您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

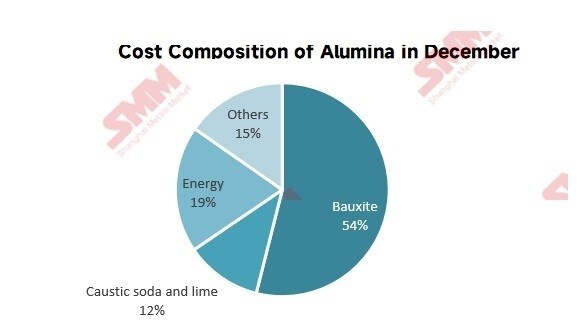

In December, the national weighted average full cost of alumina fell by 1.93 per cent month-on-month. Key factors driving the cost down included a weaker US dollar exchange rate, lower caustic soda prices, and a slight decline in thermal coal prices. According to SMM statistics, the monthly average alumina index price in December was RMB 2,722 per tonne. Based on this average, nearly 40 per cent – 50 per cent of alumina plants had cash costs higher than the monthly average price, indicating significantly increased operational pressure on enterprises.

{alcircleadd}Cost breakdown

In December, weakening prices in the bauxite market alleviated cost pressures for alumina producers. On one hand, although supply in domestic northern mining areas remained tight, alumina plants’ bauxite inventories rose to historically high levels. Coupled with continuously declining alumina prices, companies’ procurement willingness noticeably weakened, putting downward pressure on domestic ore prices. On the other hand, expectations for imported ore supply remained loose, with mainstream shipments maintaining high volumes. Moreover, long-term contract prices for bauxite from regions like Guinea saw reductions, further reinforcing bearish sentiment in the raw material market. Overall, under the combined effect of high inventories and weaker ore prices, raw material costs for alumina production showed a marginally looser trend in December. This not only allowed room for the downward transmission of alumina prices but also helped companies improve cost management capabilities in a weak market. Entering January, with the Q1 2026 Guinea bauxite long-term contract price set around RMB 65-67 per tonne and the exchange rate trending downward, bauxite costs are expected to decline further.

In December, domestic caustic soda market prices continued their downward trend. Influenced by weaker alumina prices, regional long-term contract prices were generally adjusted downward: Guangxi liquid caustic soda long-term contract prices fell by RMB 150-200 per tonne, while Henan and Shanxi regions also saw reductions of RMB 200 per tonne each. In Shandong, liquid caustic soda prices dipped slightly at the beginning of the month. However, due to fluctuations in the quality of imported bauxite mid-month, spot demand increased, pushing prices back to end-November levels, resulting in limited overall price volatility. Entering January, the market remains weak. Guangxi’s liquid caustic soda long-term contract prices are expected to drop by another RMB 150 per tonne, while Shanxi and Henan are projected to see reductions of around RMB 100 per tonne. Prices in Shandong are expected to fluctuate weakly. Overall, the cost side of caustic soda continues its downward trend in January.

In summary, the national weighted average full cost of alumina is projected to decline further in January, falling to approximately RMB 2,750-2,850 per tonne, while cash costs are expected to range around RMB 2,600-2,700 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses