Rio Tinto announces record returns of US$13.5 billion including final dividend of US$3.1 billion and special dividend of US$4.0 billion to its shareholders for 2018.

Commenting on the announcement, Rio Tinto chief executive J-S Jacques said “We have once again announced record cash returns to shareholders of $13.5 billion on the back of $18 billion of underlying EBITDA and a Return on Capital Employed of 19%. These strong results reflect the efforts of the team to implement our value-over-volume strategy as we continued to strengthen the portfolio and invest in future growth.”

{alcircleadd}

“Our world-class portfolio and strong balance sheet will serve us well in all market conditions, and underpin our ability to continue to invest in our business and deliver superior returns to shareholders in the short, medium and long term,” he added.

Rio recorded an EBITDA of US$18.1 billion, just 2% less than 2017. This was notwithstanding the divestments and input cost pressures in aluminium and alumina. Rio said in their press release that US$0.4 billion exit rate from their mine-to-market productivity programme was impacted by $0.3 billion higher costs from raw materials – in particular caustic soda, petroleum coke and tar pitch for Aluminium.

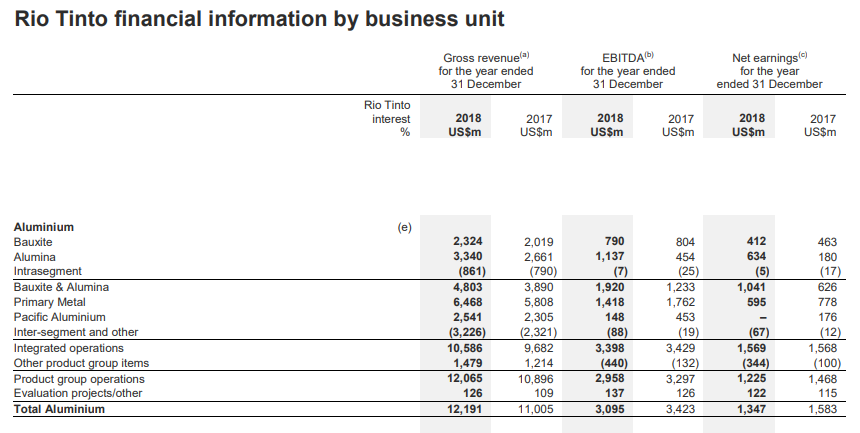

Underlying EBITDA for aluminium operations stood at US$ 3,095 million, down about 10% from US$3,423 million in 2017. Underlying earnings stood at US$1,347 million, down 15% from US$1,583 million in 2017. Underlying EBITDA for bauxite and alumina operations stood at US$ 1,920 million and underlying EBITDA for primary metal stood at US$1,418 million.

US$11.8 billion operating cash flow was15% below 2017, driven by tax payments and higher inventory balances driven by higher prices of raw materials.

US$2.9 billion were invested in high value development projects including AutoHaul™ automated trains and Amrun bauxite project. Strong contribution from copper & diamonds business, compensated for lower underlying earnings in other product groups.

Average prices for aluminium were up 7% compared with 2017 which benefited the company. It was also benefitted from higher market premiums for aluminium, in particular the mid-west premium in the US which averaged US$419 per tonne in 2018 compared with US$199 per tonne in 2017. The company said that the 10% tariff on imported aluminium from Canada is not likely to have a significant financial impact on their business in the near term.

Responses