您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Qatar Aluminium Manufacturing Company (QAMCO) reported a strong performance for the third quarter and the nine months ended 30 September 2025, driven by firmer aluminium prices, steady output, and solid market demand.

In Q3 2025, the company produced 172 thousand metric tonnes of aluminium, a small but steady rise from 171 thousand metric tonnes in Q2 2025 — roughly a 1 per cent increase. The gain came mainly from stable plant operations and smoother production efficiency.

Sales saw a much sharper rise. QAMCO sold 189 thousand metric tonnes in the third quarter, compared with 167 thousand metric tonnes in Q2, marking a 13 per cent increase. The improvement was largely driven by better demand for extrusion ingots, as downstream sectors picked up pace.

The company’s share of JV revenue grew 7 per cent to QAR 929 million (USD 255 million), from QAR 870 million (USD 238 million) in the previous quarter. Its share of JV EBITDA rose 3 per cent to QAR 313 million (USD 86 million), against QAR 304 million (USD 83.4 million) in Q2 2025.

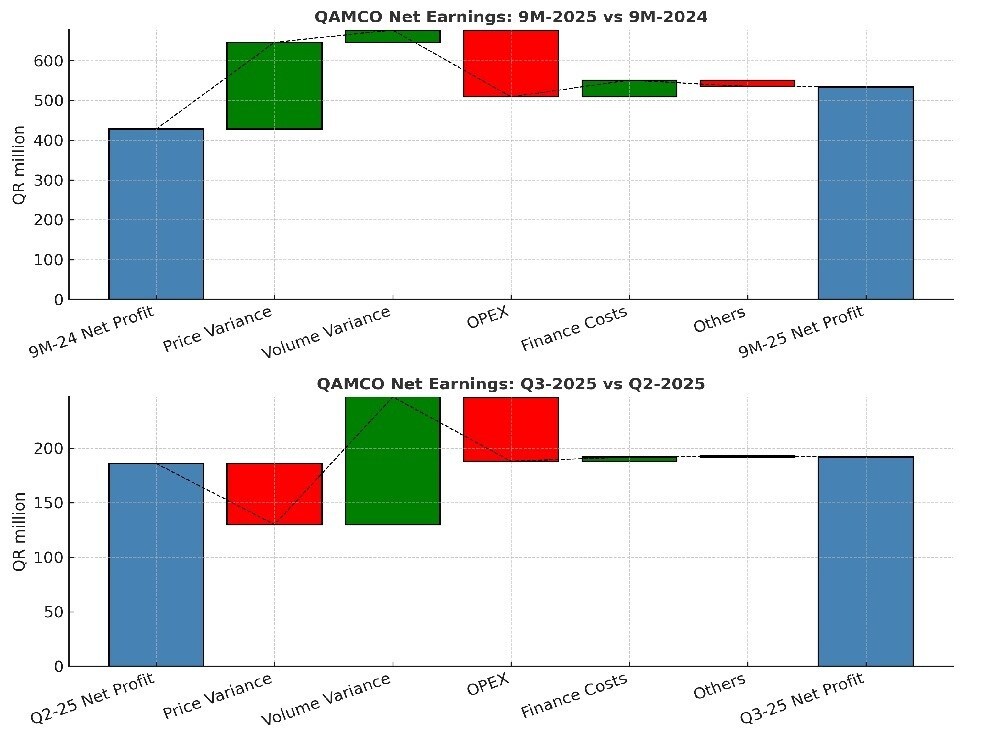

Net profit followed the same direction, reaching QAR 192 million, (USD 52.7 million) compared with QAR 186 million (USD 51 million) a quarter earlier. Earnings per share (EPS) edged up too, to QAR 0.034 from QAR 0.033.

Margins, however, were slightly softer. The EBITDA margin came in at 34 per cent, down from 35 per cent, mostly because the average selling price slipped about 6 per cent to USD 2,702 per tonne, from USD 2,865 per tonne earlier. Still, the stronger sales volumes helped cushion the effect of lower prices and higher costs.

Also read: Hydro Q3 2025: Profit rises to NOK 2.1B, strong cash flow and renewable focus support outlook

9M 2025 vs 9M 2024: Strong growth and stable margins

For the nine-month period, QAMCO reported a net profit of QAR 534 million (USD 146.6 million), a 25 per cent jump from QAR 428 million (USD 117.5 million) in 9M 2024. The increase came on the back of higher revenues, better price realisation, and healthy margins throughout the period.

Earnings per share (EPS) climbed 25 per cent as well, to QAR 0.096, from QAR 0.077 last year. The company’s share of JV revenue reached QAR 2.6 billion (USD 714 million), compared with QAR 2.3 billion (USD 631 million) in 2024 — up 10 per cent.

Similarly, its share of JV EBITDA improved 11 per cent to QAR 895 million (USD 245.7 million), from QAR 809 million (USD 222 million), with the EBITDA margin steady at 34 per cent in both years.

The average realised price for aluminium rose 9 per cent year on year, hitting USD 2,816 per tonne, versus USD 2,584 per tonne in 2024. Production stood at 514 thousand metric tonnes, up slightly from 510 thousand metric tonnes a year earlier, while sales volumes increased 1 per cent to 513 thousand metric tonnes, compared with 506 thousand metric tonnes in 9M 2024.

But it wasn’t just about pricing. Lower finance costs also played a role — mostly because of refinancing moves and scheduled debt repayments at the joint venture level. These helped offset the pressure from higher alumina prices.

Outlook

By the end of September 2025, QAMCO had a cash and bank balance, including its share of JV funds, of about QAR 1.8 billion (USD 494.3 million). That figure underlines its strong liquidity and disciplined financial management.

While aluminium prices dipped a little compared to the previous quarter, they remained higher year-on-year, reflecting the steady recovery in demand. Overall, QAMCO’s performance during 9M 2025 showed resilience and focus — higher revenue, consistent margins, and solid operations kept the company on a firm growth path.

Also read: The World of Aluminium Extrusions – Industry Forecast to 2032

Responses