The US dollar dropped against a basket of currencies overnight after the US Federal Reserve the Federal Reserved announced aggressive asset purchases to support markets.

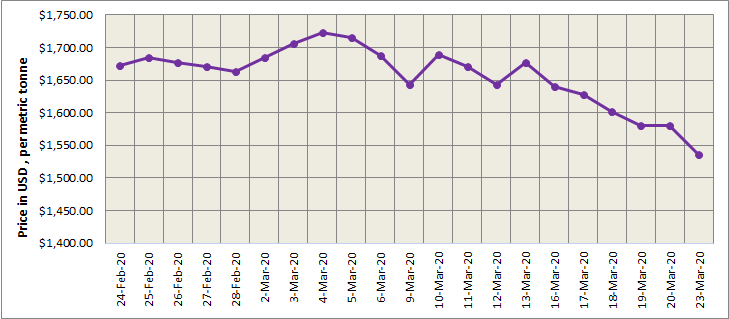

Three-month LME aluminium rebounded to an intraday high of US$ 1,580 per tonne after plumbing its lowest since June 2016 at US$ 1,538.5 per tonne in late Asian trading hours. It later eased to end the day lower at US$ 1,560 per tonne, with the build-up of short positions primarily accounting for the loss. LME aluminium is expected to move between US$ 1,540 per tonne and US$ 1,600 per tonne today.

{alcircleadd}

As of Monday, March 23, LME aluminium cash (bid) price inched down from US$ 1580 per tonne to US$ 1536 per tonne. LME official settlement price dipped to the same amount from US$ 1580.5 per tonne. 3-months bid price and 3-months offer price slipped to US$ 1568 per tonne from US$1603 per tonne and US$ 1605 per tonne, respectively. Dec 21 bid price and Dec 21 offer price hovered at US$ 1686 per tonne.

The LME aluminium opening stock recorded a hike to 1076050 tonnes from 1069925 tonnes on the previous day. Live Warrants stood at 901350 tonnes and Cancelled Warrants at 174700 tonnes.

LME aluminium 3-months Asian Reference Price stood at US$ 1543.88 per tonne inching down from US$ 1617.77per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE rose today, on March 24, from US$ 1598 per tonne to US$ 1603 per tonne.

The most-traded SHFE May contract slumped below all moving averages and closed down 5.22 per cent on the day at RMB 11,345 per tonne. Bearish sentiment amid worsening coronavirus crisis, coupled with a lack of improvement in fundamentals, is likely to cap any rebound in aluminium prices in the near term. Resumption of downstream demand and maintenance schedule at smelters will be closely monitored.

The most-active SHFE 2005 contract is trading at RMB 10,800-11,800 per tonne. East China spot discounts are seen at RMB 80-60 per tonne against the SHFE 2004 contract.

Responses