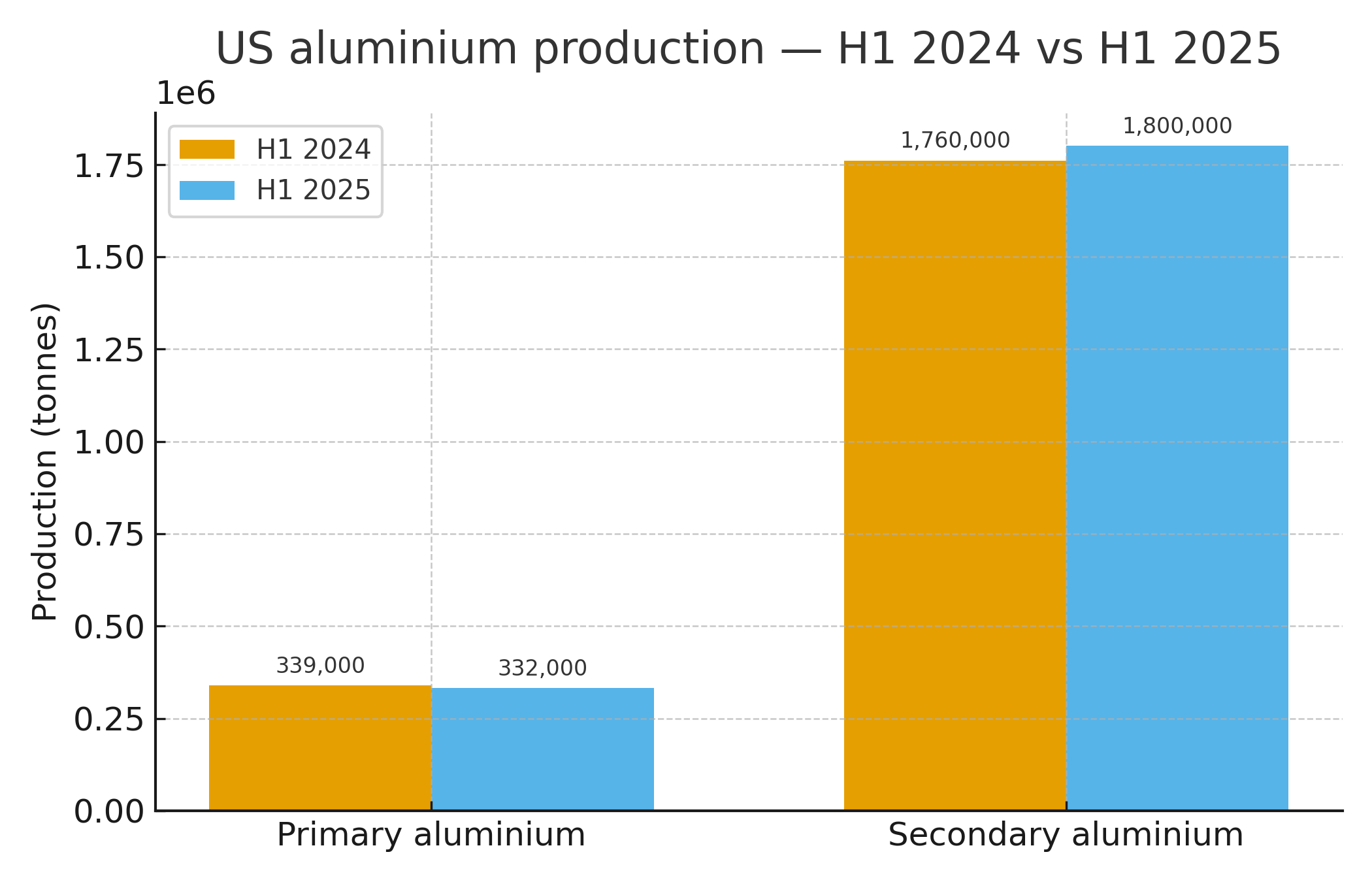

Secondary aluminium production in the United States has stepped up just as primary output has faltered, rising 2 per cent in the first half of 2025 to offset the equivalent decline in primary production. The United States Geological Survey data showed the primary aluminium production through the first half of 2025 recorded a year-on-year drop of about 2 per cent, weighed down by persistent declines or restraints in output.

In June, the output dropped by 1,000 tonnes over a year, standing at 54,000 tonnes, mirroring the same trend as the previous month when the primary aluminium production dropped Y-o-Y from 57,000 tonnes to 56,000 tonnes. In April, however, the output had grown by 1,000 tonnes, while in the two preceeding months; it stood restrained at 577,000 tonnes and 52,000 tonnes. The highest decline was seen in January by about 9.5 per cent, from 63,000 tonnes to 57,000 tonnes.

Thus, the United States’ cumulative production of primary aluminium through H1 2025 summed at 332,000 tonnes versus 339,000 tonnes during the corresponding period of the previous year.

The daily average production in June was 1,820 tonnes, reflecting a drop of 1 per cent than 1,830 tonnes a year earlier and the lowest since the beginning of 2025. In January and February, the daily average production stood at 1,850 tonnes, which dropped in March to 1,840 tonnes but revived in the subsequent month (April) to 1,870 tonnes.

Potential cause

One of the key reasons for the decline in US primary aluminium production is high energy costs caused by lifted demand from data centres, businesses, and households. In tandem, electricity prices are rising and hovering near record highs in a majority of US states. In July 2025, the average price of electricity for industrial purpose was 9.29 cents per kilowatthour versus 8.75 cents per kilowatthour a year ago. In New England, the average electricity price was 18.06 cents per kilowatthour versus 16.37 cents per kilowatthour in the previous year, and that in Middle Atlantic and East North Central was 10.33 cents and 9.46 cents, compared to 8.78 cents and 8.45 cents in July 2024.

Aluminium recovered from scrap

As a result, the United States shifted its focus to recycling scrap in order to meet the domestic demand for aluminium. In June 2025, the United States recovered 305,000 tonnes of aluminium from scrap, compared to 295,000 tonnes of aluminium recovered from scrap in June 2024. The total volume of aluminium recovered from scrap through the first six months of 2025 was 1.8 million tonnes, which was 2.3 per cent higher than 1.76 million tonnes during the corresponding period of the previous year.

Of the total scrap recovered in June 2025, 161,000 tonnes of aluminium was recovered from new scrap and the remaining 144,000 tonnes from old scrap.

Prices and inventories

The average US primary aluminium ingot spot market price in June 2025 was USD 1.72 per pound – 16 per cent more than in May 2025 and 29 per cent higher than in June 2024. The average cash price on the London Metal Exchange was USD 1.14 per pound – up by 3 per cent M-o-M and 1 per cent Y-o-Y.

Inventories of primary aluminum in LME-approved warehouses, including off-warrant inventories, in the United States were 11,970 tonnes at the end of June 2025, 14 per cent more than those at the end of May 2025. Inventories of aluminum alloy (North American Special Aluminum Alloy Contract) in LME-approved warehouses, including off-warrant inventories, in the United States were 160 tonnes at the end of June 2025, 46 per cent less than those at the end of May 2025.

Responses