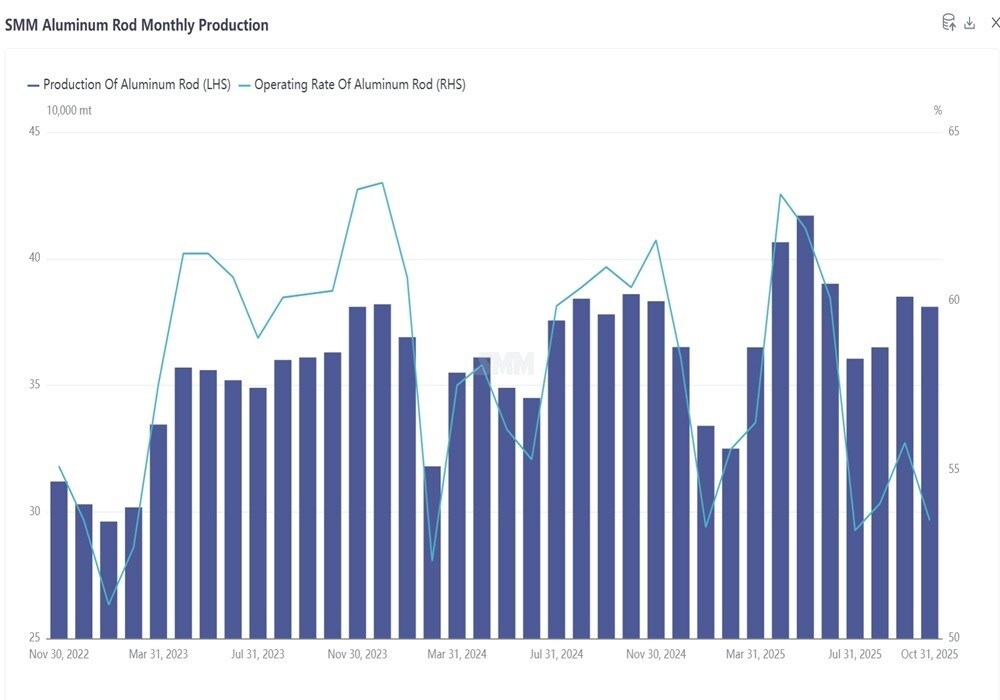

According to SMM statistics, China's total aluminium rod production in October 2025 was 381,000 tonnes, down 4,000 tonnes from September. The operating rate of manufacturers was recorded at 53.56 per cent, down 2.28 percentage points m-o-m and 7.44 percentage points Y-o-Y.

The production cuts affected the entire country, reducing the total operating capacity of aluminium rods by 792,000 tonnes in November. Based on SMM's sample capacity of domestic aluminium rods of 8.385 million tonnes, the scale of these cuts accounted for nearly 10 per cent of the total sample, indicating a significant contraction in supply. Regionally, Inner Mongolia led the reductions with a cut of 252,000 tonne, followed by Shandong and Shanxi (144,000 tonne each), Guangxi and Henan (72,000 tonne each), and Guizhou, Ningxia, and Chongqing (36,000 tonne each). If downstream demand continues to show no signs of recovery, the scope of production cuts may further expand.

Why did the aluminium rod industry experience a concentrated wave of production cuts in November? What are the underlying driving factors?

