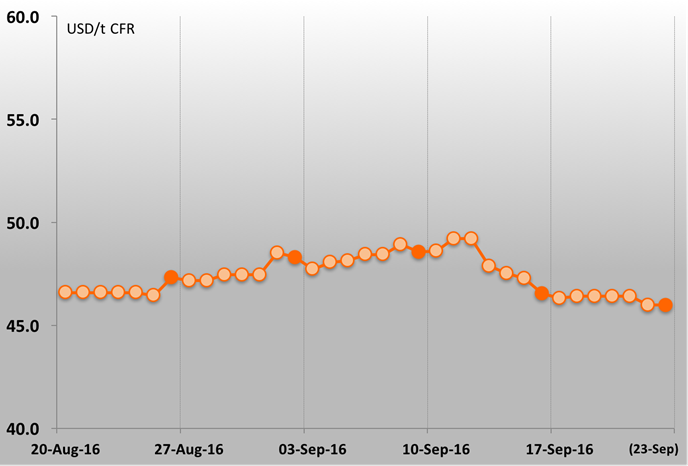

CBIX was down 1.2% (US$0.6/dmt), closing at US$46.0/dmt last week, with cargos originating in the Atlantic basin logged at lower prices than the previous week. With the situation in Malaysia now set to stagnate, prices remain unmoved, quoted at US$26/dmt unwashed and US$38/dmt FOB washed. Rising freight rates over the last few months have, however, translated to a slight increase in CFR prices for Malaysian bauxite, up approximately $US1/dmt over the period.

Chinese domestic alumina prices jumped, with the North up 4.5% (RMB89/t) to RMB2,083 /t (US$312/t including VAT) and the South, following the North’s lead, up 2.7% (RMB50/t) to RMB1,930/t (US$289/t including VAT). Last week's price rises are attributed to the same factors as last week; smelters looking to build stocks prior to the National Day week-long holiday commencing 1st October, some spot tightness in Henan and Shanxi, due to a shortage of freight capacity in delivering orders, and a significant volume of alumina having been forward sold.

{googleAdsense}

The Guinea-Shandong capesize rate jumped 15.4% (US$2.0/wmt) to US$14.7/wmt on the back of higher vessel timecharter rates, with bunker (fuel) prices essentially unmoved from last week. The North Australia - Shandong panamax rate remained at US$4.9/wmt. Rises in spot freight rates from beginning September are yet to significantly impact landed Guinea prices, due in part to the long travel time (>30 days).

{alcircleadd}

Responses