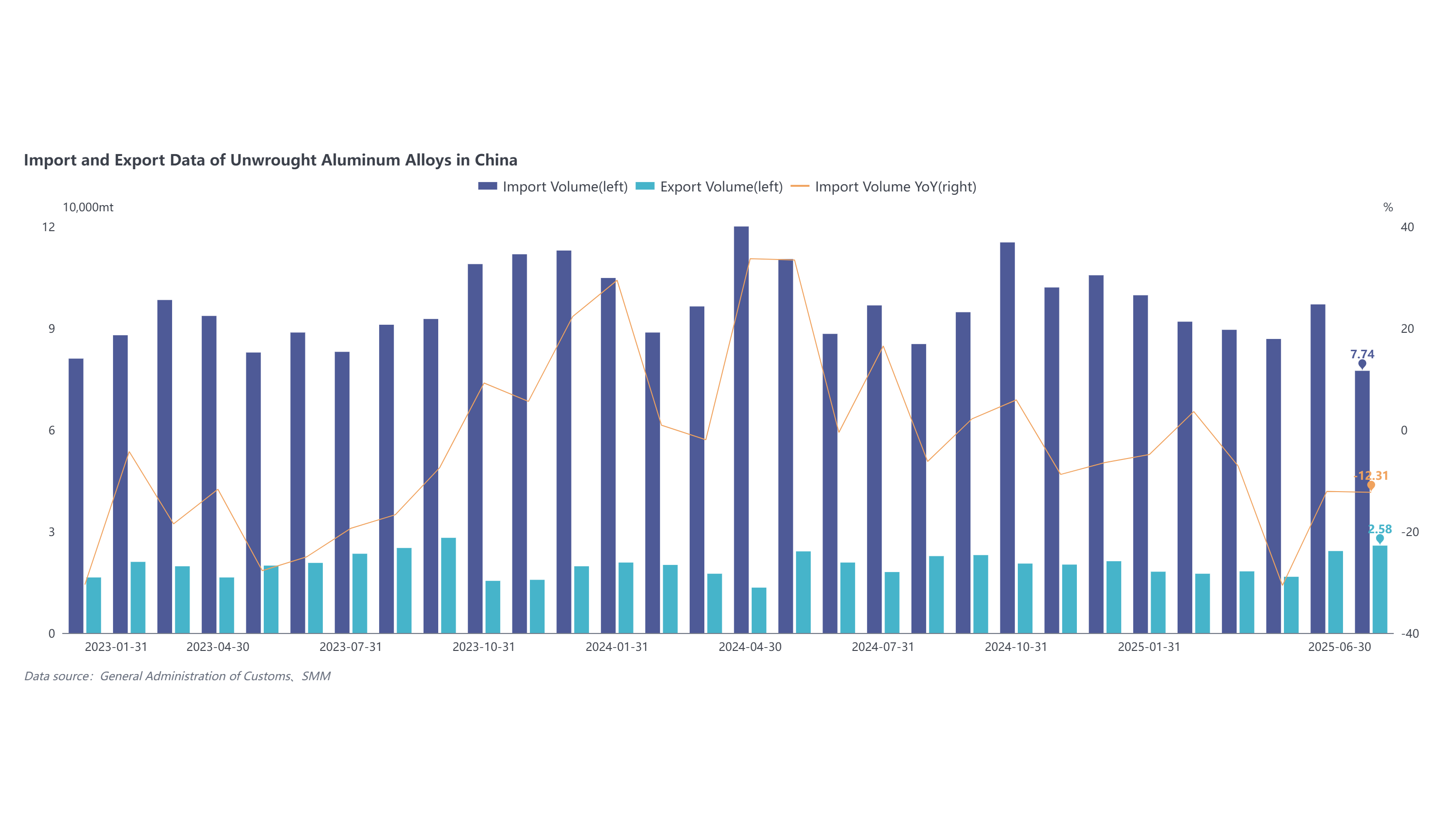

Overall, in the first half of 2025 (H1), total imports of unwrought aluminium alloy amounted to 542,300 tonnes, representing an 11.7 per cent decline Y-o-Y. Monthly imports were all below 100,000 tonnes, while exports rebounded slightly Y-o-Y. Recently, the General Administration of Customs released the import and export data for June 2025. According to customs data:

Image source: https://news.metal.com/newscontent/103440456/

Image source: https://news.metal.com/newscontent/103440456/

In June 2025, imports of unwrought aluminium alloy reached 77,400 tonnes, down 12.3 per cent Y-o-Y and 20.2 per cent M-o-M. From January to June 2025, cumulative imports totalled 542,300 tonnes, down 11.6 per cent Y-o-Y. In June 2025, exports of unwrought aluminium alloy reached 25,800 tonnes, up 23.8 per cent Y-o-Y and 6.6 per cent MoM. From January to June 2025, cumulative exports totalled 120,300 tonnes, up 3.1 per cent Y-o-Y.

From the perspective of import origins, the top five source countries of China's unwrought aluminium alloy imports in H1 2025 were Malaysia (216,000 tonnes, accounting for 40 per cent), Russia (96,000 tonnes, accounting for 18 per cent), Thailand (68,000 tonnes, accounting for 13 per cent), Vietnam (26,000 tonnes, accounting for 5 per cent), and Indonesia (25,000 tonnes, accounting for 5 per cent), with the remaining countries accounting for approximately 21 per cent in total.

From a Y-o-Y change perspective, China's unwrought aluminium alloy imports in H1 this year decreased by 72,000 tonnes compared to the same period last year. Among them, imports from Malaysia decreased by 52,000 tonnes, making it the country with the most significant reduction. Imports from Thailand, Vietnam, and South Korea also experienced varying degrees of decline. In contrast, imports from Russia increased by 66,000 tonnes Y-o-Y, becoming the region with the most significant growth in imports in H1.

In terms of exports, the total volume of unwrought aluminium alloy exports in H1 2025 reached 120,300 tonnes. Japan was the largest export destination, with exports amounting to 66,000 tonnes, accounting for 55 per cent of the total, followed by India, South Korea, Mexico, and Vietnam. The trade mode was dominated by processing with supplied materials and processing with imported materials.

Overall, in the first half of 2025 (H1), total imports of unwrought aluminium alloy amounted to 542,300 tonnes, representing an 11.7 per cent decline Y-o-Y. Monthly imports were all below 100,000 tonnes, while exports rebounded slightly Y-o-Y. Specifically, in mid-November of last year, the continuous decline in domestic aluminium prices dragged down the price of ADC12, while overseas prices remained stable, coupled with the depreciation of the RMB, leading to a continuous squeeze on the profit margins of imported ADC12 and resulting in losses by the end of January.

In February, import profits briefly recovered to the break-even line, but from late February to April, overseas ADC12 prices continued to strengthen, reaching a peak of USD 2,510 per tonne. Meanwhile, due to the decline in aluminium prices and weaker-than-expected demand, domestic spot prices continued to fall, leading to renewed import losses that expanded, causing a contraction in aluminium alloy ingot imports.

In May, although domestic prices continued to decline, the rate of decline narrowed, and overseas prices also fell below USD 2,400 per tonnes, significantly narrowing immediate import losses and approaching the break-even point. In summary, due to the long-term inversion of the price spread between domestic and overseas markets in H1, the import advantage continuously diminished, leading to a significant decline in import volumes.

After mid-June, overseas prices rose again to around USD 2,480 per tonne driven by policy tightening and insufficient raw materials. Although domestic prices also rose to around RMB 19,600 per tonne due to cost-push inflation, there was still an immediate import loss of RMB 600-900 per tonne. Coupled with the constraints of the off-season demand, it is expected that import volumes will remain low in July-August.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses