您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

At the start of 2026, the Trump administration once again dominates global headlines—much as it did at the beginning of 2025. Then, the flashpoint was tariffs on aluminium and steel imports; now, it is the US military strike on Venezuela. In the early hours of January 3, 2026, around 2 a.m. local time, the United States launched a military operation codenamed Operation Absolute Resolve; and within the next few days, speculation over Washington’s motives and the broader consequences has intensified.

{alcircleadd}Well, President Donald Trump has been unequivocal about the intent. Following the seizure of President Nicolás Maduro, Trump announced that the US would assume control of Venezuela to tap into the South American nation’s vast oil reserves. This move is quite a familiar geo-political pattern as oil has been a strategic resource in international conflicts. From World War II (1939-1945) to Gulf War (1990-91), oil was a recurring factor for all the geo-political conflicts. The US intervention in Venezuela appears to follow the same script.

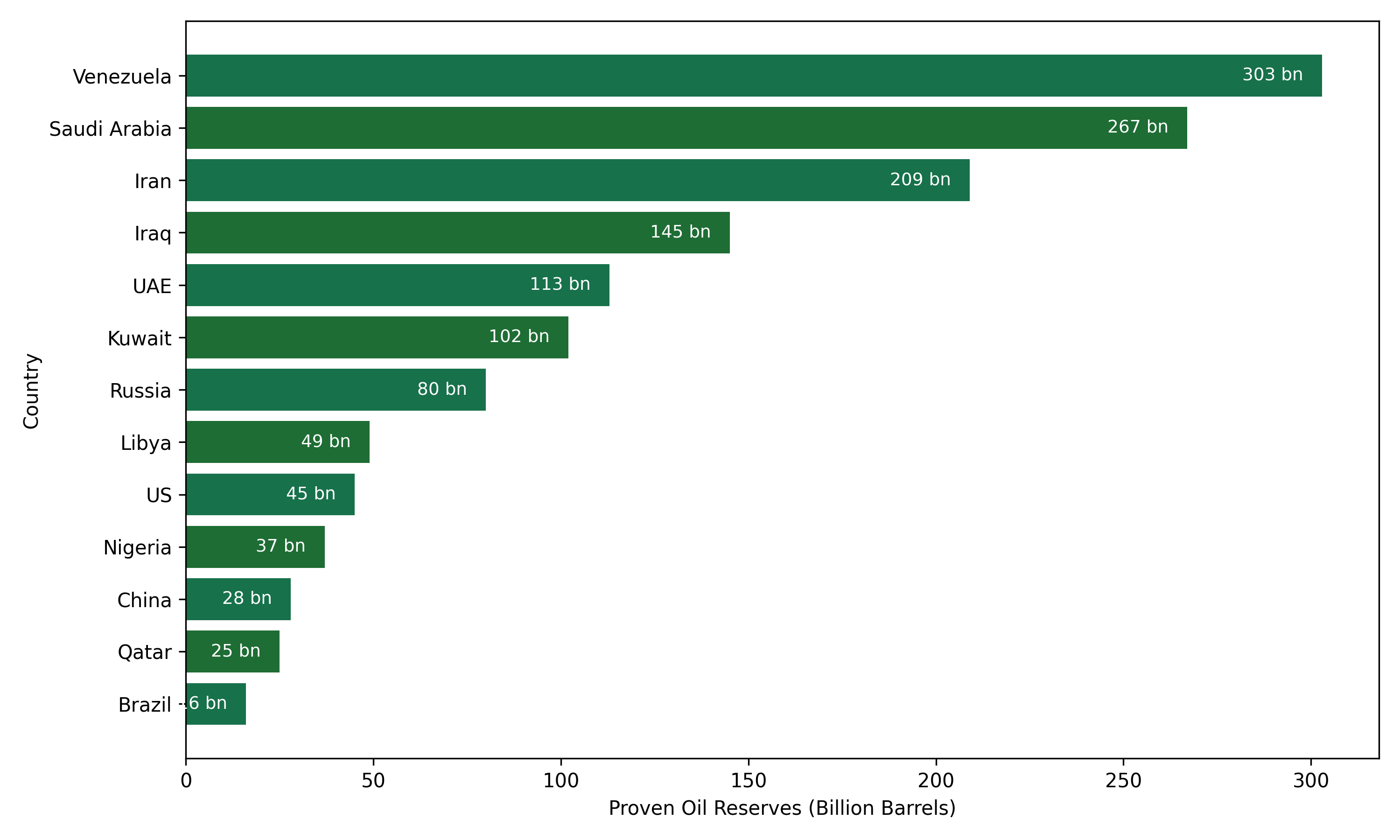

The attraction is obvious and it is the 303 billion barrels of proven crude oil reserves - nearly one-fifth of the world’s proven reserves, according to the US Energy Information Administration (EIA). This places Venezuela well ahead of Saudi Arabia with oil reserves of 267 billion, Iran 209 billion, Iraq 145 billion, the UAE 113 billion, Kuwait 102 billion, and so on and so forth.

But despite these massive reserves, Venezuela produces barely one million barrels a day. According to data from the Organization of the Petroleum Exporting Countries (OPEC), Venezuela produced 934,000 barrels per day in November – which were less than 1 per cent of global supply and a fraction of 3.5 million barrels per day that it used to churn out at its peak in the late 1970s.

The decline began under former President Hugo Chavez and carried on with Maduro, primarily attributed to chronic underinvestment, poor maintenance, and deterioration of infrastructure. PDVSA, Venezuela’s state-owned oil company, has admitted that pipelines have not been upgraded in last five decades. Sanctions also compounded these structural weaknesses. By cutting off oil-for-debt swaps, US-led sanctions severed the country’s primary revenue stream, thus resulting in the collapse of both the economy and the oil sector.

Now, estimates suggest that investments of USD 58 billion to USD 180 billion would be required over the next 15 years to take the country’s oil production to its historical highs.

Trump has pledged to make this investment by accumulating all the United States oil producers that are prepared to enter Venezuela and invest to restore oil production in the country. This announcement has particularly triggered two dominant lines of speculation: whether Washington intends to monetise Venezuelan oil to ease its staggering debt burden, or whether the oil will be channelled as a strategic input for domestic heavy industries and energy security.

Also read: Interest rates down, aluminium costs up: Breaking down the Fed’s move

Responses