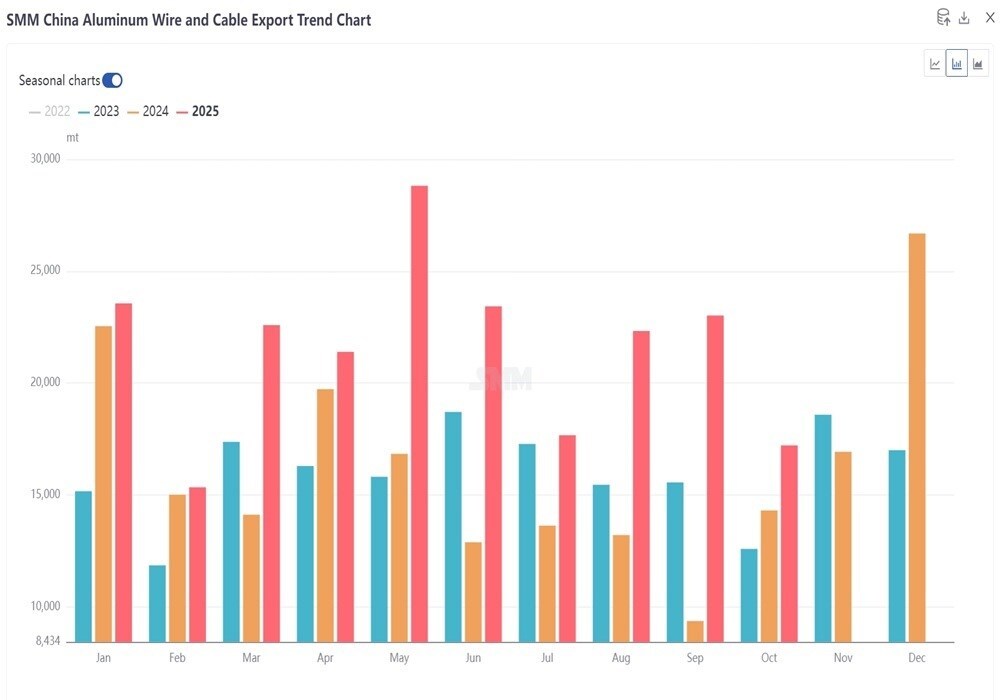

Customs data shows that China’s aluminium cable exports in October 2025 reached 17,200 tons, down 25.2 per cent month-over-month but up 20.3 per cent year-over-year. Cumulative exports from January to October 2025 totalled 215,000 tons, a 42 per cent increase compared to 151,600 tons during the same period in 2024. By product type, steel-reinforced aluminium stranded conductors accounted for 10,500 tons—down 33 per cent month-over-month but up 23 per cent year-over-year—while aluminium stranded conductors totalled 6,700 tons, a 10 per cent month-over-month decline but a 16 per cent year-over-year increase. (HS codes: 76141000, 76149000)

