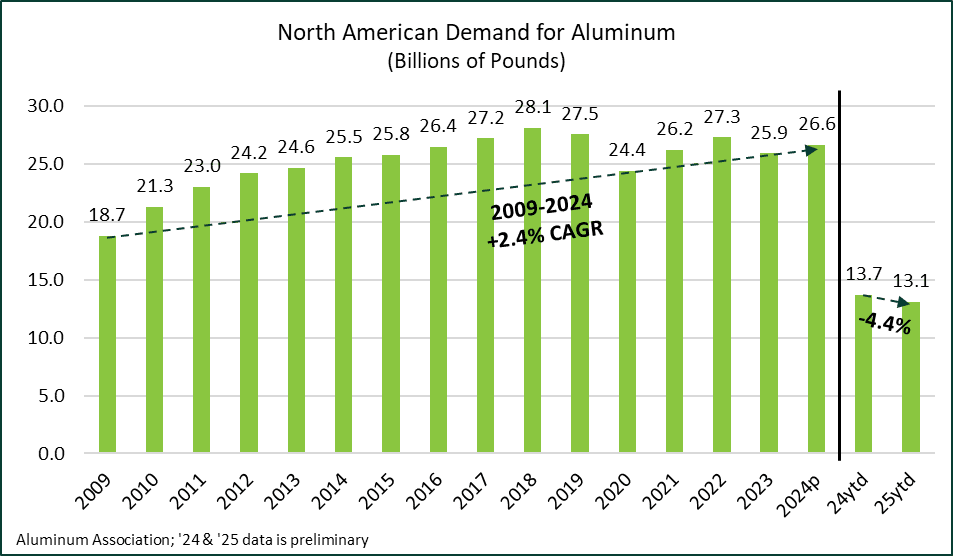

According to preliminary estimates from the Aluminum Association, aluminium demand in North America (the US and Canada) fell 4.4 per cent year-on-year in the first half of 2025. Whether this decline is the direct fallout of Washington’s punitive duties is a question the Association intends to probe. Its president and CEO, Charles Johnson, has stressed that trade policies must bolster and not burden the domestic aluminium industry. The numbers also point to a deeper dilemma: does a slowdown in aluminium demand signal an equal cooling in both aluminium ingot and scrap? While unwrought aluminium imports are sliding, scrap inflows are climbing, and inventories are swelling. This raises tough questions about how the market is truly shifting.

A deeper look at the data and its analysis may offer a clearer picture:

Looking closer at the data, the sharpest drag on domestic producers’ shipments in the US and Canada came from plunging ingot demand. Trade data shows US unwrought aluminium imports from Canada slipped 14 per cent in the first half of 2025, falling to 1.2 million tonnes from 1.4 million tonnes a year earlier. Imports from the rest of the world also edged lower, from 2 million tonnes to 1.94 million tonnes.

Mirroring the same trend, Canada’s unwrought aluminium imports from the US shrank to 27,840 tonnes from 43,655 tonnes, while that from the world fell to 61,162 tonnes from 71,822 tonnes over the same period.

Responses