Automobile Industry, a manufacturing sector paddling through multiple challenges which include the economic slowdown, delays in regards to BS-VI-related and now the Covid-19 pandemic. Despite all the depression, the Industry could cast upon the opportunity of electric vehicles as a positive trend to gear up.

_0_0.jpg)

Aluminium usage is traditional across multiple sectors as the silver metal is universally versatile. It is aluminium which made jets to fly due to its sustainability, light and energy-efficient features.

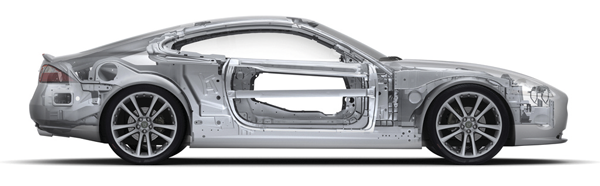

Aluminium has been part of the auto industry for over a century. At the Berlin International Motor Show in 1899, the first sports car was premiered, featuring an aluminium body. Presently, aluminium is the second most used material in the automotive sector next to steel. In the process of manufacturing, 1 kg aluminium can replace 2 kg of steel or cast iron.

The auto industry uses aluminium in manufacturing the vehicle’s frame and body, in electrical wiring, wheels, ABS brakes, transmission, air conditioner condenser and pipes, magnets for speedometers, tachometers and airbags and in engine parts like pistons, radiator, and cylinder head. The replacement of steel using aluminium, augments performance, safety, fuel efficiency and durability, and also renders many environmental benefits.

The electric vehicles industry and its privilege are accredited for the rise in consumption of aluminium. The government has announced a series of measures, comprising investments worth USD1.4-billion, to make India a hub for EV. This constant push from the Government of India is estimated to make India the fourth-largest market for EVs by 2040.

KR Raghunath, Vice-Chairman, Jindal Aluminium said: “The success of electric vehicles would largely rely on lowering the mass weight of the vehicles by using lighter metals. This is where Aluminium can step in. With a bit of innovation and joint engineering both the sectors – aluminium and EV - could evolve a win-win strategy to focus on.”

“If we estimate the increase in manufacturing and sale of EVs in 2030, for every 10 lakh vehicle sold the aluminium demand will be 2.5 lakh tonnes, with an average aluminium content of 250 kg/EV. Therefore, the demand for aluminium will skyrocket as the manufacturing and sale of electric vehicles increase."

He also added: “With our country adopting this development, there will be a considerable increase in demand for aluminium on account of infrastructure for serving EVs. The metal is commonly used in the making of EV charging stations and other related infrastructure.”

The batter enclosures for EV battery are another opportunity for the aluminium industry.

Responses