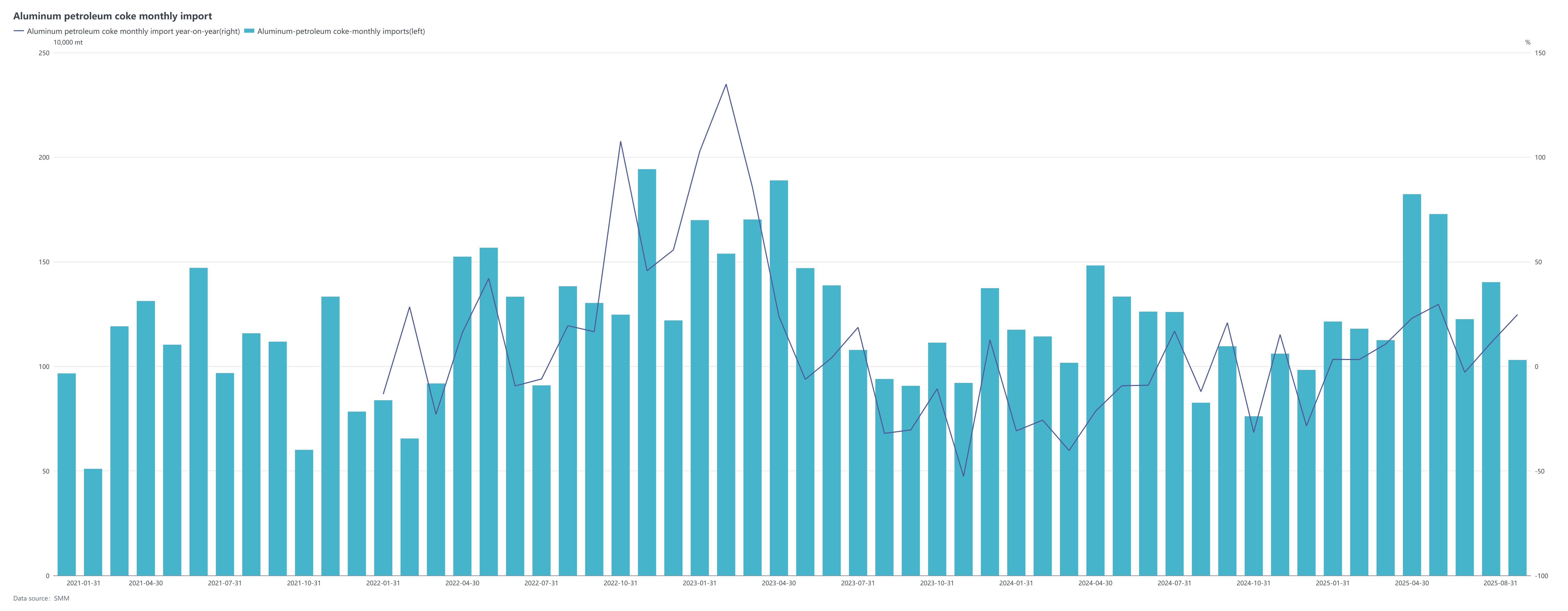

According to customs data, China's petroleum coke imports in August 2025 totalled 1.0304 million per tonne, down 26.53 per cent m-o-m but up 24.74 per cent y-o-y. The estimated import price of petroleum coke in August was USD199.06 per tonne, down 1.79 per cent m-o-m but up 30.45 per cent YoY. From January to August 2025, China's cumulative petroleum coke imports reached approximately 10.729 million per tonne, up 12.96 per cent YoY.

By source country, China's main petroleum coke import origins in August 2025 were Russia (319,300 per tonne, 31 per cent), the US (157,200 per tonne, 15 per cent), and Saudi Arabia (110,300 per tonne, 11 per cent).

On the import price front, petroleum coke import prices trended downward in August 2025, with the average import price at around USD 199.06 per tonne, down 1.79 per cent m-o-m. Imports were sourced from 17 countries per region, with 15 showing continuous import volumes: prices of petroleum coke from Azerbaijan, Indonesia, and Oman rose significantly, up over USD 130 per tonne m-o-m, while prices from Colombia and Argentina fell noticeably, down around USD 70 per tonne m-o-m.

In Q3 2025, both supply and demand in the domestic petroleum coke market worked in tandem, showing a clear recovery trend. On the demand side, stockpiling activity in the anode material industry improved significantly, coupled with reduced domestic supply of low-sulphur petroleum coke, driving strong performance for low-sulphur coke. Meanwhile, carbon used in aluminium production enterprises maintained just-in-time procurement, further boosting market sentiment.

Led by the supply-demand gap for low-sulphur coke, domestic petroleum coke prices diverged from import averages, with low-sulphur coke leading price increases, port shipments improving noticeably, and inventory officially entering a destocking phase. On the import side, although improved domestic demand supported moderate buying sentiment among traders in the overseas market, factors such as shipping schedules constrained Q3 petroleum coke imports, which are expected to decline m-o-m from Q2, with SMM estimating a drop of 25 per cent-30 per cent.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses