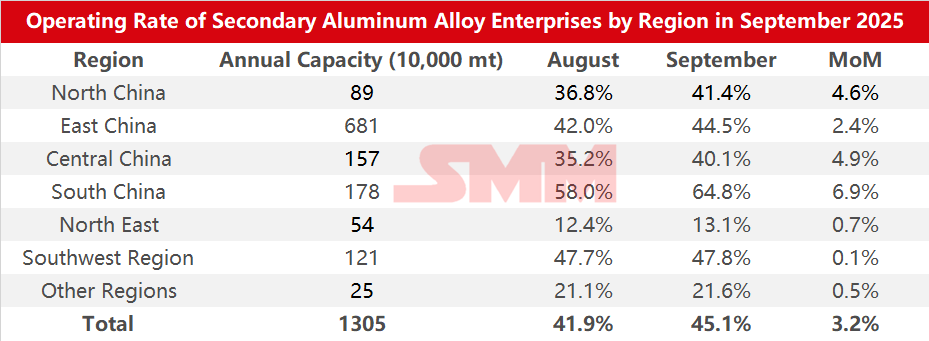

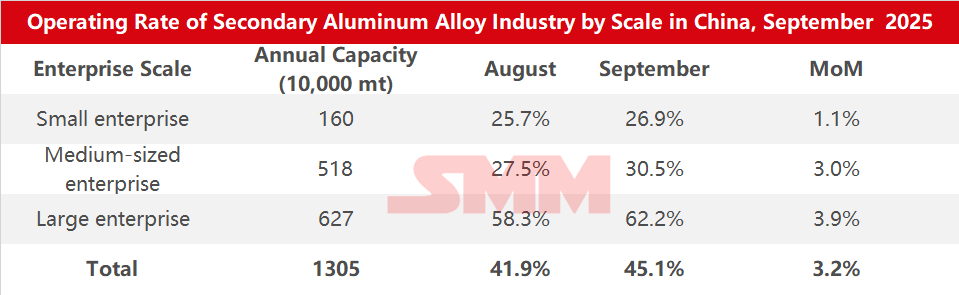

Survey data on operating rates of secondary aluminium alloy enterprises by region and scale in October 2025:

According to the SMM survey, the operating rate in the secondary aluminium industry rose by 3.2 percentage points MoM to 45.1per cent in September 2025, up 3.8 percentage points y-o-y.

