The Republic of Singapore, a vibrant island nation and city-state in Southeast Asia, boasts a robust construction industry, driven by government initiatives, technological advancements, and a focus on sustainability. The sector spans commercial, institutional, industrial, and infrastructure projects, positioning Singapore as a regional leader in construction. Moreover, recent investments in renewable energy infrastructure to achieve a solar energy capacity of 2GW by 2030 further bolster the industry's growth in the construction sector. According to market research firms like IMARC Group and Next Move Strategy Consulting, Singapore’s construction market is projected to expand at a compound annual growth rate (CAGR) of 4.2 per cent from 2025 to 2033. Valued at approximately USD 31.18 billion in 2023, the market is expected to reach around USD 43.22 billion within the next 5 to 7 years.

According to Teo Jing Siong, Group Director of the Strategic Planning and Transformation Office at the Building and Construction Authority, Singapore’s construction industry recorded a 5 per cent increase in GDP contribution up to 2024, more than 20 times higher than its level in 1965. In 2024, the construction industry bagged contracts worth around USD 44.2 billion, up from USD 34.2 billion in 2023.

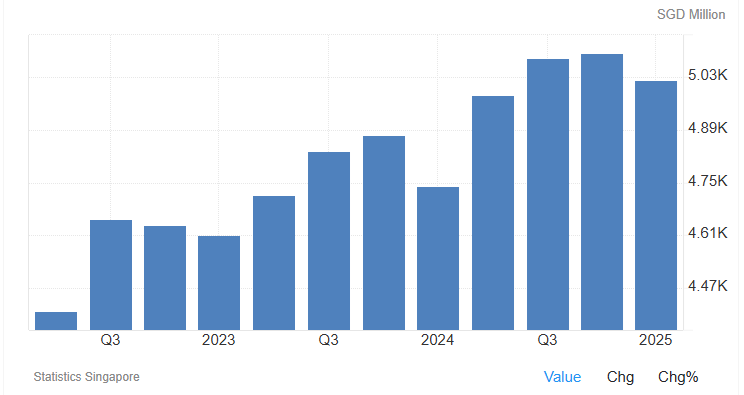

But currently, various reports suggest that the Singapore construction sector is facing headwinds as a result of the US tariffs on aluminium and steel, putting firms under uncertainty with volatile pricing and supply chain of raw materials. In the first quarter of 2025, the industry's GDP contribution declined to SGD 5,022 million (USD 3,902 million), down from SGD 5,093.20 million (USD 3,958 million) in the fourth quarter of 2024.

Explaining the situation, Mr Benjamin Lim, Singapore Manufacturing Federation’s (SMF) industry group chairman for building products and construction materials, said: “New US tariffs on steel and aluminium are tightening global supply chains, and Singapore is starting to feel the strain. Mills in China and India are fully booked for the next six to seven months as US buyers stockpile materials, limiting availability in Asia, and driving up costs.”

Despite benefiting from two decades of free trade with the United States, Singapore was not spared from tariffs. A 10 per cent duty was imposed on most of its exports, signaling a broader shift in US policy from alliance-based trade to a more transactional approach. Additionally, President Donald Trump halted his planned interest rate cuts, pointing to ongoing inflationary pressures stemming from imported price shocks. The Federal Reserve, which had earlier indicated a dovish turn, now confronts a more complicated macroeconomic landscape, caused not just by domestic inflation, but also by global supply chain disruptions triggered by the new tariffs.

Responses