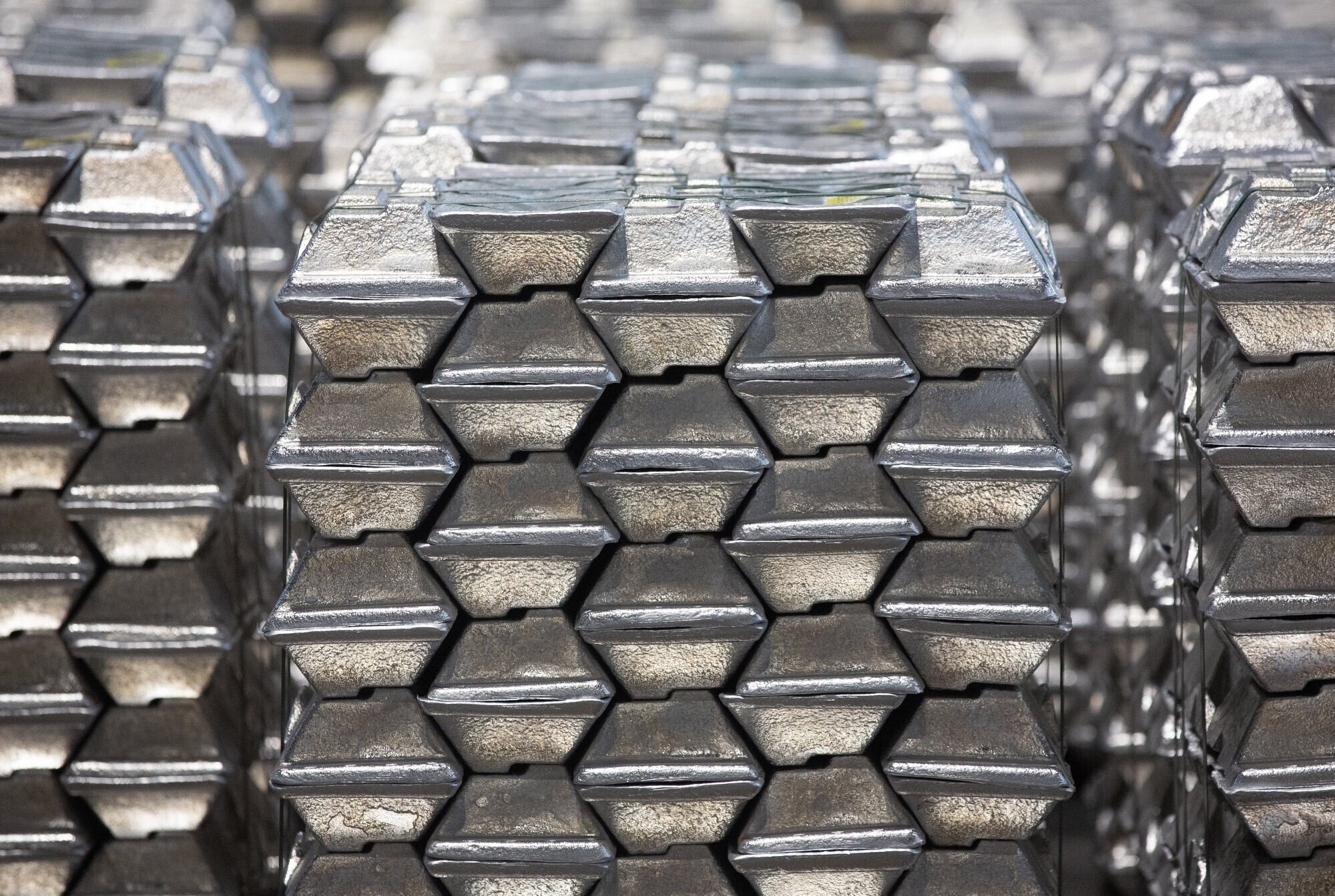

Amidst ongoing market fluctuations, the London Metal Exchange (LME) has reported that the share of available aluminium stocks originating from Russia remained steady at 91% in March, mirroring figures from the previous month. This data, while reflective of current market realities, underscores a consistent presence of Russian metal within LME-approved warehouses.

In fact, at this moment, 40 per cent of the existing LME metals stocks are of Russian origin.

For industry stakeholders, including both producers and consumers, the dominance of Russian-origin metal raises pertinent considerations with Russia's Rusal being a key competitor in the market, alongside geopolitical tensions stemming from the Ukraine-Russia crisis since 2022, there exists a discernible impact on decision-making within the aluminium sector.

Shifting dynamics – Aluminium – Copper – Nickel

In March, the quantity of Russian primary aluminium stocks held on LME warrant experienced a marginal decrease, totalling 311,900 metric tonnes compared to 324,675 metric tonnes in February.

Concurrently, the share of Russian-origin copper stocks saw an increase to 62 per cent, up from 52 per cent the prior month, with a rise in inventory levels to 60,750 tonnes from 53,575 tonnes.

Similarly, the proportion of Russian nickel in LME inventories rose to 36 per cent in March, a modest uptick from 35 per cent in February, with quantities reaching 24,858 tonnes.

Navigating market realities

As the industry continues to grapple with geopolitical tensions and market fluctuations, a nuanced approach to managing Russian-origin metal stocks on the LME is warranted. By staying abreast of evolving dynamics and fostering diplomatic engagements, stakeholders can navigate these challenges effectively, ensuring resilience and sustainability within the aluminium market.

If you wish to learn about the international aluminium dynamics in more details please have a look at AL Circle's special report, Global Aluminium Industry Outlook 2024.

Responses