Alcoa, the leading producer of aluminium globally and the largest producer in the US, is at a crossroads. US tariffs on aluminium have triggered record high prices and raised flags about vulnerabilities not only in the US supply chain but also in Europe. Already, the company has faced a hit due to the impacts of US tariffs on prices and supply disruption. Besides, the increased volume of aluminium scrap flowing out from Europe has put Alcoa under the pressure of raw material shortages for recycling in its Spain facility, costing the company’s revenue.

Margins under pressure

Alcoa's earnings in Q2 2025 reflected good resilience. The revenue was USD 3.02 billion. This was an increase of about 4 per cent year-on-year. The net income increased to USD 151 million from USD 31 million. Earnings per share increased 387 per cent to USD 0.63, with operating cash flow of USD 488 million. However, tariff costs are beginning to have an impact. In Q2 2025, Alcoa reported only around USD 115 million in tariff costs. While Rio Tinto has lost more than USD 300 million over 6 months.

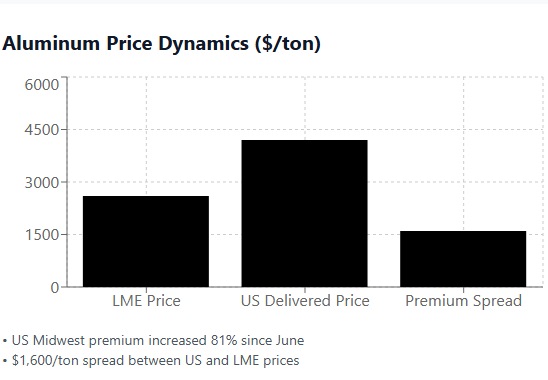

These costs underscore the volatility in using premiums to counter input inflation. The US Midwest premium has increased 81 per cent since June. Consequently, delivered US prices now average almost USD 4,200 per tonne, compared with about USD 2,600 on the LME. Extraordinary spreads are projected to boost short-term sales. But they carry risks, including potential impacts on future margins. This is in case premiums normalise due to contract rigidity and trade frictions.

Long-term demand signals

Despite near-term turbulence, demand tailwinds remain intact. Global decarbonisation, EV adoption, and renewable energy infrastructure all point to higher aluminium consumption. Alcoa projects USD 13.6 billion in revenue and USD 592.1 million in earnings by 2028, requiring steady but achievable 2 per cent growth. However, forecasts assume smoother regulatory terrain than the present.

Investor sentiment remains split. The fair values of Alcoa range between USD 29 and USD 110.77. This suggests that uncertainty around tariffs and European supply shocks makes valuation challenging.

Alcoa's medium-term performance hinges on its capacity to offset tariff costs with improved margins, whereas Europe's aluminium shortage underscores the critical need for robust supply chains.

Also read: When tariffs double: How aluminium majors rewired Q2 2025 to survive

Responses