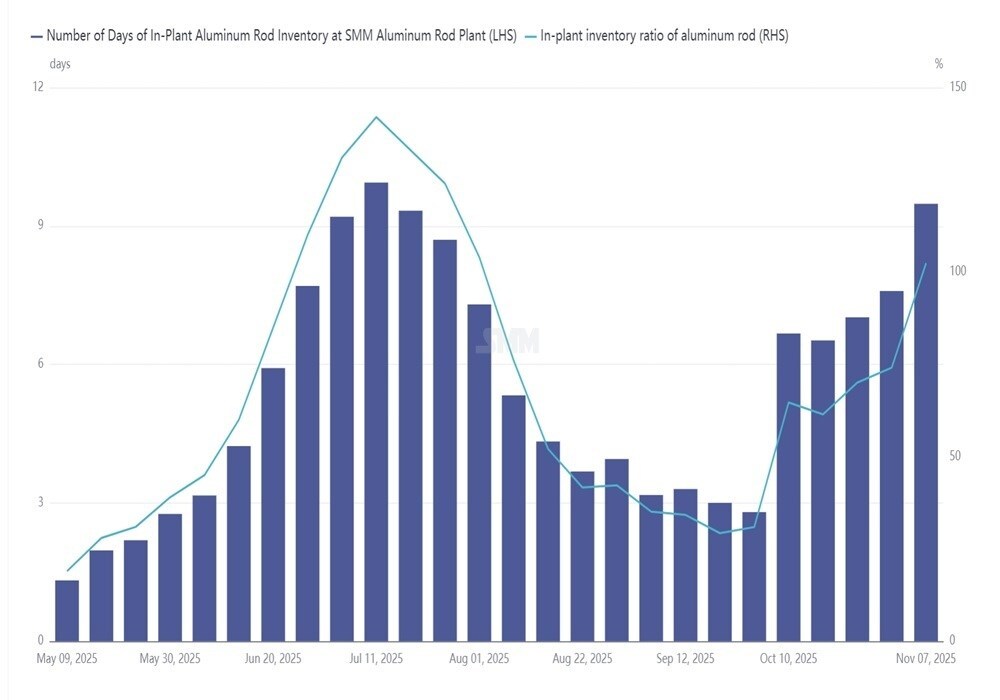

Persistent inventory buildup at plants and funding pressure forced production cuts: According to SMM statistics, as of November 7, 2025, days of inventories at aluminium rod plants reached 9.48 days, an increase of 2.8 days m-o-m from early October. After the National Day holiday, aluminium rod plants faced a significant inventory buildup. Due to relatively optimistic expectations for downstream demand and relatively small funding pressure, plants maintained a normal production pace, and production remained relatively stable. However, as time went on, plants realised that downstream demand did not materialise as expected. Additionally, continuously high aluminium prices suppressed procurement demand, leading to persistent inventory buildup at plants. Under the pressure of inventory and funding, aluminium rod plants had to consider maintenance and production cuts to reduce in-factory inventory, alleviate funding pressure, and improve enterprise cash flow.