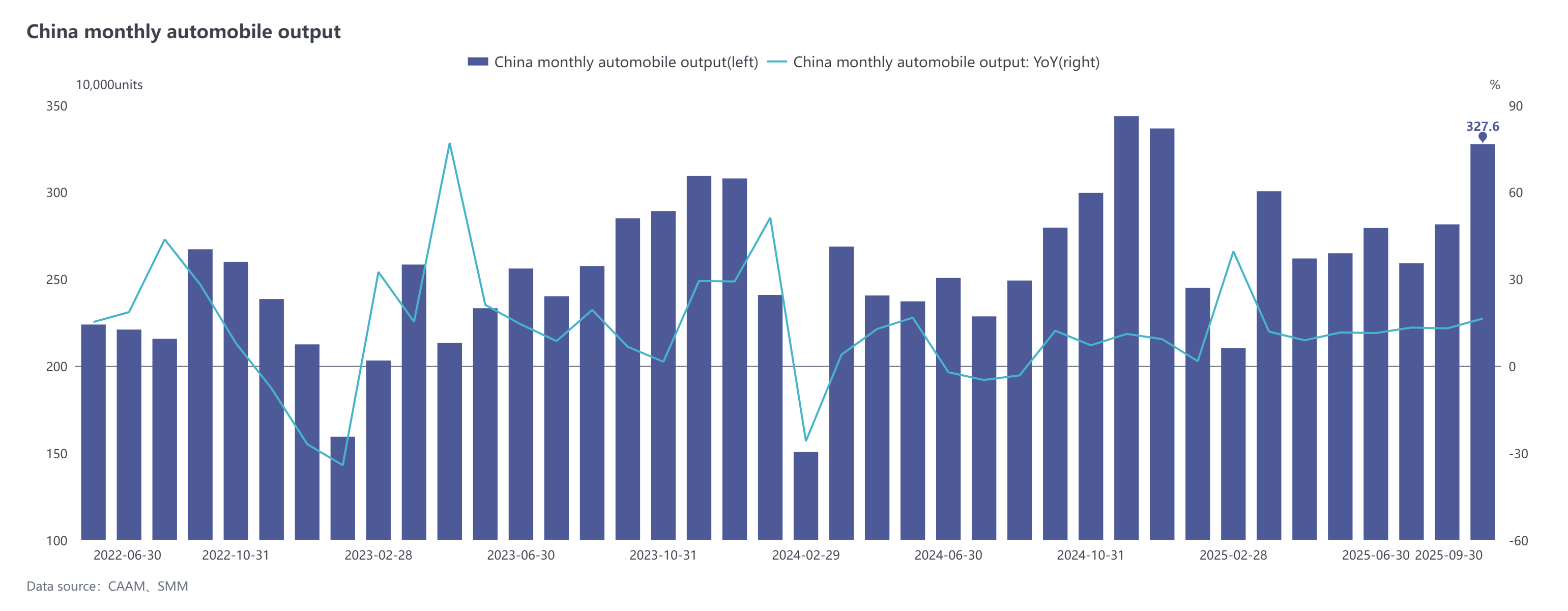

With improved end-use consumption in sectors such as automobiles, the operating rates of secondary aluminium plants, especially large ones, rebounded significantly, with orders related to aluminium liquid performing notably well. According to CAAM statistics, automobile production and sales in September reached 3.276 million units and 3.226 million units, up 16.4per cent and 12.9per cent M-o-M, and up 17.1per cent and 14.9per cent y-o-y, respectively.

Recently, the automotive trade-in policy continued to show effects, with some suspended regions resuming the policy. Positive progress has been made in comprehensive industry governance to address involution, local auto shows are in full swing, and enterprises are intensively launching new products. The overall automotive market maintained a favourable trend, with monthly y-o-y growth rates in production and sales exceeding 10per cent for five consecutive months. Moreover, new momentum accelerated, and foreign trade demonstrated resilience.

However, the growth in industry supply in September remained constrained by multiple factors, including tight raw material supply, policy uncertainties, and regional typhoon impacts. Among these, the supply deficit of aluminium scrap was particularly prominent, with the circulation of aluminium scrap remaining persistently tight. Market competition for goods drove prices to rise rapidly, forcing secondary aluminium enterprises to either purchase at high prices across regions or increase the proportion of wrought aluminium used. Although a mid-month correction in aluminium prices led to a marginal improvement in aluminium scrap circulation, the tight supply situation had not yet eased. Coupled with the concentrated release of stocking demand ahead of the month-end holiday, procurement pressure was further heightened.

However, the growth in industry supply in September remained constrained by multiple factors, including tight raw material supply, policy uncertainties, and regional typhoon impacts. Among these, the supply deficit of aluminium scrap was particularly prominent, with the circulation of aluminium scrap remaining persistently tight. Market competition for goods drove prices to rise rapidly, forcing secondary aluminium enterprises to either purchase at high prices across regions or increase the proportion of wrought aluminium used. Although a mid-month correction in aluminium prices led to a marginal improvement in aluminium scrap circulation, the tight supply situation had not yet eased. Coupled with the concentrated release of stocking demand ahead of the month-end holiday, procurement pressure was further heightened.

Entering October, affected by the holiday factor, production pace at some enterprises slowed down temporarily, but most maintained continuous production or only halted briefly for 1–3 days, resulting in limited impact on the overall production side. On the policy front, production at secondary aluminium plants remained somewhat constrained, with some enterprises in Jiangxi and Anhui indicating that they needed to wait for further clarity on local policies before resuming production, leading to continued limitations on capacity release. Demand side, post-holiday downstream consumption performance was moderate, but the M-o-M improvement was limited, with overall demand recovery falling short of expectations. Overall, the industry operating rate in October is expected to show a slight correction.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses