The 2021 outlook has enhanced significantly for the scrap market, propelled in part by constrained supply chains and rising prices of the metal have seen a dramatic turnaround. However, prices remain volatile and most market participants remain cautiously optimistic. Aluminium scrap can be recast for multiple uses like extensively in construction projects and also in the manufacturing automobiles, aircraft, etc.

Thailand’s mixed economic system delivers a variety of private freedom, blended with centralized economic planning and government regulation. According to the World Bank, Thailand is a newly industrialized country, with a GDP of $505 billion in 2018, and the 8th largest economy of Asia.

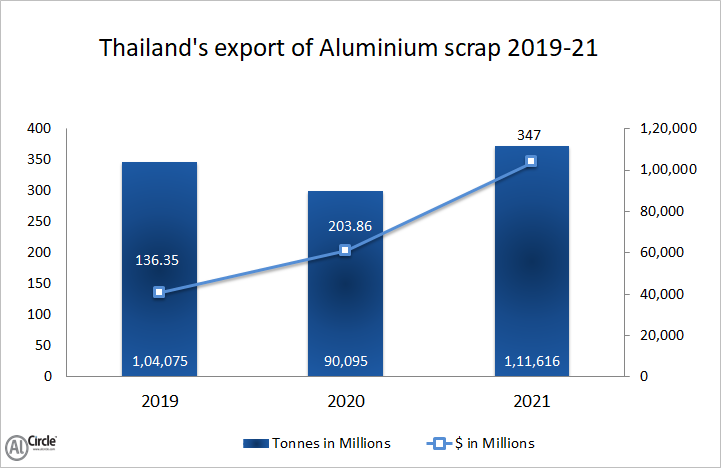

The South-East Asian nation, Thailand running industries like auto manufacturing and automotive parts, electrical appliances and components, heavy and light industries gathers a huge amount of aluminium scrap. During 2019-20, it exported 194,170 tonnes of aluminium scrap, which incurred earnings of around $340.21 million, whereas in 2020 the export descended by 13.43%, as the export volume dropped to 90,095 tonnes, while revenue earnings also ascend to $203.86 million.

Thailand’s export of aluminium scrap for 2021 is analysed with growth by 23.88%, as the export volume is predicted to gain power for reaching 111,616 tonnes with earnings to stand at $347 million.

The major trading nations for Thailand’s export of aluminium scrap are Cambodia, China, Hong Kong, Indonesia, India, Japan, Malaysia, Singapore, South Korea, Taiwan, Turkey, USA, etc.

Responses