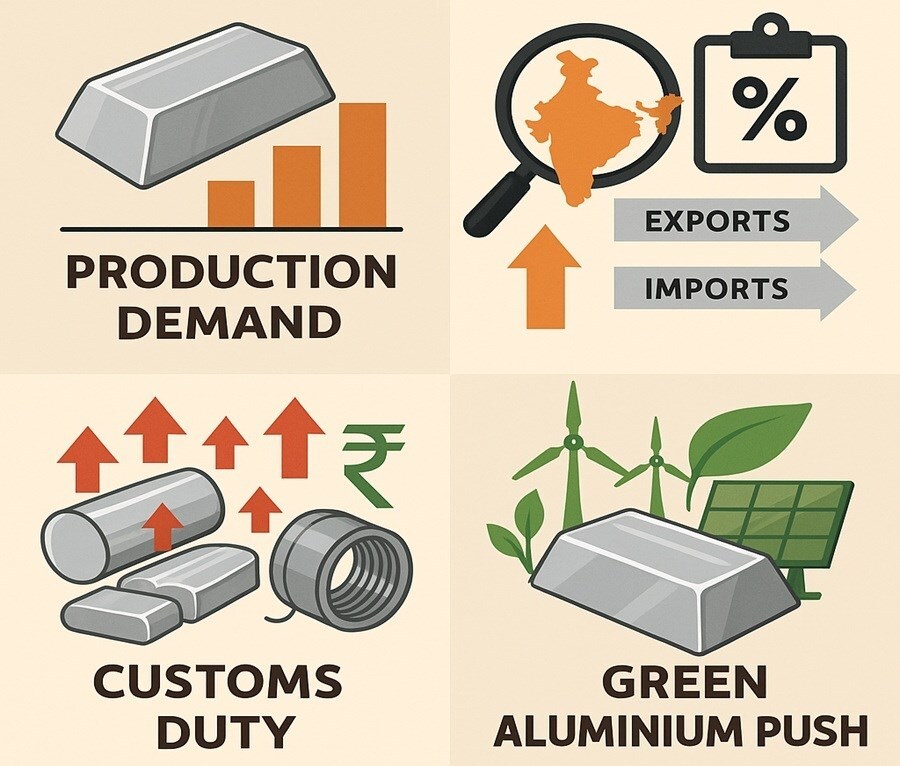

The proposed 15 per cent customs duty on aluminium and its downstream products is set to bring a new outlook to India’s aluminium sector, reshaping its trade dynamics and strengthening domestic resilience.

In FY 2024–25, India’s aluminium production capacity, including downstream products, stood at 6.4 million tonnes, while domestic demand was 4.9 million tonnes — clearly showing that India can comfortably meet its own requirements and export the surplus. The country also exported 2.23 million tonnes of aluminium and downstream products during the fiscal year.

However, despite this surplus, India imported around 3 million tonnes of aluminium — including primary, alloyed, unwrought, and fabricated forms. These imports, largely from China and Gulf-based producers, are not driven by a shortage but by price distortions. With protectionist barriers limiting exports elsewhere, these countries redirect their low-cost or subsidised aluminium to India, often sold below fair market value.

Industry experts note that these dumped imports are eroding domestic price stability, discouraging investment, and reducing capacity utilisation. The AAI warns that imports have risen over 50 per cent in the past five years, threatening India’s industrial sustainability and employment across thousands of MSMEs tied to the aluminium value chain.

Also read: The World of Aluminium Extrusions – Industry Forecast to 2032

Responses