您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

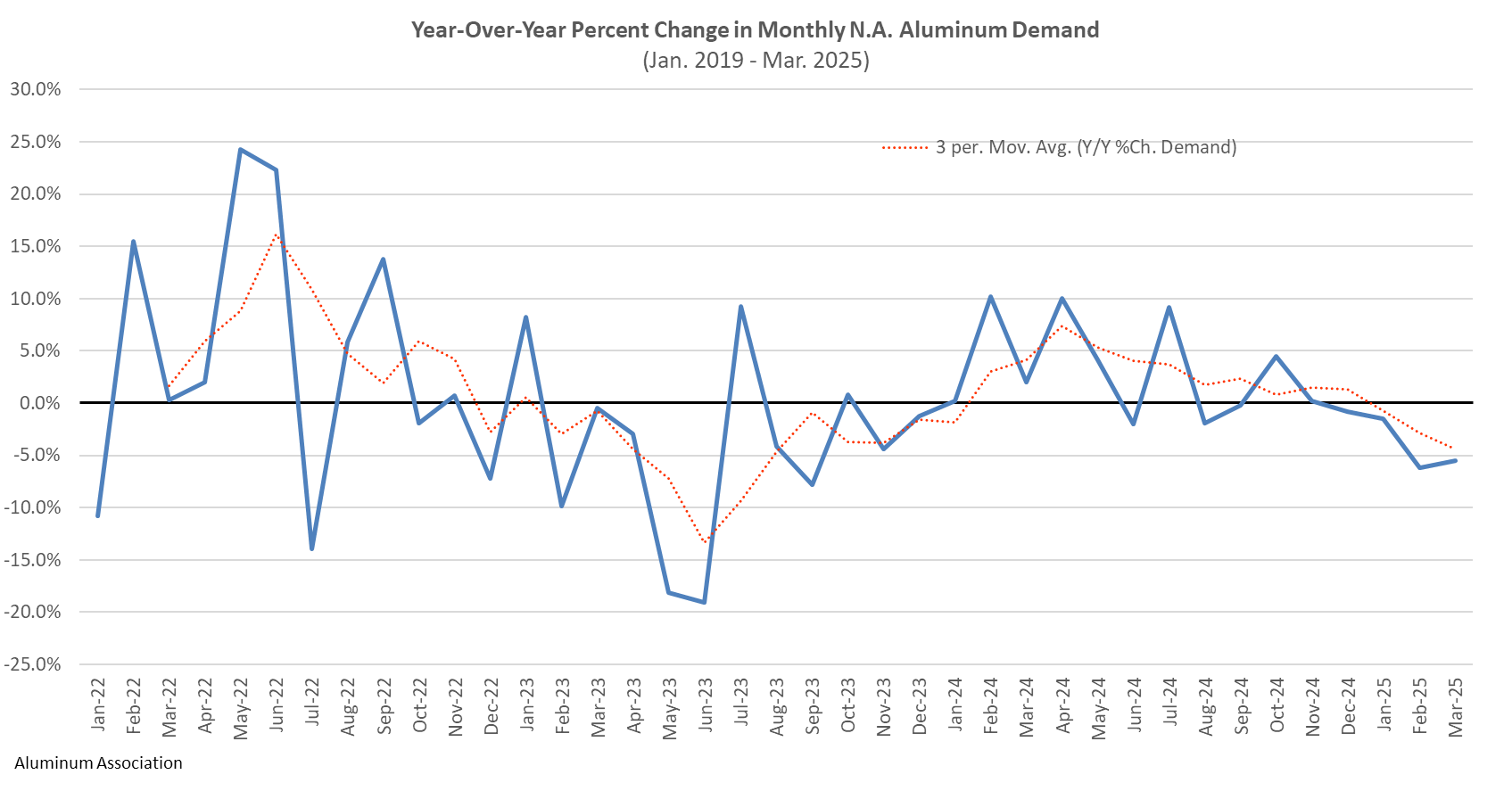

The protectionist tariff strategy once touted by US President Donald Trump to revitalise domestic aluminium and steel production appears to be yielding the opposite effect - at least in early 2025. Industry indicators point to a clear downturn, with aluminium demand and production trending downward during the first quarter of the year.

Image credit: Aluminum Association

Image credit: Aluminum Association

PMI signals early warning

The first signs of contraction came from industrial sentiment. Both the US and Canadian Purchasing Managers’ Indexes (PMI) dipped below the critical 50-point threshold in March 2025, registering at 49 and 46.3, respectively, indicating a shrinking manufacturing sector. Historically, a PMI below 50 signals a downturn in production and purchasing activity, which typically correlates with weakening demand for industrial metals like aluminium.

Demand contracts after 2024 rebound

According to data from the Aluminum Association, total aluminium demand in North America fell 4.1 per cent year-on-year in Q1 2025, slipping to 6.53 million tonnes, compared to 6.83 million tonnes in Q1 2024. This decline starkly contrasts the 4.3 per cent rebound recorded during the same period a year earlier.

…and so much more!

SIGN UP / LOGINResponses