In the first quarter of 2025, the global electric vehicle (EV) battery market experienced a considerable surge, with total installed capacity reaching 221.8 GWh, which is a 38.8 per cent increase compared to the same period in 2024. Today, we delve into the leading brands and their performance in 2025, which has aided in the surge against all odds. Country-wise, China has shoved South Korea and Japan in the sustainable battery race.

{alcircleadd}

China’s battery manufacturers lead the charge

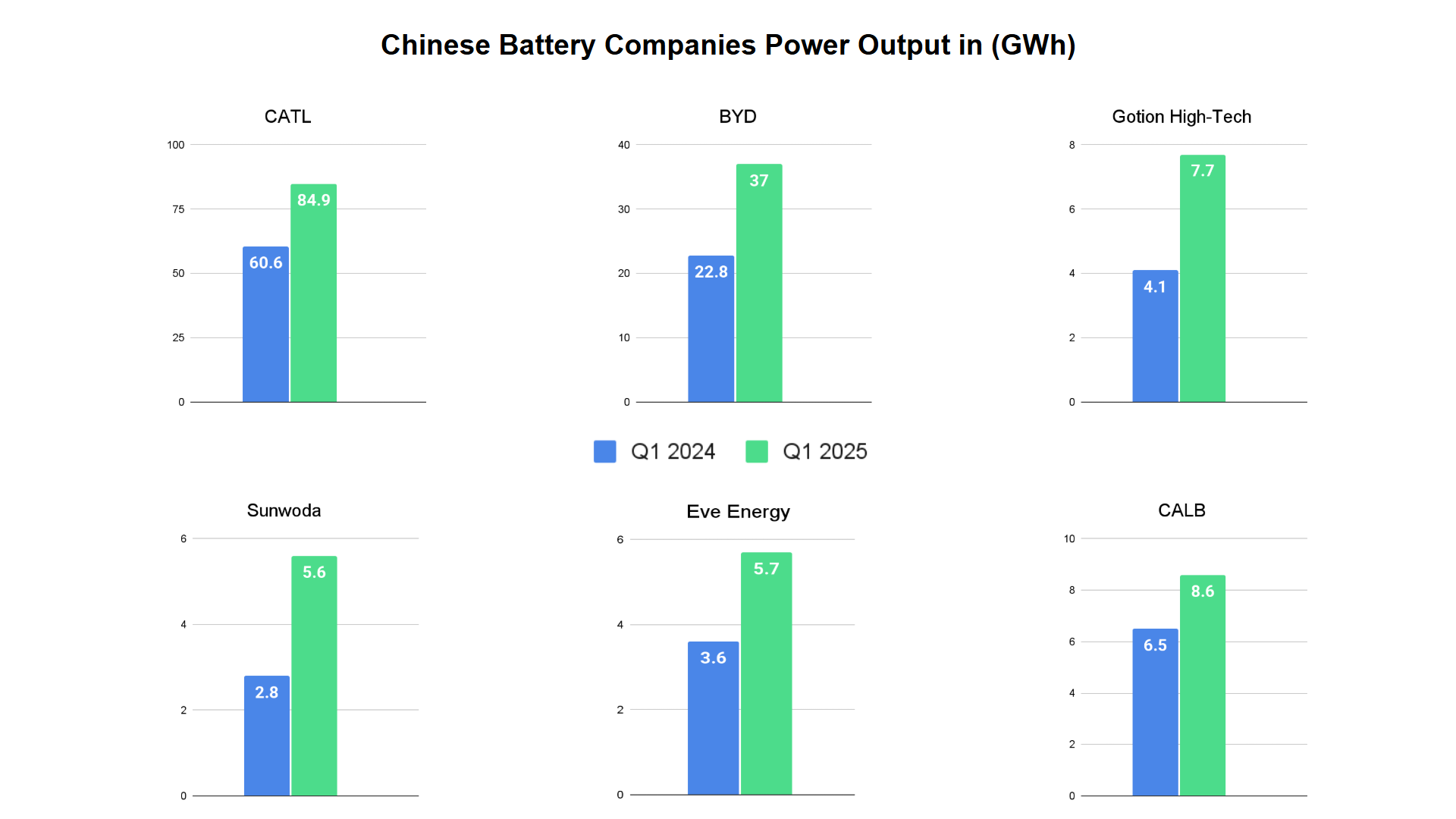

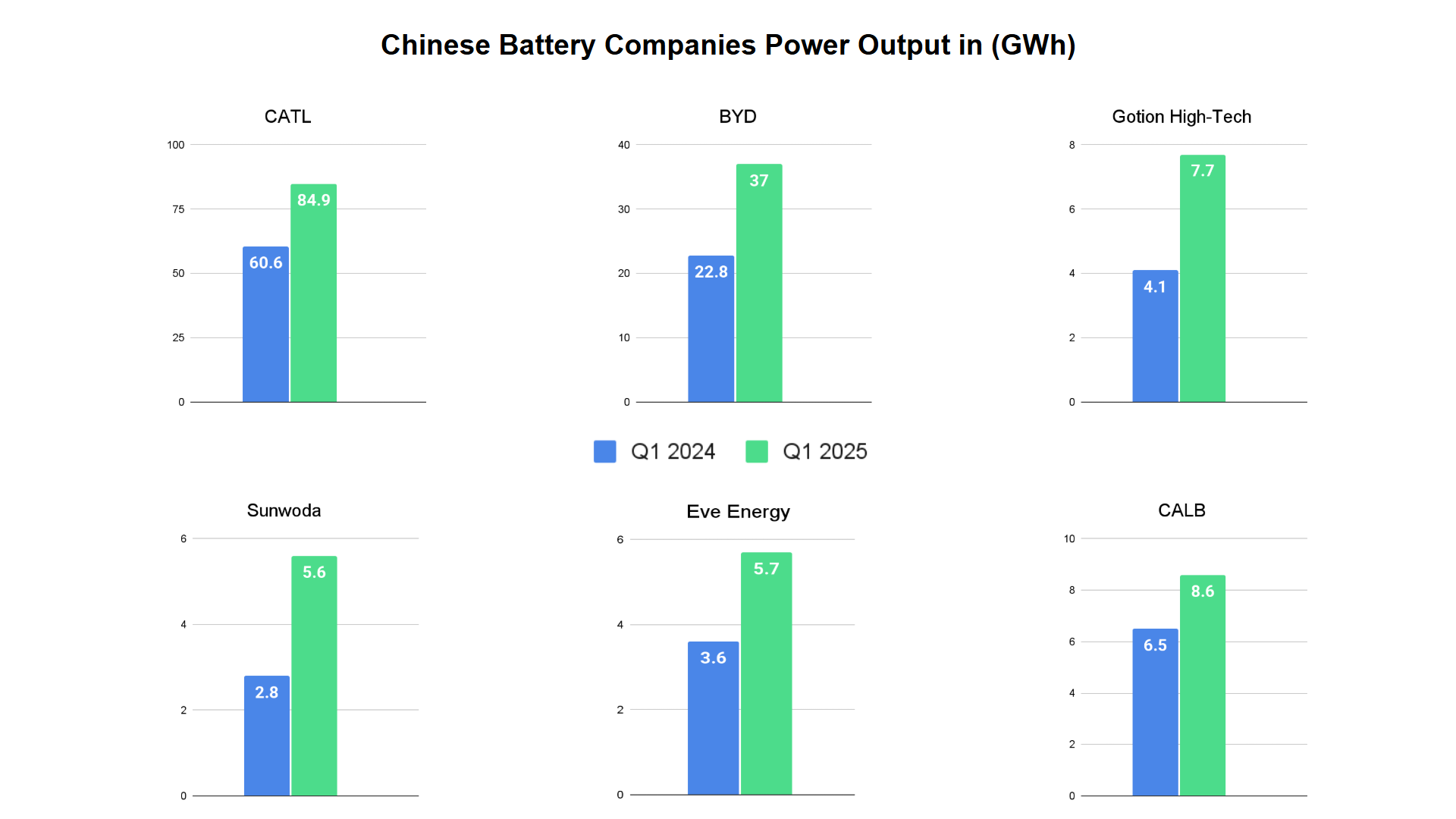

Chinese battery manufacturers have solidified their dominance in the global EV battery market:

- CATL (Contemporary Amperex Technology Co. Limited): Maintained its position as the world’s leading EV battery supplier, with an installed capacity of 84.9 GWh, marking a 40.2 per cent year-over-year increase. CATL’s batteries are utilised by major automakers, including Tesla, BMW, Mercedes-Benz, and Volkswagen.

- BYD: Recorded a 62 per cent year-over-year growth, reaching 37 GWh in battery installations. As both a battery and EV manufacturer, BYD’s competitive pricing and popular models have propelled its expansion in Asia and Europe.

- CALB (China Aviation Lithium Battery): 8.6 GWh (+31.5 per cent Y-o-Y)

- Gotion High-Tech: 7.7 GWh (+86.6 per cent Y-o-Y)

- EVE Energy: 5.7 GWh (+59.6 per cent Y-o-Y)

