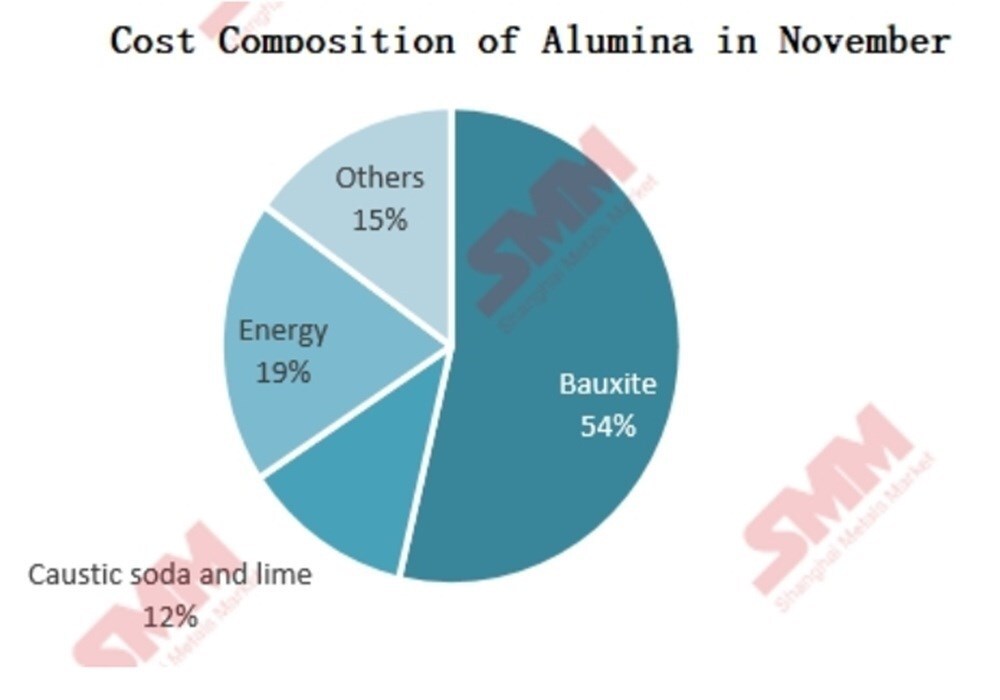

In November, the national weighted average full cost of alumina was approximately RMB 2,949 per tonne, down by RMB 7 per tonne month-on-month; the weighted average cash cost was about RMB 2,779 per tonne.

Cost Breakdown:

Bauxite:

In November, the bauxite market overall showed a weak and fluctuating pattern. In terms of pricing, the average spot price for imported Guinean bauxite was USD 71 per tonne, slightly weaker month-on-month, while Australian bauxite prices remained generally stable. Due to seller price support, cost-side declines faced some resistance, with prices showing only a slight downward trend. From the supply side, absolute port inventories remain high, and the overall supply of bauxite is abundant.

The pattern of ample supply is difficult to reverse in the short term, leading to weak restocking willingness among alumina plants. Even news of equipment removal in mining areas did not trigger a significant market reaction. Entering December, domestic mining operations in northern regions have been suspended due to environmental inspections, creating temporary tight supply pressure in the area, though the overall impact is limited. On the import side, December arrivals are expected to increase slightly compared to November. Coupled with still-high absolute supply levels, there is no significant supply gap in the bauxite market fundamentals. Overall, despite localised supply disruptions, the high inventory and loose overall supply structure remain unchanged. Alumina plants remain cautious about high-priced purchases. It is expected that bauxite prices will continue to fluctuate weakly in the near term, and close attention should be paid to the resumption of domestic mining operations and actual transaction conditions.

Caustic Soda:

In November, domestic caustic soda prices declined significantly, primarily due to the continuous weakening of alumina prices. Long-term contract prices in Shanxi, Henan, Guangxi, and Shandong continued to fall, driving down the overall alkali costs for alumina enterprises. Entering December, the downward trend in costs persists: long-term contract prices for caustic soda in Shanxi and Henan are expected to decrease by RMB 200 per tonne, while Guangxi is expected to see a reduction of RMB 150 per tonne. Prices in Shandong continue to decline, with the average price for this month expected to be lower than November levels. Overall, under the pressure of weak alumina market conditions, caustic soda prices across regions are generally under downward pressure. It is expected that the cost of caustic soda for alumina production will further decline in December.

Additionally, although the costs of bauxite and caustic soda generally declined in November, the rise in thermal coal and energy prices during winter, combined with a slight strengthening of the U.S. dollar exchange rate compared to October, limited the downward space for alumina production costs.

Overall Outlook:

Looking ahead, the national weighted average full cost of alumina in December is expected to experience a slight decline, operating within the range of RMB 2,850–2,950 per tonne, while cash costs are projected to range between RMB 2,700–2,800 per tonne.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses