AMAG Austria Metall AG, the biggest company in the Austrian aluminium sector, has announced the results for Q1 2025. The company witnessed growth in both revenue and earnings, with a 10 per cent rise in shipments under the rolling division, while the Metal Division benefited from higher aluminium prices and increased premiums. As anticipated, the challenging conditions in the European automotive sector had a noticeable impact on the Casting Division.

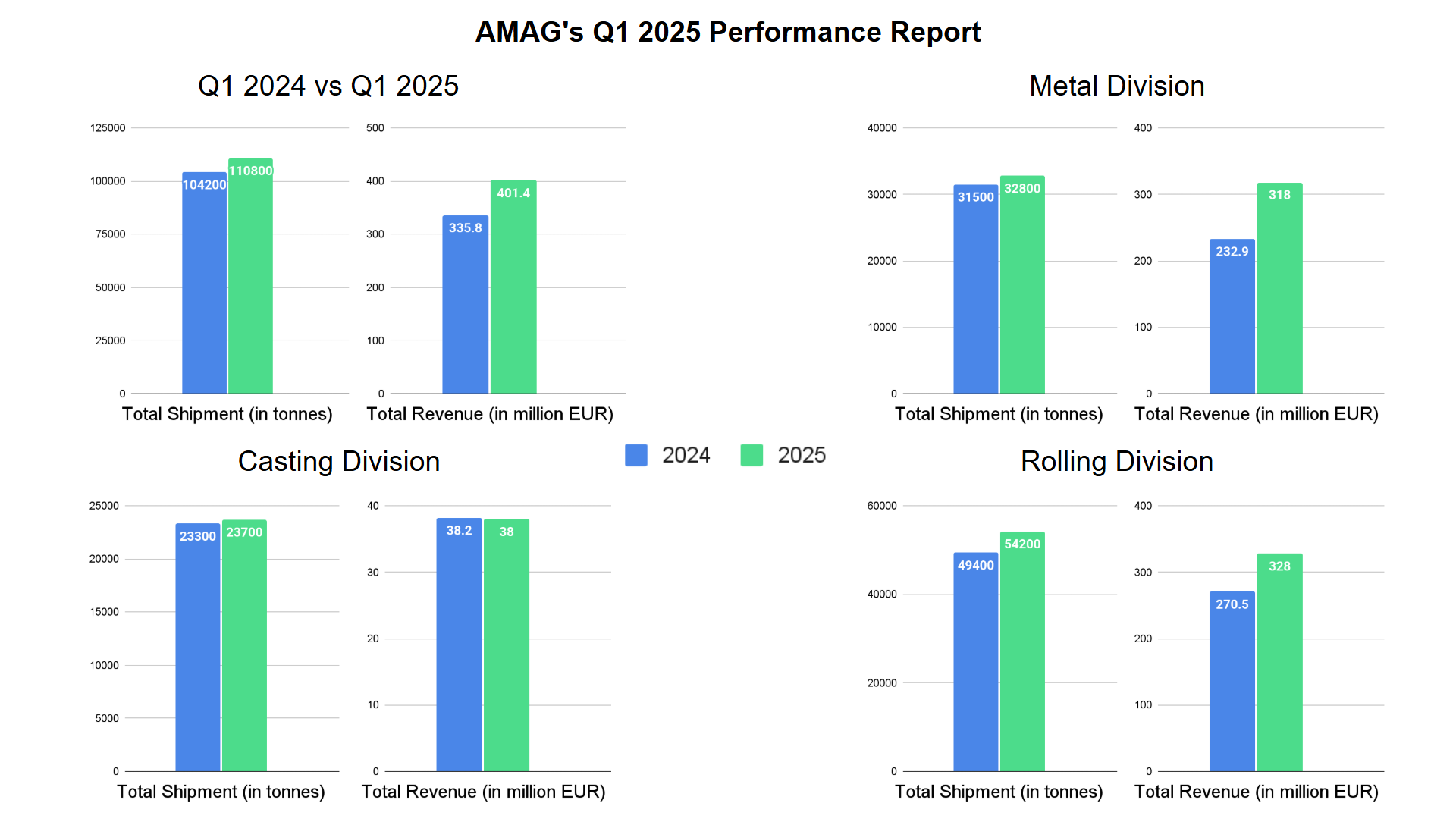

AMAG Group's revenues rose by nearly 20 per cent to EUR 401.4 million in Q1 2025, up from EUR 335.8 million in Q1 2024, driven by higher shipment volumes and increased aluminium prices. Total shipments grew by approximately 6 per cent to 110,800 tonnes, compared to 104,200 tonnes in the same period last year.

