您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

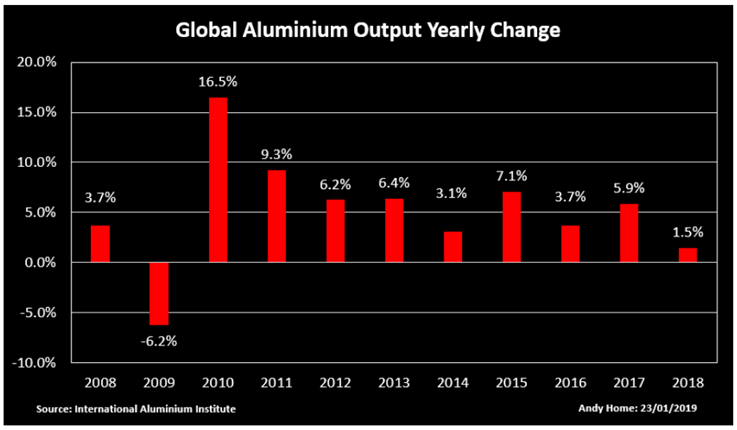

According to the International Aluminium Institute (IAI), the global aluminium production grew at its slowest pace in a decade in 2018, totalling at 64.34 million tonnes, up by 1.5 per cent from 2017. Most of this production occurred in the first half of the year, while in the second half did no more than flat-line. This was the weakest production performance since 2009, when the industry was hit by the collapse in prices, United States’ sanctions on Rusal, tariffs on aluminium imports, and production cut at multiple smelters.

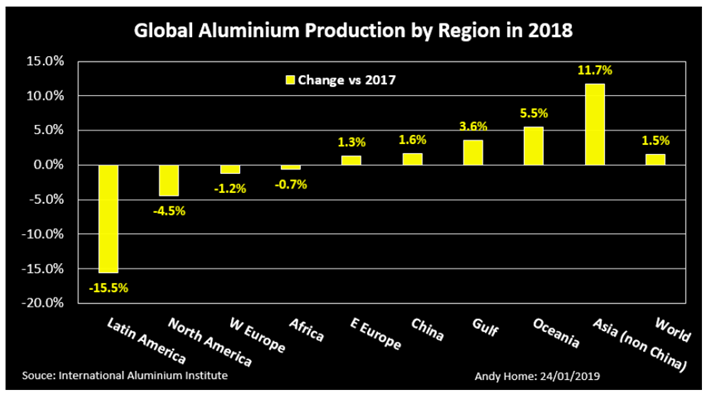

Even China, the world’s dominant producer, ran out of expansion steam last year with growth of 1.6 percent, while the rest of the world managed just 1.4 percent. In Latin America, North America, West Europe, and Africa, the aluminium production even dwindled by 15.5 per cent, 4.5 per cent, 1.2 per cent, and 0.7 per cent respectively over the past one year, as shown in the graph below.

Based on the latest global aluminium production data, here we provide the list of top 5 primary aluminium producers of the world. The list is dynamic and is subject to change under various macro-economic conditions of the global industry.

Aluminium Corporation of China Limited (Chinalco): Established in 2001, the multinational aluminium company headquartered in Beijing emerged as the highest aluminium producer in the world in 2018. The acquisition of Yunnan Metallurgical Group in May 2018 gave Chinalco access to Yunnan Aluminium’s 1.6 million tonnes of smelting capacity, with another 1.45 million tonnes under construction, in addition to Chalco’s annual aluminium smelting capacity of 3.93 million tonnes. This resulted in a total production capacity of 6.98 million tonnes, higher than China Hongqiao’s capacity of 6.46 million tonnes per year.

In the first half of 2019, Chinalco reported a 40 per cent year-on-year increase in profits to about RMB 2.36 billion, while operational income exceeded RMB 170 billion, attributing the success to sweeping organisational reforms. But despite the rise in profits, the world’s largest aluminium group remains under heavy debts, with asset-to-liability ratio standing at 66.12% of 651.4 billion total assets, as of the end of March 2019.

