您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

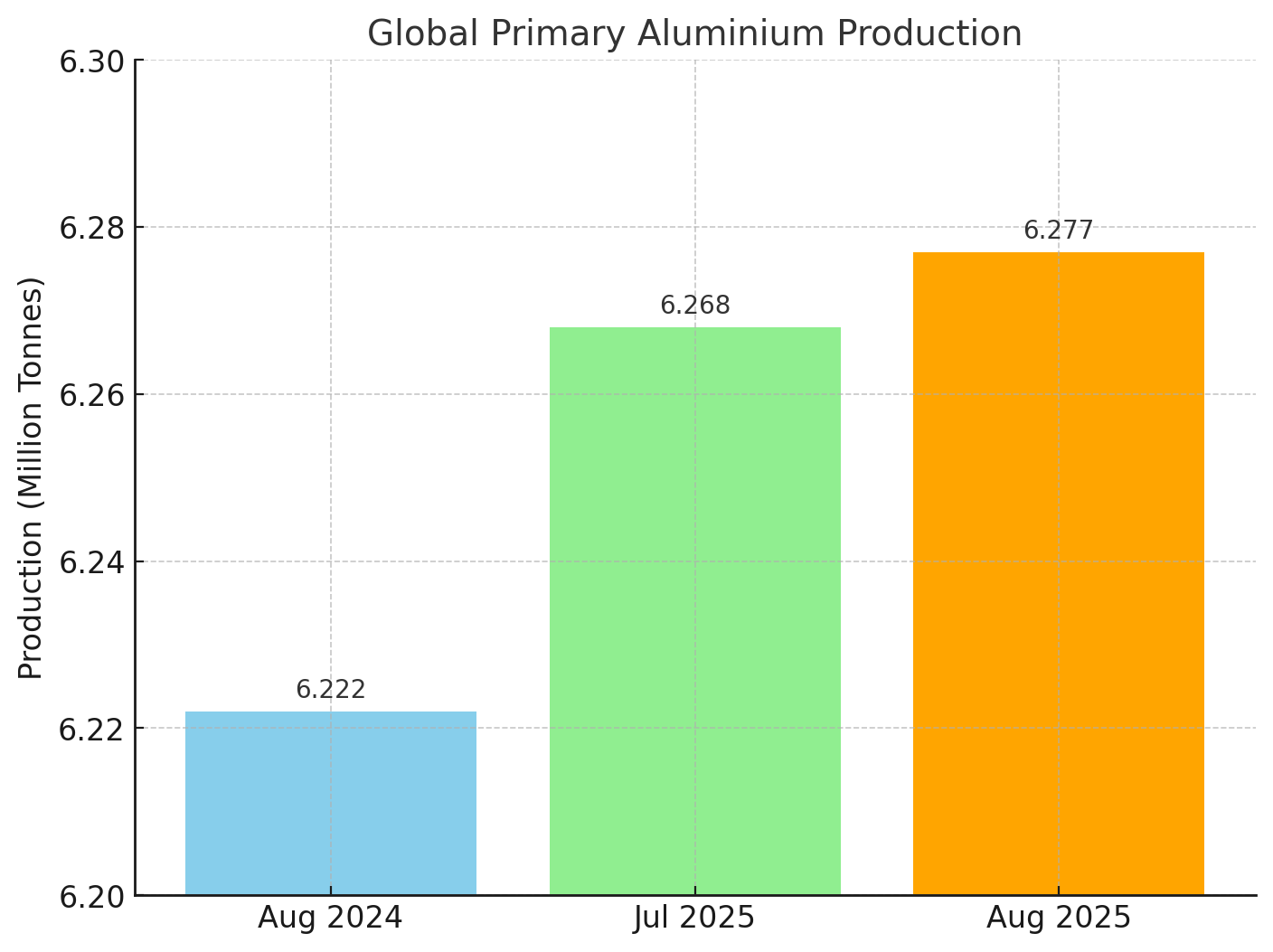

The world’s primary aluminium production remained almost muted over a month in August 2025, mirroring the same trend as the previous year. However, on an annual basis, the output stood 1 per cent higher than 6.222 million tonnes.

According to the data reported by the International Aluminium Institute, the world primary aluminium production in August 2025 summed at 6.277 million tonnes, just slightly higher than 6.268 million tonnes in July. While growth was minimal, the sector at least avoided another decline—after the last month-on-month drop in June, when production fell 3 per cent from 6.258 million tonnes to 6.070 million tonnes.

Cumulatively, global primary aluminium output from January to August reached 49.04 million tonnes, marking a 1.32 per cent year-on-year rise from 48.4 million tonnes.

Interestingly, the world’s monthly primary aluminium production stood muted despite the rise in daily average output from 202,200 tonnes in July to 202,500 tonnes in August. With both months having the same number of calendar days, the restrained growth suggests regional slowdowns offsetting gains.

China holds back, South America declines

The drop in monthly output in South America and restraint in China’s production led to the overall muted output in August. As per the IAI data, South America’s primary aluminium production in August stood at 132,000 tonnes versus 134,000 tonnes in July, reflecting a decline of 1.5 per cent.

But most importantly, the restraint in China’s output, the world’s largest primary aluminium producer, affected the global primary aluminium production in August. China’s production stood at 3.764 million tonnes in the said month – muted compared to July but 3.266 per cent higher than 3.645 million tonnes in June.

Also read: Primary aluminium production growth slows down in July’25 – energy crisis behind it

According to Shanghai Metals Market (SMM), the proportion of liquid aluminium at domestic smelters rebounded M-o-M, rising 1.3 percentage points to 75.07 per cent this month. Based on liquid aluminium ratio data, domestic aluminium ingot casting volume decreased by 10.38 per cent Y-o-Y and 4.68 per cent M-o-M.

However, post the monthly decline in June from 3.751 million tonnes to 3.645 million tonnes, China’s primary aluminium production rebounded in July and stood steady even in the subsequent month, reflecting a transition between off-season and peak-season.

Similar to China, Africa’s primary aluminium production also showed no change M-o-M in August from 140,000 tonnes. Over a year, it rose by 2,000 tonnes from 138,000 tonnes.

Regions with monthly rise

Now, coming to the regions that showed monthly gains, primary aluminium production in North America grew by 4,000 tonnes M-o-M from 330,000 tonnes in July to 334,000 tonnes in August. Year-on-year, it showed an increase of only 1,000 tonnes. However, despite the monthly and annual increases, the region’s cumulative production of the metal from January to August stood 1.13 per cent down Y-o-Y at 2.629 million tonnes versus 2.659 million tonnes.

In Europe (including Russia), Oceania, and GCC, primary aluminium production in August grew by 2,000 tonnes M-o-M, standing at 600,000 tonnes, 160,000 tonnes, and 521,000 tonnes, respectively. However, annually, the production in these regions, except for Oceania, declined by 1.15 per cent and 2.6 per cent, respectively, from 607,000 tonnes and 535,000 tonnes, respectively. Only in Oceania, the output rose 7 per cent Y-o-Y from 155,000 tonnes to 160,000 tonnes.

In Asia (ex-China), primary aluminium production rose 1.5 per cent Y-o-Y from 406,000 tonnes to 412,000 tonnes but fell M-o-M by 1,000 tonnes. Total production in Asia through the eight months of 2025 was 3.23 million tonnes, which was up by about 1 per cent from 3.207 million tonnes.

Also read: China’s unwrought aluminium trade in 2025: Imports soar but exports stumble, what’s next?

Summing up

Even though the production stood low or restrained M-o-M in many major primary aluminium-producing regions, the increase in cumulative production through the first eight months in most of those regions ultimately propelled the growth in the world’s output during January-August. In Africa, primary aluminium production in eight months saw a rise of 4.6 per cent from 1.033 million tonnes to 1.081 million tonnes. In South America, the output in eight months of this year stood at 1.03 million tonnes, up by 1.98 per cent from 1.01 million tonnes. Similarly, in Europe (including Russia), primary aluminium output during January-August 2025 posted an increase of 1.48 per cent Y-o-Y from 4.607 million tonnes to 4.675 million tonnes. In China, the year-to-date output was 29.379 million tonnes, up by 2.28 per cent from 28.723 million tonnes.

To learn more about the global aluminium production dynamics, explore our reports here.

Responses