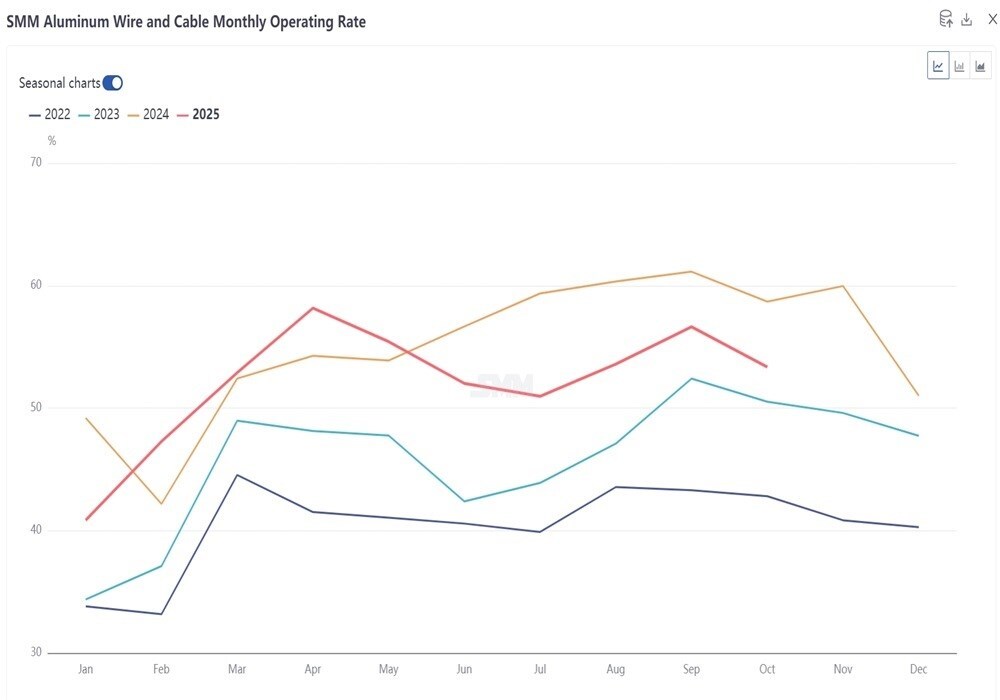

Strong demand expectations failed to materialise: In October 2025, the comprehensive operating rate of China's aluminium wire and cable industry was recorded at 53.32 per cent, down 3.31 percentage points m-o-m and down 5.38 percentage points Y-o-Y. The decline in the operating rate of wire and cable enterprises in October was mainly affected by the National Day holiday, coupled with weak cargo pick-up by end-users, leading to sluggish operations at factories. Although top-tier enterprises maintained high-voltage production at full load in October, many manufacturers have lowered their shipment expectations for November. In addition, environmental protection monitoring in certain regions has contributed to the weak performance in the operating rate of aluminium wire and cable factories. At the same time, many manufacturers reported that end-user procurement enthusiasm from the power grid this year has fallen short of expectations, with issues such as "order mismatch" and "order delays" being prevalent. Weak end-user cargo pick-up is the main reason for the aluminium wire and cable industry entering the off-season earlier than usual. Although power grid tenders continued in early November, the situation of "tendering without ordering" remains unchanged. In the short term, the industry continues to operate in the doldrums with little prospect of improvement.

Regional processing fees continued to deteriorate, with processing and trade sectors suffering consecutive losses: According to SMM, as of November 12, 2025, ex-factory prices were RMB 0-100 per tonne in Shandong, RMB -100-100 per tonne in Inner Mongolia, RMB 200-300 per tonne in Henan, delivered prices were RMB 0-200 per tonne in Hebei, RMB 100-300 per tonne in Jiangsu, and RMB 300-400 per tonne in South China. As aluminium prices continued to rise and end-use demand remained weak, suppliers repeatedly lowered processing fees to facilitate shipments, leading to vicious competition in the market. Due to the weakness in aluminium rod processing fees, some processing plants without aluminium resources faced losses, while others relied on annual framework agreements with downstream customers to maintain production. On the trade side, the continuous decline in processing fees also caused traders holding spot cargo to incur losses. Coupled with uncertain downstream end-user demand, traders avoided purchasing and mostly adopted a cautious wait-and-see approach.

Outlook: How will the aluminium rod sector evolve under the triple pressures of high inventory, weak prices, and sluggish demand?

The sector-wide production cuts in the aluminium rod industry are a direct manifestation of deep adjustment driven jointly by supply-demand imbalance and cost pressure.

Short term, the destocking trend is likely to persist amid continued end-use demand weakness, cut-throat competition in processing fees, and unresolved inventory-financing strains. Yet, after the concentrated cuts, further room for operating capacity to fall is limited. Medium and long term, this round of cuts could mark a turning point for structural optimisation. On one hand, more than 700,000 tonnes of new aluminium rod capacity came on stream this year, and the blind expansion seen in some regions is expected to be curbed. On the other hand, as the competitive landscape stabilises, the processing-fee system is expected to return to rational levels, and regional price spreads should converge after capacity is reallocated.

SMM expects in-factory inventory at aluminium rod plants to peak in November and enter a slow destocking phase in December. However, with no sign of a material recovery in end-use demand, aluminium rod processing fees are unlikely to stage a strong rebound within the year, and the sector as a whole will remain under pressure.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses