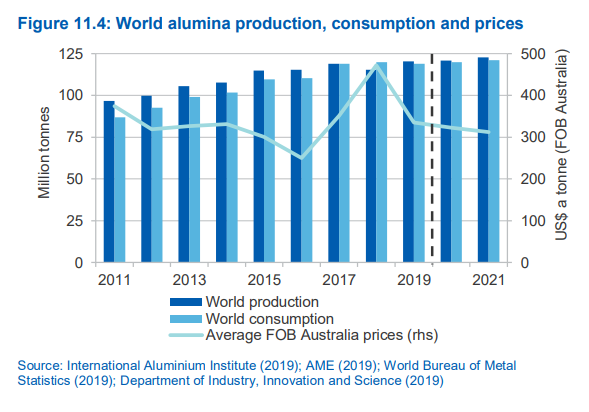

Alumina market recovered from the price volatility of last year, which was driven by 50% capacity cuts in Alunorte alumina refinery, workers strikes in Alcoa refineries and sanctions against Rusal. Australian alumina FOB price, which shot up to US$ 710 per tonne in April 2018, plunged to the lowest at US$ 278.50 per tonne by the end of 2019.

Global alumina output for the period from January-October 2019 stood at 110 million tonnes (IAI data), 1.8% more than 108 million tonnes in the same period of 2018. Metallurgical alumina production stood at 103 million tonne. China produced 66.49 million tonnes of alumina in the first eleven months of 2019, an increase of 1.8% from the same period last year. Slow restarting of primary aluminium capacities led to a build-up in alumina stocks in China pressurising prices. The market has been oversupplied with the wrap up of supply related issues, new capacities coming online and weak demand from aluminium smelters. A surplus alumina market is predicted for the whole year 2019. Read through the article that sketches the development in the alumina industry over the year 2019.

Price Scenario

Production ramp-up at EGA’s 2 million tonnes Al Taweelah refinery in Abu Dhabi, resulting in overseas supply jump, and restart of Hydro’s 3.2 million tonnes closed capacity in Brazil Alunorte refinery knocked Australia alumina FOB prices to $280 per tonne level, down from $323 per tonne at the end of June.

Australian Alumina FOB Price

Australian Alumina FOB Price, according to Shanghai Metals Market stands at US$ 278.50 per tonne currently after starting the year with US$ 415 per tonne, registering a drop of about 33%. The highest in the year was US$ 422 per tonne in April and it has been constantly falling due to an oversupplied market. Average imported alumina price in China also stands unchanged at US$356 per tonne. Imported alumina prices are constantly on a downward curve as the international market has been going through a period of oversupply.

As shown by Shanghai Metals Market’s data, China’s alumina price has been continuing its downward trend over 2019. It was expected that the domestic alumina price will go up after Xinfa’s Jiaokou refinery stopped production in June. Despite the output drop of 1.4% in May and expected production drop in June, alumina prices were still on a downward curve. The average spot alumina price at China’s domestic market continued to fall through June touching the lowest in April. Though capacity cuts have buoyed the prices, pushing it to a high of US$ 459 towards the end of May, the price again came down to stand currently at US$346 per tonne.

The alumina index is down 27% from early 2019 and 42% YoY from US$500 per tonne on September 28, 2018. Lower alumina prices affected the earning results of key alumina suppliers like Nalco, South 32, Hydro and Alumina Ltd.

Demand supply scenario

Alcoa projected a global surplus market for alumina in 2019, ranging between 1 million and 1.8 million tonnes, driven by faster restarts and expansions of new alumina projects in the world ex-China as well as lower alumina demand due to disruptions at several aluminium smelters in China. Emirates Global Aluminium recently announced that its Al Taweelah alumina refinery in Abu Dhabi produced one million tonnes of alumina since operations started in April 2019. Alunorte, with an annual production capacity of 6.3 million tonnes, reached 83 per cent utilization of its capacity in the third quarter. The refinery production increased 61% QoQ to 1.3 million tonnes in Q32019.

Alcoa estimates around 1 million tonnes of Chinese alumina surplus in 2019 contributing to it. We expect the Chinese alumina market to end the year 2019 with a surplus.

South 32’s Brazil Alumina, India Vedanta’s Lanjigarh refinery and Friguia refinery in Guinea are other refineries that are adding to alumina capacity in 2019. An abundant alumina market will also take away the cost support from aluminium price. Michael Peter Ferraro, Alumina Limited - MD, CEO & Executive Director also forecasts a modest surplus of alumina in 2019.

Huo Yunbo, senior analyst with Chinese consultancy Antaike projected China’s 2019 alumina output to reach 71.59 million tonne, up slightly YoY from 71.54 million tonne (IAI data) with a surplus of around 400,000 tonne. Alumina capacity in China is projected to increase by 3.8 million tonne YoY to touch 87.15 million tonne in 2019.

Liang Xuan, a senior aluminium analyst at Shanghai Metals Market, estimates China’s alumina market to turn into a “tangible surplus” in the fourth quarter of 2019, as the newly started refineries ramp up their domestic production and import arbitrage window opens. As per Liang’s estimation, alumina capacity in China will likely expand by 2.5 million tonnes on an annualised basis in 2019

A surplus alumina market and lower price in China is driven by lower aluminium production in China caused by a number of factors like suspension and relocation of operations, winter production cuts, and flexible production schedules driven by reduced demand.

Trade Focus:

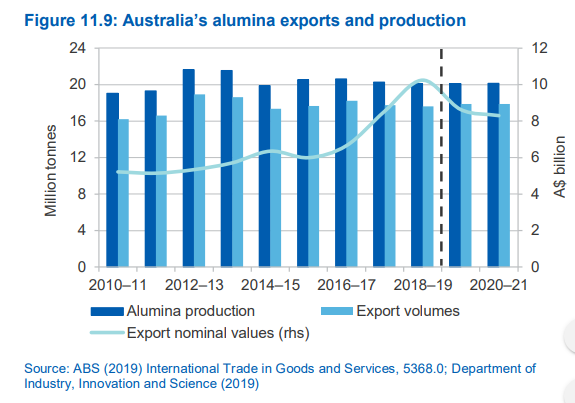

Australia remained the world’s second largest alumina producer after China and top alumina supplier in 2019. The country produced 20.1 million tonnes of alumina and exported about 17.6 million tonnes. Alumina exports increased about 3.5% YoY.

Brazil’s exports of alumina increased to 3.14Mt during the first half of 2019 as Norsk Hydro bounced back to almost normal levels following the lifting of a 50% production embargo on its Alunorte alumina refinery in May. The rise represents a 17% increase on exports for H2 2018. At the same time, the average value of Brazilian alumina exports declined by 16% to US$376/t.

Poor demand for alumina due to lower-than-expected recommencement of primary aluminium projects in China or no expansion after the Winter Heating season of FY2019 due to weak aluminium prices resulted in lowered alumina imports by China. However, September onwards, the imports started growing month-on-month due to substantial primary aluminium capacity coming on stream on higher aluminium prices. The total amount of imports in the first nine months of the year stood at 790,000 tonnes, up 93.3 per cent from the same period last year. By the end of 2019, China is expected to import around 1 million tonnes alumina, almost double the 510,000 tonnes imported in 2018.

Export earnings from alumina are projected to decline further in 2020 due to softening of alumina prices due to abundant supply.

Short Term Outlook

As presented by Huo Yunbo, senior analyst with Chinese consultancy Antaike during Aluminum Week in Qingdao, China’s alumina production will increase to 74.35 million tonne by 2020 with new operations coming online, leading to a surplus of 730,000 tonne putting pressure on price. She projected domestic alumina prices to hover around RMB 2,400-2,900 per tonne (US$342-413/t) in 2020.

About 4.7 million new alumina capacity will be added in 2020 with about 1.8 million t/year of delayed new capacity coming on stream by 2020. Chinese alumina market, which is in balance this year is likely to go into surplus in 2020. She projected domestic alumina capacity to increase with capacities relocating to Southwest regions, closer to bauxite resources. This combined with the inflow of low-cost seaborne alumina may add more pressure to domestic supply.

Alumina production costs are expected to drop as there will be abundant supply of bauxite with more bauxite coming from new bauxite projects in Guinea.

The outlook for alumina price in 2020 has been revised down by 5.5 per cent to US$ 316 per tonne by Australian department of industry, due to a larger than expected fall in the FOB Australian alumina price in the December quarter 2019.

Responses