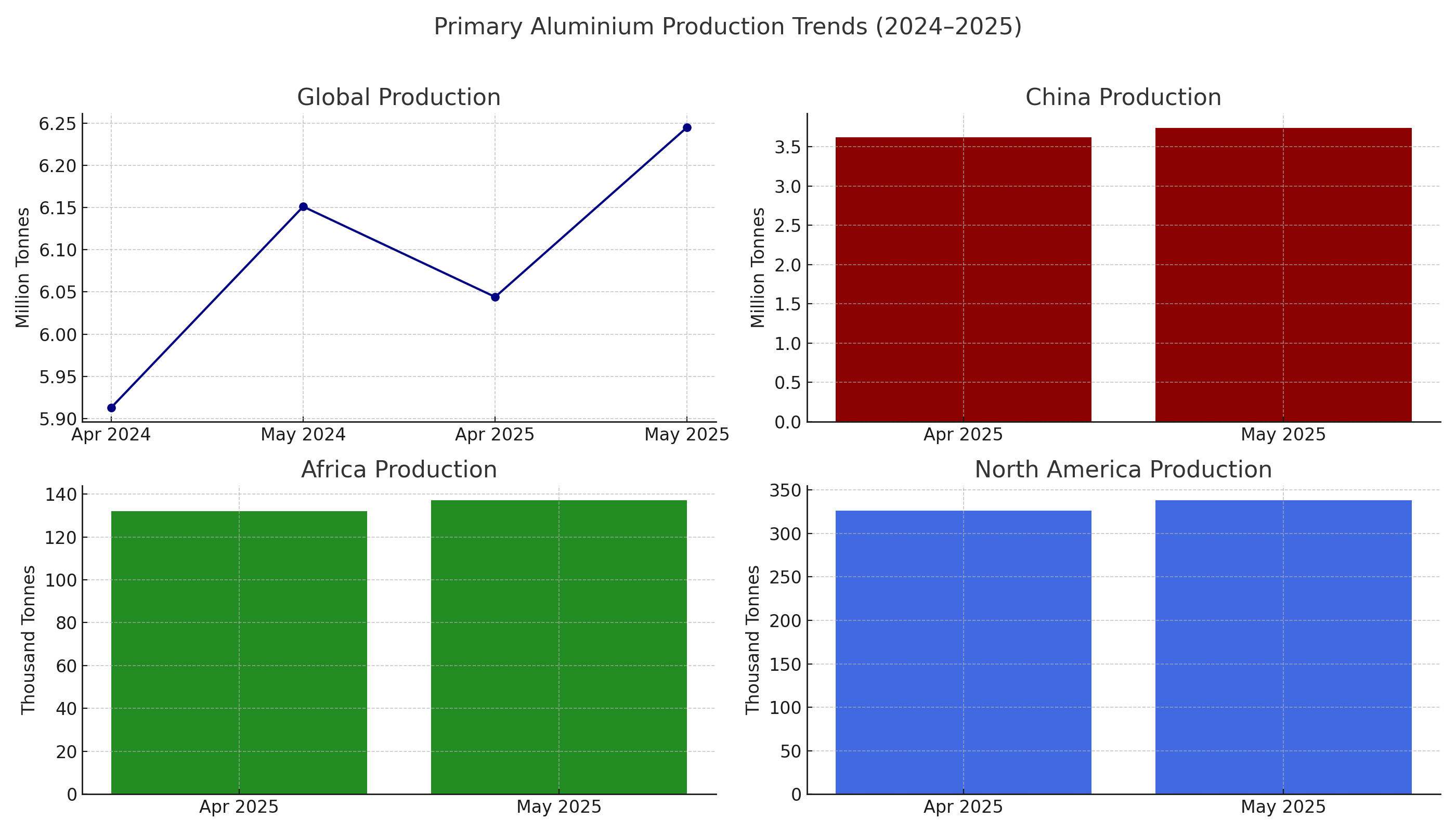

According to the International Aluminium Institute (IAI), the world’s primary aluminium production in May 2025 trended up over a month, mirroring the pattern observed in the same period last year—but with a sharper pace of growth. While in May 2024, the world’s output had grown by 2.22 per cent month-on-month, this year, it increased by 3.3 per cent.

From 6.044 million tonnes in April 2025, global output rose to 6.245 million tonnes in May, while the same period in 2024 had seen a climb from 5.913 million tonnes to 6.151 million tonnes. Thus, on a year-on-year calculation, the production volume in May 2025 was 1.53 per cent higher than in the same period of the earlier year.

Nations with a 5-month high output – China leads, but how long?

The production increased worldwide, but in some regions, it stood the highest since the beginning of 2025. Those regions include China, Africa, and North America. In China, primary aluminium production in May amounted to 3.741 million tonnes, up by 3.34 per cent M-o-M from 3.62 million tonnes. According to SMM, there were no production cuts in May and the aluminium industry operated steadily overall. The M-o-M increase to a five-month high in May brought China’s cumulative primary aluminium production to 18.191 million tonnes – marking an annual increase of 2.58 per cent from 17.733 million tonnes.

But as the primary aluminium output in China continues to grow each month, it nears the 45-million tonne cap. However, to touch the ceiling, China needs a monthly average production of 3.83 million tonnes through the rest of the year. This is an increasingly challenging prospect as operating rates have already reached over 95 per cent capacity. Data from SMM indicates that, as of May, China’s active primary aluminium capacity stood at 43.91 million tonnes out of a total 45.69 million tonnes—leaving little room for further growth without significant new capacity additions.

Also read: Overview of China's primary aluminium production in May 2025 and forecast for June

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses