Porsche has issued a profit warning, citing severe flooding at a key aluminium supplier as the primary cause for expected production delays and reduced financial performance this year. The Stuttgart-based sports car manufacturer has revised its profit margin forecast downward, predicting an operating profit margin of 14-15 per cent for the year, compared to the earlier estimate of 15-17 per cent.

The flooding, a significant event that affected a European production facility crucial for supplying special aluminium alloys used across all of Porsche's vehicle series, has resulted in significant supply shortages. This disruption is expected to impair production and drag Porsche's annual sales forecast down to between €39 billion and €40 billion, from the previous estimate of €40 billion to €42 billion.

The flooding, which occurred last month in southern Germany, led to a state of emergency being declared in parts of Bavaria and Baden-Württemberg, regions vital to the country's automotive industry. A few days back in Frankfurt, the news of the flooding caused Porsche's share price to fall by a significant 3 per cent, highlighting the immediate and substantial financial implications of the situation.

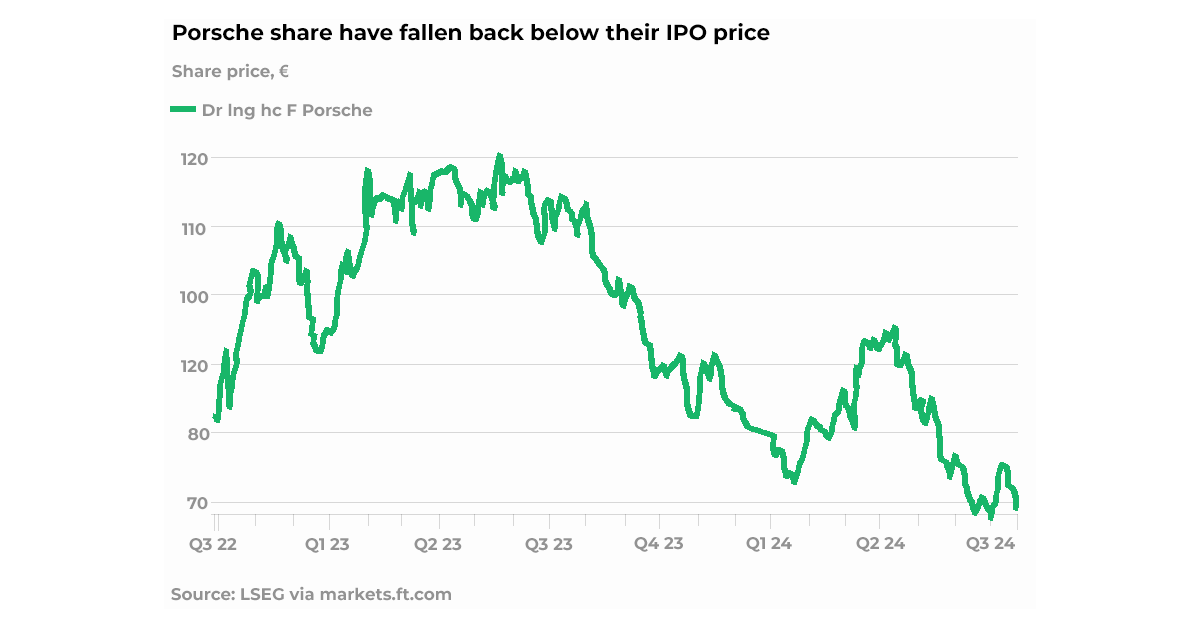

This setback comes amid a series of other challenges for Porsche, including a declining operating margin, decreasing sales in China, and a 40 per cent drop in its share price over the past year. These ongoing challenges further compound the impact of the recent flooding on Porsche's financial performance.

The company reported that production delays are anticipated to extend for several weeks and could potentially result in the shutdown of one or more vehicle series. It also noted that the impact of these delays on vehicle production and delivery will not be fully mitigated in the remaining part of the financial year.

Numerous manufacturing companies have faced significant disruptions due to severe rainfall across central Europe.

Novelis, a US-based aluminium producer whose Sierre plant is in Switzerland, has been closed since the end of June due to flooding.

Novelis stated, “With our plant shut down due to the flooding, our ability to fully deliver to our automotive customers in Europe has been impacted."

In early July, Constellium announced that its Sierre and Chippis facilities in Switzerland were severely impacted by "exceptional flooding" from the Rhone River, forcing the suspension of operations. The company also stated that it is currently unable to assess the full extent of the damage or estimate when production might resume.

Responses