您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Guinea’s bauxite sector has drawn significant attention in recent years, with production nearing 130-137 million tonnes annually and multiple mining and infrastructure projects underway. Key developments include initiatives by Kebo Energy SA, GAC, and Arrow Minerals, along with the Trans-Guinean railway to streamline ore transport. But the Guinean government has recently moved to withdraw Kebo Energy SA’s mining concession, following EGA’s mining licence cancellation last week.

Image source: EGA

Image source: EGA

According to a recent report, Kebo has failed to meet its investment commitments, prompting the Guinean government to revoke the long-standing mining concession. Some sources close to Kebo also confirmed the news, citing shortfall to inadequate funding, including for a planned alumina refinery.

Now, the recent string of license revocations and concession cancellations has raised the question: “Why?” According to sources, these actions are part of a broader strategy aimed at increasing state control over mineral wealth and revenues. Guinea is now seeking to secure more direct benefits from its abundant natural resources, particularly bauxite.

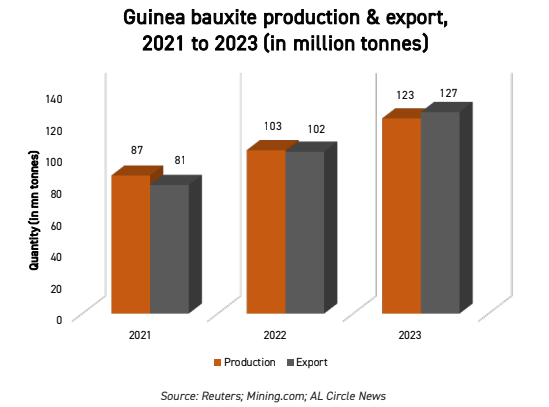

Guinea is a growing hub for bauxite mining. Its production as well exports is witnessing a steady rise over the years. From 87 million tonnes of production and 81 million tonnes of exports in 2021, Guinea’s output and exports grew to 103 million tonnes and 102 million tonnes, respectively, and further rose to 123 million tonnes and 127 million tonnes in the subsequent year. Eventually, in 2024, production and exports reached around 137 million tonnes and 146 million tonnes.

In an international conference, honorable Bouna Sylla, current Minister of Mines and Geology for the Republic of Guinea cited the country witnessed a 10x growth in bauxite production in the past ten years. It exported over 609,232,070 tonnes of bauxite in ten years to feed the world market.

The problem is, in an effort to capitalise on the growing bauxite market, several mining companies operating in Guinea have come under scrutiny for selectively extracting high-grade ore while leaving behind significant deposits of medium-grade bauxite. Dr Ashok Nandi, President of the International Bauxite, Alumina, and Aluminium Society (IBAAS), India, traces this practice back to CBG’s use of a high alumina cut-off grade for resource estimation, a methodology that has since been adopted by other major operators in the country. He warns that this approach is leading to the underutilisation of substantial volumes of low to medium-grade bauxite, which remain viable for alumina production. In response, Guinea’s military-led government, following its recent rise to power through successive coups, is moving to reform mining laws and renegotiate contracts to promote more efficient resource management and maximise national returns.

…and so much more!

SIGN UP / LOGINResponses