您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

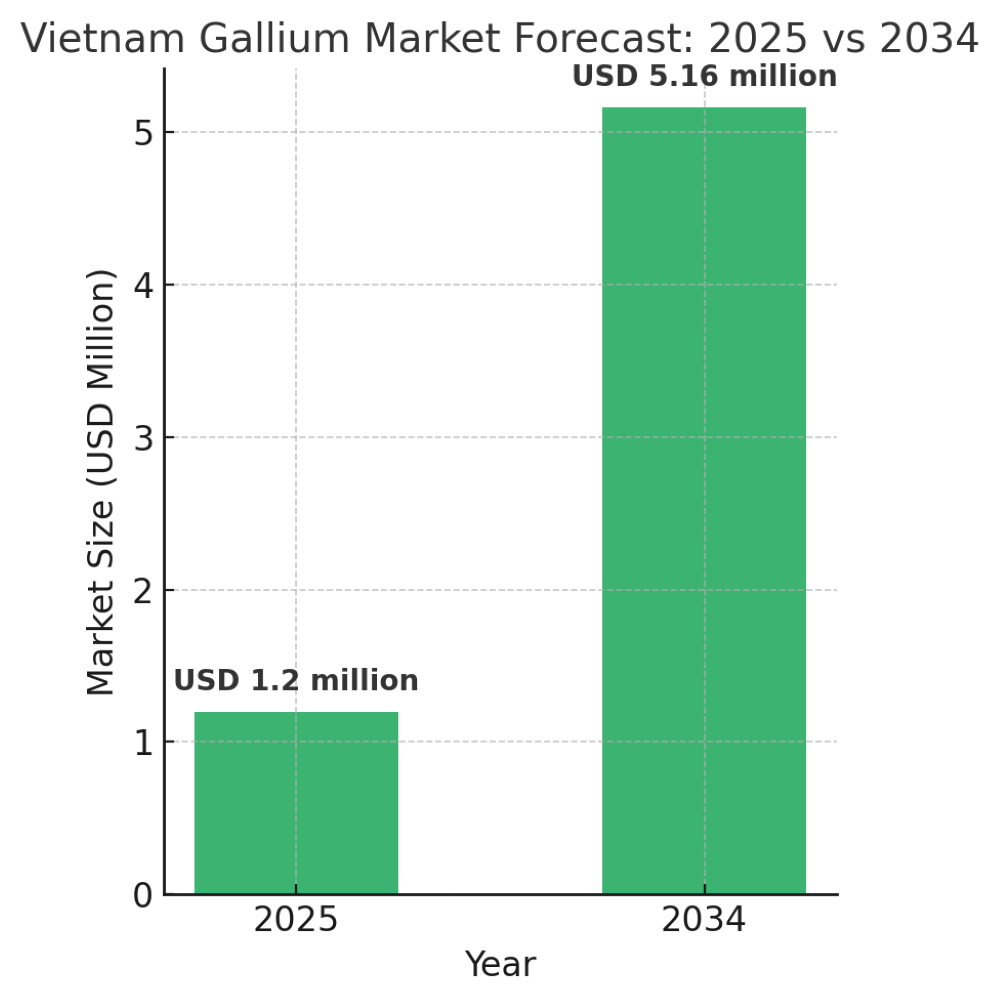

Vietnam’s gallium industry is gathering pace, supported by the country’s substantial bauxite reserves. While current production levels remain modest, government-led efforts are underway to enhance mining and smelting capabilities. Analysts project strong growth from 2025 to 2034, driven by advanced refining methods and increased international collaboration.

Image credit: en.wikipedia.org

Gallium, a silvery-white metal with a melting point of 29.8°C, plays a vital role in modern technology and is primarily extracted as a by-product of aluminium and zinc smelting. Due to its low concentration in natural ores such as bauxite, coal and zinc ore, recovery remains complex.

The gallium value chain is divided into three key segments: upstream, involving resource extraction and smelting; midstream, focused on refining high-purity gallium and developing semiconductor materials like GaN and GaAs; and downstream, where gallium is used in semiconductors, LED lighting, solar panels, electronics and military radar systems.

Global demand for gallium is rising rapidly, owing to its irreplaceable use in semiconductors and solar technology. Its importance in integrated circuits, photovoltaics and radar systems underscores its strategic value across high-tech sectors.

Vietnam is becoming a key player in the global gallium market due to its 5.8 billion tonnes of bauxite, 19 per cent of global reserves, concentrated in the Central Plateau. These reserves are well-suited for open-pit mining given the favourable geology.

However, the country’s gallium output is currently limited by ageing infrastructure. To address this, the Vietnamese government is promoting rare earth and mineral development. With improved refining techniques and global cooperation, Vietnam is well-placed to boost production shortly.

From 2025 to 2029, Vietnam’s gallium market is projected to grow at varied rates: 14.37 per cent in 2025, peaking at 16.42 per cent in 2028, and levelling off at 15.86 per cent by 2029. A 15.98 per cent growth rate is forecast for 2027, signalling Vietnam’s growing importance in Asia’s tech-driven economy. China remains dominant in the region, followed by India, Japan, Australia and South Korea.

Though still niche, Vietnam’s gallium market is attracting attention due to its role in semiconductor production. Gallium is vital for manufacturing LEDs and electronic components, and its demand is rising alongside Vietnam’s expanding electronics industry. The market’s trajectory remains closely tied to global semiconductor trends.

Looking forward, Vietnam’s gallium sector presents strategic opportunities for international mining and tech firms. Supported by progressive policies and growing global partnerships, Vietnam is set to claim a greater share of the global gallium market by 2034. Addressing challenges in technology adoption and industrial modernisation will be key. With foreign investment and expertise, the sector is poised for transformative growth in the decade ahead.

Also read: For Vietnam’s mining sector, the future isn’t about digging deeper, it’s about digging smarter

Responses