China Hongqiao: Hongqiao stood second as an aluminium producer in the world in 2018, with a total capacity of 3.78 million tonnes after the closure of 2.68 million tonnes of capacity in mid-2017 from the licensed capacity of 6.46 million tonnes per year. Hongqiao’s full year net income was at RMB 5.41 billion, implying a second-half profit of RMB 3.6 billion, down 0.9 percent from a year earlier. Full-year profit was up by 5.4 per cent despite lowered revenues of 7.9 per cent year-on-year to RMB 90.19 billion.

According to a report in April 2019, China Hongqiao Group plans restart some of its closed smelting capacities. The move will allow the company to replace ageing production lines with newer technology, including a high-performing 600 kiloampere (kA) potline, and will keep its total capacity roughly the same. According to the Industrial Securities note Hongqiao’s production guidance for 2019 is fixed at 6.3-6.35 million tonnes of aluminium.

UC Rusal: UC Rusal held the third position in the world as an aluminium producer in 2018, by having its production 0.79 per cent lower than China Hongqiao Group. The output stood at 3.753 million tonnes, up 1.3 per cent from the previous year. This shared about 5.8 per cent of the total aluminium production across the world. Aluminium sales, however, decreased over the year from 3.95 million tonnes in 2017 to3.67 million tonnes in 2018, down 7.2 per cent.

“The company was operating under the sanctions for the majority of 2018. These circumstances, coupled with other factors… led to certain changes [in] operational performance,” Rusal said.

In the first six months of 2019, Rusal’s aluminium sales volume increased by 13.2% to 1,978 thousand tonnes, compared to 1,748 thousand tonnes in the same period last year. But the increase was offset by 15.6 per cent decrease in the weighted-average realized aluminium price to US$ 1,960 per tonne in H1 2019, from US$ 2,322 per tonne in H1 2018. Company’s net profit also dropped by 41.4 per cent fromUS$952 million in H1 2018 to US$558 million in H1 2019.

Rio Tinto: In 2018, the Anglo-Australian mining group produced 3.45 million tonnes of aluminium, 3 per cent down from 2017, but in line with guidance, which was revised during the year due to an ongoing lock-out at the non-managed Becancour smelter, which began on 11 January 2018, and a power interruption at Dunkerque Aluminium in the first quarter. Excluding these smelters, aluminium production was 1 per cent higher than 2017, reflecting continued productivity creep.

In the first half of 2019, Rio Tinto’s aluminium production stood at 1.59 million tonnes. But despite the strong production, the aluminium business suffered due to price declines. The company achieved an average realised aluminium price of US$2,174 per tonne compared to US$2,547 per tonne in 2018 first half. However, higher iron ore prices offset the impact of lower aluminium prices. Rio’s consolidated sales revenue pegged at US$20.7 billion, up 9 per cent from H1 2018.

Emirates Global Aluminium: Emirates Global Aluminium, owned equally by Mubadala Development Company of Abu Dhabi and Investment Corporation of Dubai, produced 2.64 million tonnes of aluminium in 2018, besting the prior year’s record by 40,000 metric tons and cementing its place as the world’s third-biggest producer of aluminium outside the People’s Republic of China.

But the company’s net income stood at AED 1.2 billion (US$325 million), down 64 per cent from AED 3.3 billion (US$900 million) in 2017. Adjusted EBITDA also fell from AED 6.6 billion (US$1.8 billion) in 2017 to AED 4.4 billion (US$1.2 billion) in 2018. However, revenue increased from AED 20.5 billion (US$5.6 billion) in 2017 to AED 23.5 billion (US$6.4 billion) in 2018, up 14 per cent due to an increase in sales volume and benchmark prices.

Vedanta, Alba, and Alcoa were the three other prominent aluminium producers in 2018. Alcoa produced 2.3 million tonnes of aluminium and third party aluminium shipment stood at 3.3 million tonnes.Vedanta, on the other hand, posted 17 per cent growth in aluminium production to 1.95 million tonnes outstripping FY18's 1.67 million tonnes, buoyed by stabilisation and ramp-up of its smelters at Jharsugda (Odisha).

Responses