您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

China has long capped its domestic primary aluminium production at 45 million tonnes, a ceiling designed to curb industrial emissions and contain environmental risk. In 2025, it finished the year with 88.2 million tonnes of alumina and around 44 million tonnes of primary aluminium, in line with the industry’s two-to-one production ratio.

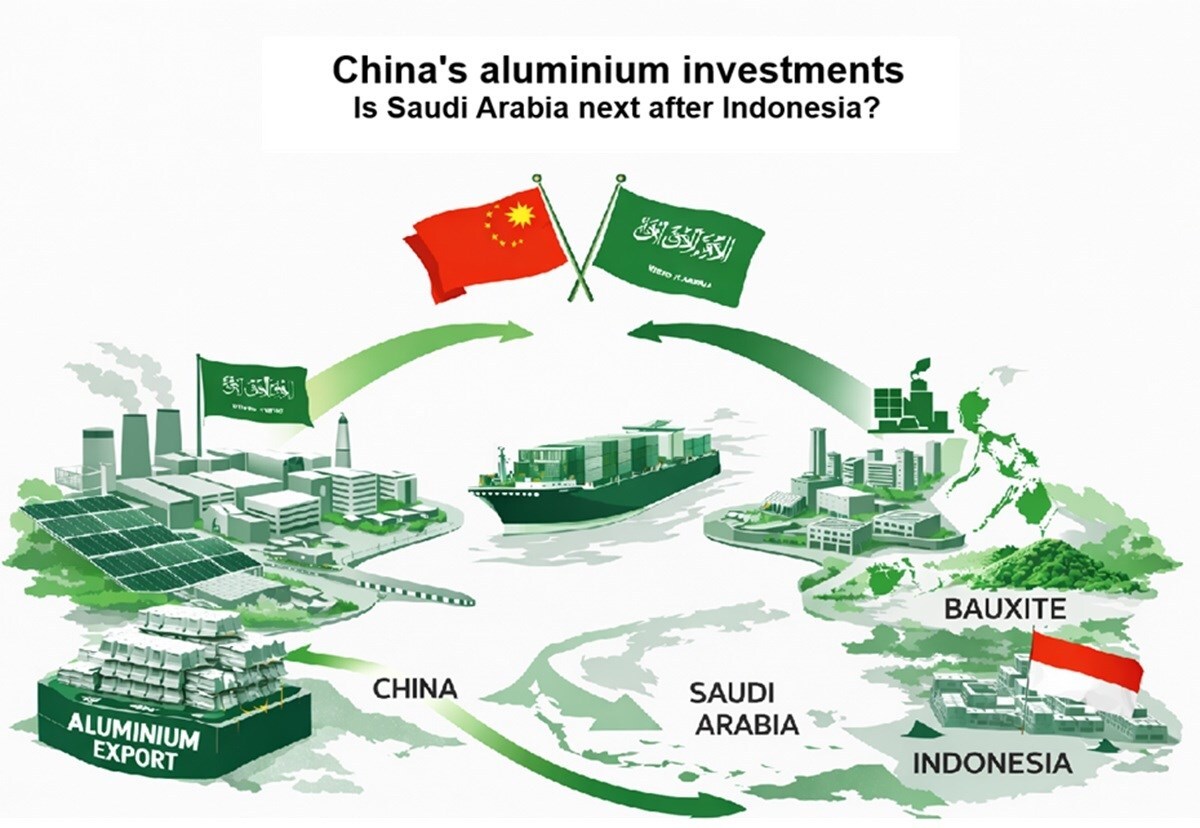

{alcircleadd}But as that cap presses tighter, Chinese companies are not slowing down. Instead, they are shifting strategy - pushing capital, technology and industrial muscle overseas so that aluminium keeps flowing, even if it is increasingly produced on other people’s soil. And in this expanding map, Indonesia has already become the central pillar, while China’s projects in Saudi Arabia - only a handful tied to aluminium so far - leave open the question of whether the kingdom will be next aluminium hub for China.

A new frontier: Saudi Arabia?

As Indonesia has already emerged as one cornerstone in China’s offshore aluminium strategy, Saudi Arabia is now entering the conversation - though whether it becomes the next pillar remains uncertain.

…and so much more!

SIGN UP / LOGINResponses