您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

The General Administration of Customs recently released import and export data for December 2025. Customs data showed that:

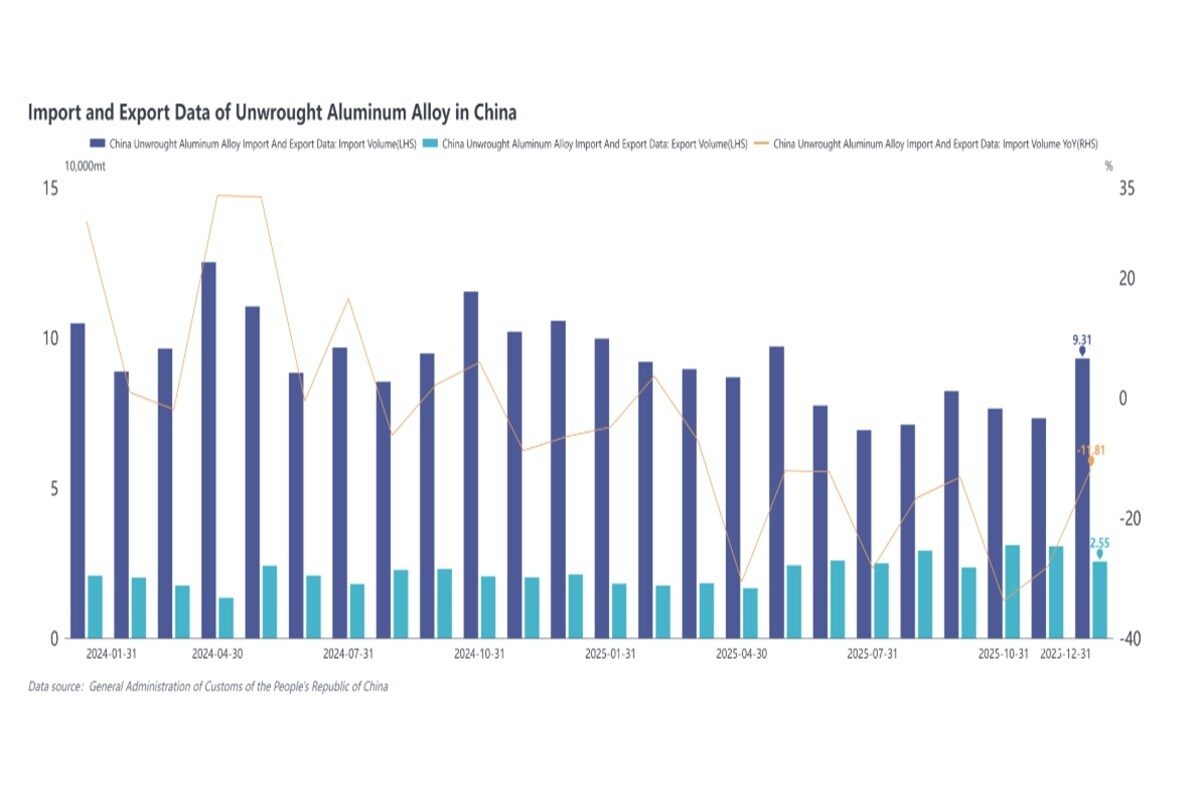

In December 2025, unwrought aluminium alloy imports were 93,100 tonnes, down 11.8 per cent y-o-y, but up 27.2 per cent m-o-m. Cumulative imports for the full year of 2025 reached 1.0084 million tonnes, down 16.9 per cent y-o-y.

In December 2025, unwrought aluminium alloy exports were 25,500 tonnes, up 20.0 per cent y-o-y, but down 16.8 per cent m-o-m. Cumulative exports for the full year of 2025 totalled 284,700 tonnes, up 17.5 per cent y-o-y.

Total imports for the full year of 2025 decreased by 203,900 tonnes y-o-y. Imports from major suppliers generally declined: although imports from Malaysia fell by 164,600 tonne to 356,700 tonne, it remained the top supplier; Thailand, Vietnam, South Korea, and Pakistan also saw reductions ranging from 14,100 to 46,100 tonne. In contrast, imports from Russia surged, increasing by 131,600 tonnes to 225,400 tonnes y-o-y, moving up from fourth place in 2024 to second. In terms of trade characteristics, imports from Russia were mainly through Processing Trade with Imported Materials (accounting for 39 per cent), focusing on aluminium alloy slabs such as 3003 and 5052; in terms of flow, about 79 per cent of the goods entered Henan, effectively supplementing the production needs of local sheet and strip enterprises.