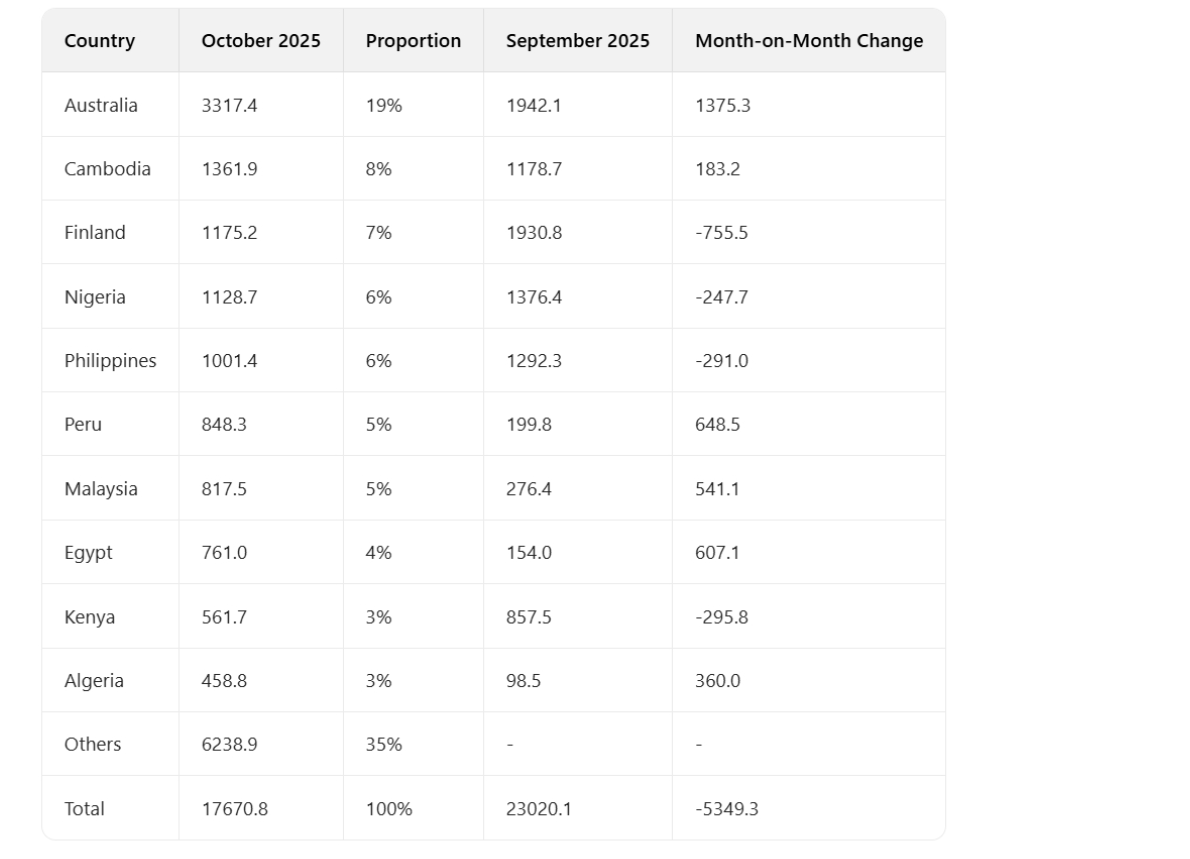

In October 2025, China’s aluminium cable export market underwent notable structural shifts. Australia emerged as the top destination with exports of 3,317.4 tons (19 per cent of total volume), surging by 1,375.3 tons from the previous month and becoming the largest incremental market. This growth was driven by Australia’s recently announced “Solar Sharer” initiative (officially unveiled on November 14, 2025), which will launch a “three hours of free electricity per day” policy in July 2026 to encourage consumption during peak solar generation periods. Coupled with the ongoing “Rewiring the Nation” national grid upgrade program—a AUD 20 billion initiative launched in 2022 and running through 2030—demand for high-conductivity aluminium cables has intensified significantly. Cambodia ranked second with 1,361.9 tons (8 per cent share), up 183.2 tons month-over-month, benefiting from its National Assembly’s approval of 27 new energy projects (including 13 solar plants), which accelerated grid infrastructure development. Meanwhile, Finland’s imports declined to 1,175.2 tons (7 per cent share), down 755.5 tons from September, reflecting a temporary adjustment in European markets. Overall, global trends toward renewable energy adoption and grid modernisation continue to drive demand, with Australia and Cambodia emerging as key growth markets, while Europe enters a phase of seasonal recalibration.

From a domestic regional perspective, China’s aluminium cable exports in October showed strong concentration. Henan Province led with 6,448.6 tons (37.5 per cent of total exports), a sharp month-over-month increase of 2,086.1 tons, making it the top exporting province. Jiangsu Province followed closely with 5,513.5 tons (32.0 per cent share), despite a month-over-month drop of 2,920.5 tons, maintaining its position thanks to its robust manufacturing base. Zhejiang Province ranked third with 1,029.8 tons (6 per cent share). Together, Henan and Jiangsu accounted for nearly 70 per cent of total exports, underscoring their role as the core pillars of China’s aluminium cable export capacity and highlighting significant industrial clustering effects.

SMM Commentary: Overall, China’s aluminium cable exports have maintained strong growth momentum in 2025. Exports from January to October reached 215,000 tons—already far exceeding the full-year 2024 total. Although October’s export volume dipped 25.2 per cent month-over-month to 17,200 tons, the 20.3 per cent year-over-year increase confirms resilient underlying overseas demand. Product-wise, the ratio of steel-reinforced aluminium stranded conductors to aluminium stranded conductors remained around 2:1 in October, clearly indicating that export growth is primarily fueled by overseas grid upgrades and renewable energy infrastructure projects. As countries worldwide strive to meet renewable energy targets, the road ahead for new energy installations and grid construction remains long, providing medium- to long-term support for China’s aluminium cable exports. Looking ahead to the final two months of 2025, exports may experience seasonal declines due to winter-related slowdowns in grid construction activities in certain regions. Nevertheless, on an annual basis, China’s total aluminium cable exports are well-positioned to approach or even surpass the 250,000-ton mark.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses