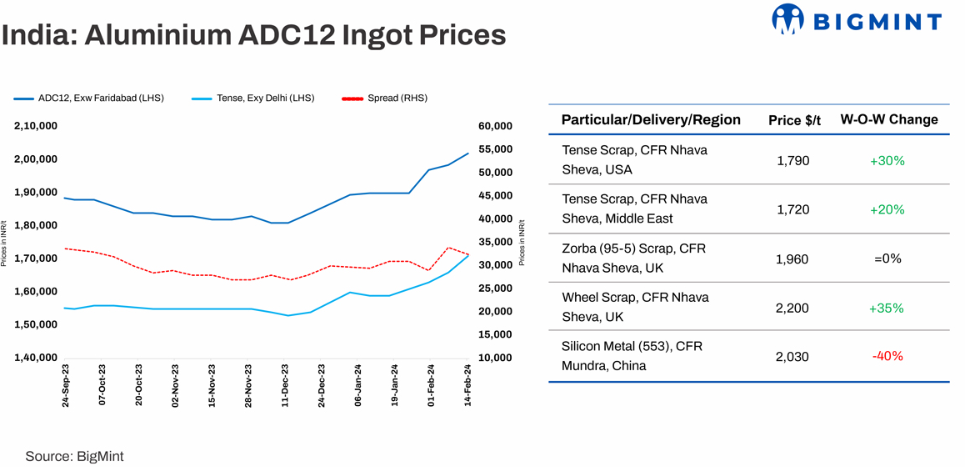

Spot prices for aluminium ADC12 alloy ingot, equivalent to automotive-grade, experienced a weekly increase of INR 3,500 per tonne, reaching INR 202,000 per tonne ex-works in Delhi, excluding GST. This rise is primarily linked to the escalation in local Tense scrap prices, mainly due to shortages observed in both northern and southern regions of India, according to BigMint's analysis.

Why the surge in costs?

In the north Indian market, soaring prices resulted from a scarcity of vital raw materials, especially tense scrap, currently priced at INR 171,000/t exy Delhi (excluding GST).

Presently, tense offers in Chennai stand at INR 165,000/t. However, bids are in the range of INR 162,000-163,000/t.

Considering the ongoing scarcity in the tense scrap market, prices are likely to reach INR 168,000-170,000/t, BigMint notes. Additionally, the spot price for ADC12 in Chennai currently stands at INR 200,000-202,000/t levels exw.

The current spread from Tense to ADC12 stands at INR 31,000/t. However, mills are moving towards an INR 35,000/t gap as per the earlier trend.

Commentary on North and South markets by market participants

In an effort to produce ADC12, producers are increasing the usage of Zorba, Trump, and other substitutes for Tense. This trend is increased by a significant shortage of Tense across the entire northern region, creating a substantial challenge in the market, sources informed BigMint.

A producer source stated, "Providing ADC12 on an immediate cash basis is not feasible, even for our regular customers. While we have ADC12 stock up to certain levels at our plant, we are not able to supply below INR 205,000/t at the moment. We are awaiting the March price announcement from Maruti to determine new rates".

An ADC12 manufacturer from south India stated, "Inquiries for ADC12 from Pune region has increased to South region as the price is INR 2,000-3,000/t less in South compared to north. Currently, ADC12 is being offered at INR 206,000/t and will be delivered to Pune this month. However, their bid price is 204,000/t exw".

A producer of small to medium-scale aluminium alloy ingots has shared that they have pre-booked orders for upcoming shipments until a specified period. This strategic move is in reaction to a notable shortage of the crucial raw material, casting scrap, as highlighted by BigMint.

Pricing trend

Imported Tense scrap prices from the Middle East, particularly from the UAE, rose by $20/t to $1,720/t yesterday. Tense (6-7 per cent) from the US was heard at $1,790/t, up by $30/t. The price for zorba 95-5 from the UK stood at $1,960/t CFR Nhava Sheva.

However, three-month futures for aluminium were currently at $2,216/t, reflecting a rangebound level w-o-w. China-origin silicon 553 prices were around $2,030/t CIF Mundra, down $40/t primarily because of the Lunar Year holidays.

Domestic market

In the domestic space, scarcity of raw materials, particularly tense scrap, has kept prices on the higher side. Tense scrap prices are INR 171,000/t, while taint tabor scrap prices are INR 170,000/t exy-Delhi (excluding GST).

Around 10 tonnes of tense scrap were sold at INR 164,000/t in Chennai.

Recent deals

Around 20 t ADC12 was traded at INR 203,000/t with 40 days of credit payment terms Exw Chennai.

Around 200 tonnes of UK-origin aluminium taint tabor HRB was traded at $1,725/t CIF West Coast India.

Around 75 tonnes of West African origin Tense 7-8 per cent was heard traded at $1,825/t CIF Chennai.

Received under the content exchange agreement with SteelMint

Responses