In 2025, the top five provinces for China's unwrought aluminium alloy imports were Zhejiang (415,800 tonne, 41 per cent), Shandong (129,200 tonne, 13 per cent), Henan (100,200 tonne, 10 per cent), Jiangsu (95,400 tonne, 9 per cent), and Guangdong (82,200 tonne, 8 per cent). Compared to 2024, the import landscape became more diversified: imports in Zhejiang, Guangdong, and Jiangsu decreased by 171,700, 91,800, and 21,500 tonnes respectively; while Shandong and Henan saw significant increases, adding 63,700 and 59,300 tonnes respectively, rising to the second and third positions in the industry.

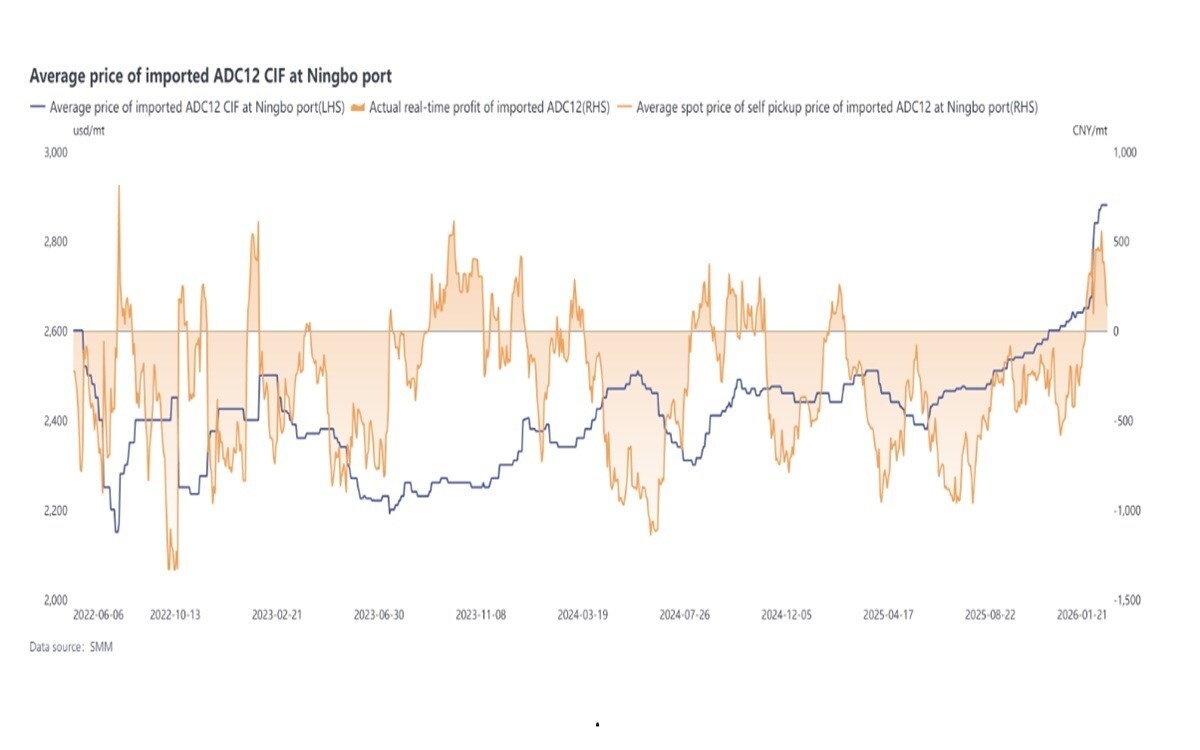

Overall, in 2025, China's unwrought aluminium alloys showed a trend of shrinking imports and growing exports. Annual imports decreased by 16.9 per cent y-o-y to 1.0084 million tonnes; exports increased by 17.5 per cent, reaching 284,700 tonnes. The weak import performance was mainly due to two factors: first, the persistent inversion of the price spread between domestic and overseas aluminium alloys throughout the year, weakening the import advantage and closing the profit window; second, the tight supply of aluminium scrap or recovering demand in Japan, South Korea, and India, which pushed up regional alloy ingot prices, leading to a significant reduction in resources flowing into China. From late December 2025 to January 2026, domestic ADC12 prices rose sharply in line with aluminium prices, reaching their highest level since October 2021. Although overseas prices also climbed rapidly to above $2,850/tonne, the increase was smaller than that in the domestic market. The immediate import profit/loss shifted from a deficit to above the break-even point, theoretically reopening the import window. Imports in January 2026 were projected to range between 80,000 to100,000 tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses