According to SMM data, the average tax-inclusive full cost of China's aluminium industry in July 2025 was RMB 16,261 per tonne, down 1.7 per cent M-o-M and 5.8 per cent Y-o-Y. During the period, alumina prices were boosted by macro policies such as "anti-rat race" competition, but due to the low absolute price at the beginning of July, the monthly average alumina price in July fell M-o-M, and its cost-supporting effect became evident in August.

SMM data showed that the monthly average SMM alumina index in July was RMB 3,157.76 per tonne (June 26 - July 25), and the weighted average cost of alumina in China's aluminium industry fell 2.8 per cent M-o-M in July. The average spot price of SMM A00 aluminium was approximately RMB 20,725 per tonne (June 26 - July 25), and the average profit of China's aluminium industry was approximately RMB 4,464 per tonne.

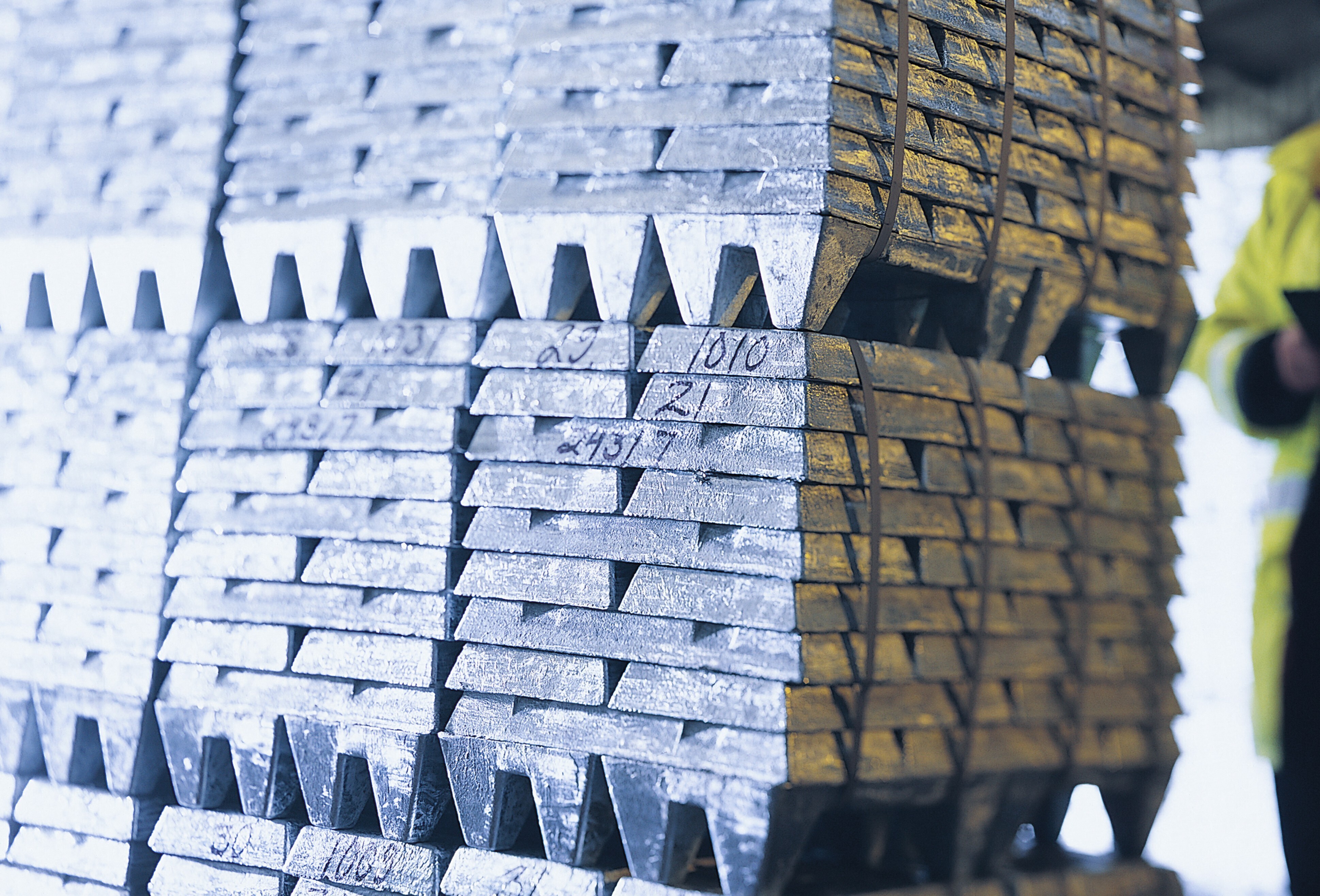

As of the end of July 2025, China's operating aluminium capacity reached 43.89 million tonnes, with the lowest full cost of aluminium at approximately RMB 13,591 per tonne and the highest at approximately RMB 19,301 per tonne. If the industry uses monthly average prices for calculation, 100 per cent of China's operating aluminium capacity was profitable in July.

On the alumina raw material side, SMM data showed that the monthly average SMM alumina index in July was RMB 3,157.76 per tonne (June 26 - July 25), and the weighted average cost of alumina in China's aluminium industry fell 2.8 per cent M-o-M in July.

Despite the strengthening of alumina futures due to macro policy news such as "anti-rat race" competition and "capacity reduction," with the most-traded contract rising to a high of RMB 3,577 per tonne within the month, the futures-spot arbitrage window opened, prompting futures-spot traders to actively inquire and purchase, tightening spot supply. Sellers refused to budge on prices, and alumina spot prices followed suit. However, due to the low absolute price at the beginning of July, the monthly average alumina price in July fell M-o-M, and a slight rebound in the average price is expected in August.

In the auxiliary material market, the prebaked anode market was affected by the weak downstream demand in the raw material market in the early period, leading to a weakening of cost support, and prices were weak in July. For aluminium fluoride, under the dual weakness of supply and demand, cost support also weakened, and prices continued to decline in July. Overall, the support of auxiliary materials for aluminium costs weakened.

In August, prebaked anode prices are expected to fluctuate relatively little, and the aluminium fluoride market is expected to continue its downward trend. Overall, the auxiliary material market remains weak and is unlikely to provide effective support for aluminium costs in the short term. Regarding electricity prices, they fluctuated rangebound in July, down 0.2 per cent M-o-M, mainly due to the impact of reduced electricity tariffs during the rainy season, as reported by some enterprises in south-west China.

Entering August, some enterprises in Sichuan reported an increase in electricity consumption costs due to the impact of high temperatures. Additionally, the state recently issued the "Notice on the Responsibility Weight for Renewable Energy Electricity Consumption and Related Matters for 2025," detailing the proportion of green electricity consumption for aluminium production in various provinces and cities. SMM learned that aluminium smelters across the country have been gradually purchasing green electricity in the past two years, and currently, the supply of green electricity is sufficient. This requirement will not affect aluminium production, but purchasing green electricity or green electricity certificates will increase enterprise costs. SMM will continue to monitor the implementation progress of enterprises.

Entering August 2025, the earlier macro-driven boost to alumina futures and spot markets continued to weaken, with a clear downward trend in the futures market, but relatively firm spot prices. It is expected that the average monthly price of alumina in August will rise slightly. The auxiliary material market remains weak, and this weakness is expected to continue in August. Electricity costs are largely stable. Overall, it is expected that aluminium costs will increase slightly.

Taking everything into account, SMM predicts that the average tax-inclusive full cost of the domestic aluminium industry in 2025 will be around RMB 16,200-16,400 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses