According to the latest Resources and Energy Quarterly for September 2017 by Australian Government's Department of Industry, Innovation and Science, World aluminium production increased by 5.8 per cent YoY in the first eight months of 2017, to over 40 million tonnes.

Production growth was driven by strong growth in China (7.7 per cent YoY), ex-China Asian countries (14 per cent year-on-year), and South America (3 per cent year-on-year). Due to reduced capacity at Portland Aluminium in Australia after a power outage in December 2016, production in Oceania fell by 11 per cent YoY. Environmental inspection and illegal capacity cut are expected to reduce China’s aluminium production by 4.3 per cent to 30 million tonnes by the end of 2017.

{alcircleadd}

The report further states that production rises in other Asian countries (up 21 per cent) and the Middle East (up 2.3 per cent) will offset the production cut in China, and cause global aluminium production to drop by a meagre 0.3 per cent in 2017 to 58 million tonnes. Aluminium production is projected to continue growing in 2018 and 2019 and reach about 65 million tonnes by 2019. A projected increase in aluminium prices in 2017 is expected to encourage some idled aluminium plants to restart by the end of 2017 or beginning of 2018. In China, existing and new capacities that have been closed by regulators due to environmental and legal reasons are expected to reopen after the winter season.

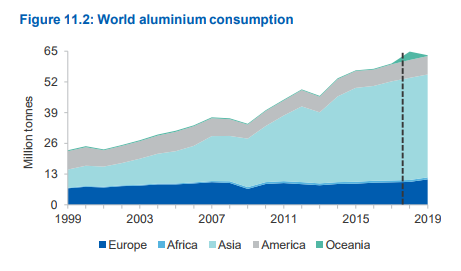

The report also states that world aluminium consumption would remain strong in the rest of 2017 and 2018. World aluminium consumption increased by 4.8 per cent YoY in the June quarter 2017, to over 15 million tonnes. Demand growth was driven primarily by increased vehicle sales in Japan, and increased fixed asset investment (FAI) in China.

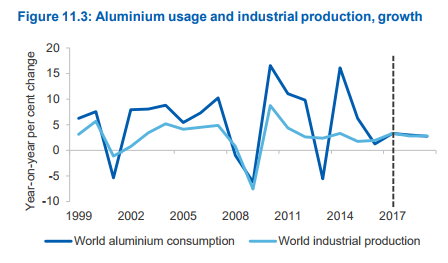

World aluminium consumption is forecast to rise at an average annual rate of 2.8 per cent over the next two years, to 62 million tonnes in 2018 and 63 million tonnes in 2019. Consumption growth is likely to track trends in global industrial production. Global industrial production is projected to increase by 3.3 per cent in 2017. This is expected to drive up world aluminium consumption by 3.3 per cent in 2017 to 60 million tonnes. Vehicle demand will continue to play a key role in driving aluminium demand in China.

Increased vehicle sales and lightweight cars with higher aluminium content will drive the rise in transport demand. Rises in vehicle sales in developed and emerging automotive markets (such as North America, China, and Latin America) would drive global vehicle sales. Aluminium consumption in the European vehicle industry is expected to increase. Hydro has already commissioned a 200,000 tpy automotive aluminium sheet facility in Germany in July.

Aluminium demand from North America is expected to grow at an annual average rate of over 3% over the next few years, to 7.5 million tonnes in 2019, buoyed by higher lightweight vehicle production. Latin America is expected to be the fastest growing regional automotive market in the world. According to the International Aluminium Institute, aluminium content per vehicle is expected to account for 16 per cent (or 565 pounds) of curb weight by 2028. This represents a rise of 42 per cent over the past 13 years.

{Image Source: CPD Netherlands Bureau for Economic Policy Analysis; Department of Industry, Innovation and Science (2017); World Bureau of Metal Statistics (2017)}

Responses