- SVOLT Energy: 5.6 GWh (+100.2 per cent Y-o-Y), the highest growth rate among the top ten suppliers

Collectively, these six Chinese companies accounted for 67.5 per cent of the global EV battery market in Q1 2025, highlighting China’s strategic investments and advancements in battery technology.

Korean battery makers face market share decline

South Korea’s top three battery manufacturers, LG Energy Solution, SK On, and Samsung SDI, experienced a combined market share drop to 18.7 per cent in Q1 2025, down from 23.2 per cent the previous year:

- LG Energy Solution: Despite a 15.1 per cent year-over-year increase to 23.8 GWh, LG’s growth was tempered by a 17.3 per cent decline in battery installations for Tesla vehicles. However, strong performances from Volkswagen’s ID series and Kia’s EV3 contributed positively.

- SK On: Achieved a 35.6 per cent year-on-year growth, reaching 10.5 GWh, supported by stable sales of Hyundai’s IONIQ 5 and EV6, as well as Mercedes-Benz’s EQA and EQB models.

- Samsung SDI: Faced a 17.2 per cent decline to 7.3 GWh, attributed to reduced demand from partners like Rivian and Audi.

The decreasing market share of Korean manufacturers underscores the intensifying competition and the need for strategic adaptations in the evolving EV landscape.

Events

Events

e-Magazines

e-Magazines

Reports

Reports