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) climbed by about 9 per cent to EUR 46.1 million, up from EUR 42.4 million in the first quarter of 2024. Throughout 2024 the company's revenue, shipments and EBIDTA were:

Metal Division

In Q1 2025, the Metal Division achieved an EBITDA of EUR 20.6 million, up from EUR 17.2 million in Q1 2024 (19.2 per cent).This performance was supported by consistently stable production at the Alouette smelter in Canada.

A higher aluminium price more than compensated for the rise in alumina costs seen in Q4 of 2024. Additionally, the division benefited from a sharp increase in US Midwest premiums ahead of the implementation of US import tariffs on 12 March 2025.

Total revenue for Q1 2025 arrived at EUR 318 million, which, when compared to Y-o-Y, witnessed a surge of 36.5 per cent from EUR 232.9 million. Shipments also increased by 4.1 per cent, arriving at 32,800 tonnes.

Casting division

The challenging conditions in the European automotive market were reflected in the Casting Division's earnings, with EBITDA declining to EUR 0.9 million in Q1 2025 (59.3 per cent), down from EUR 2.2 million in the same period last year, followed by a 0.6 per cent Y-o-Y drop in revenue to stand at EUR 38 million.

This drop was primarily due to lower price levels combined with higher energy costs. On a brighter side, the total shipments under the same division for Q1 2025 witnessed a growth of 1.7 per cent, settling at 23,700 tonnes.

Rolling division

Meanwhile, the Rolling Division saw growth in sales of industrial applications and packaging products, which helped offset declines in volumes for aerospace, heat exchanger, and other transport sectors such as lorries.

EBITDA for the division rose to EUR 24.4 million, compared to EUR 22.5 million in Q1 2024. However, the introduction of global 25 per cent US import tariffs on aluminium products is increasingly affecting order intake, prompting shifts in the product mix and intensifying price pressures. Total revenue grew by 21.3 per cent Y-o-Y arriving at EUR 328 million, followed by a growth of 9.7 per cent in total shipments. The total shipment for Q1 2025 stood at 54,200 tonnes.

Other incomes

After accounting for depreciation and amortisation of EUR 22.3 million (Q1 2024: EUR 22.2 million), AMAG Group's earnings before interest and taxes (EBIT) rose by 18 per cent to EUR 23.8 million, compared to EUR 20.2 million in the previous year. Net income after taxes increased by approximately 22 per cent, reaching EUR 16.2 million in Q1 2025 (Q1 2024: EUR 13.3 million).

Cash flow from operating activities benefited notably from strong operating earnings, climbing 44 per cent to EUR 51.1 million, up from EUR 35.6 million in the prior-year quarter. Changes in working capital largely offset one another as of 31 March 2025. With cash flow from investing activities at EUR -16.8 million (Q1 2024: EUR -26.0 million), the Group generated a free cash flow of EUR 34.4 million, significantly higher than the EUR 9.6 million recorded in Q1 2024.

As of 31 March 2025, net financial debt improved to EUR 356.1 million, down from EUR 382.3 million at the end of 2024. Cash and cash equivalents also increased, reaching EUR 306.2 million compared to EUR 278.8 million on 31 December 2024.

Outlook for 2025

Dr Helmut Kaufmann, Chief Executive Officer of AMAG, said, "The current economic environment is characterised by increased uncertainties as a result of the diverse and fluctuating trade policy measures. These considerable volatilities require the ability to adapt rapidly – a quality that characterises us as AMAG. We will act in our usual flexible and customer-orientated manner. Nevertheless, it can be assumed that the upheavals in the global economy will also affect AMAG's business development."

Global GDP growth forecasts have been significantly revised downward compared to earlier estimates. The global economy is now expected to grow by just 2.8 per cent, down from the previously projected 3.3 per cent. In the United States, growth expectations have been lowered to 1.8 per cent from 2.7 per cent, while the Eurozone is forecast to expand by only 0.8 per cent, down from 1.0 per cent. For Germany, economic growth is now expected to stagnate, with the previous forecast of 0.3 per cent no longer anticipated.

Given the highly volatile environment, particularly about trade policy measures, providing a reliable earnings outlook for the rest of 2025 is increasingly challenging. Nevertheless, based on current conditions—including the assumption that the recently implemented global US import tariffs on aluminium products remain in place—AMAG expects to achieve full-year EBITDA in the range of EUR 110 million to EUR 140 million.

Image Source: AMAG website

Responses