Officially going ex-dividend as of May 12, 2025, Norsk Hydro ASA has plans for a payout of NOK 2.25 per share for the financial year 2024. The action of the global behemoth offers a window into the financial fortitude of one of the most vertically integrated aluminium companies amid ongoing global market turmoil.

Hydro’s dividend was approved at the company’s Annual General Meeting held on May 9, with a record date set for May 13 and payment scheduled on May 20, 2025. The NOK 2.25 dividend translates into a yield of approximately 4.8 per cent at the stock’s May 9 closing price of NOK 46.70 on the Oslo Stock Exchange. This payout sits at the upper end of Hydro’s long-standing capital return policy, targeting 50 per cent of adjusted net income, highlighting continued confidence in the company’s cash flows.

The dividend declaration comes against the backdrop of a slightly recovering aluminium market, which has remained under pressure through the early quarters of 2025 due to weaker-than-expected Chinese demand and elevated energy costs in Europe. However, the company’s ability to maintain a generous dividend despite such macroeconomic headwinds suggests strategic hedging, cost management, and strong performance in its energy and extrusion segments.

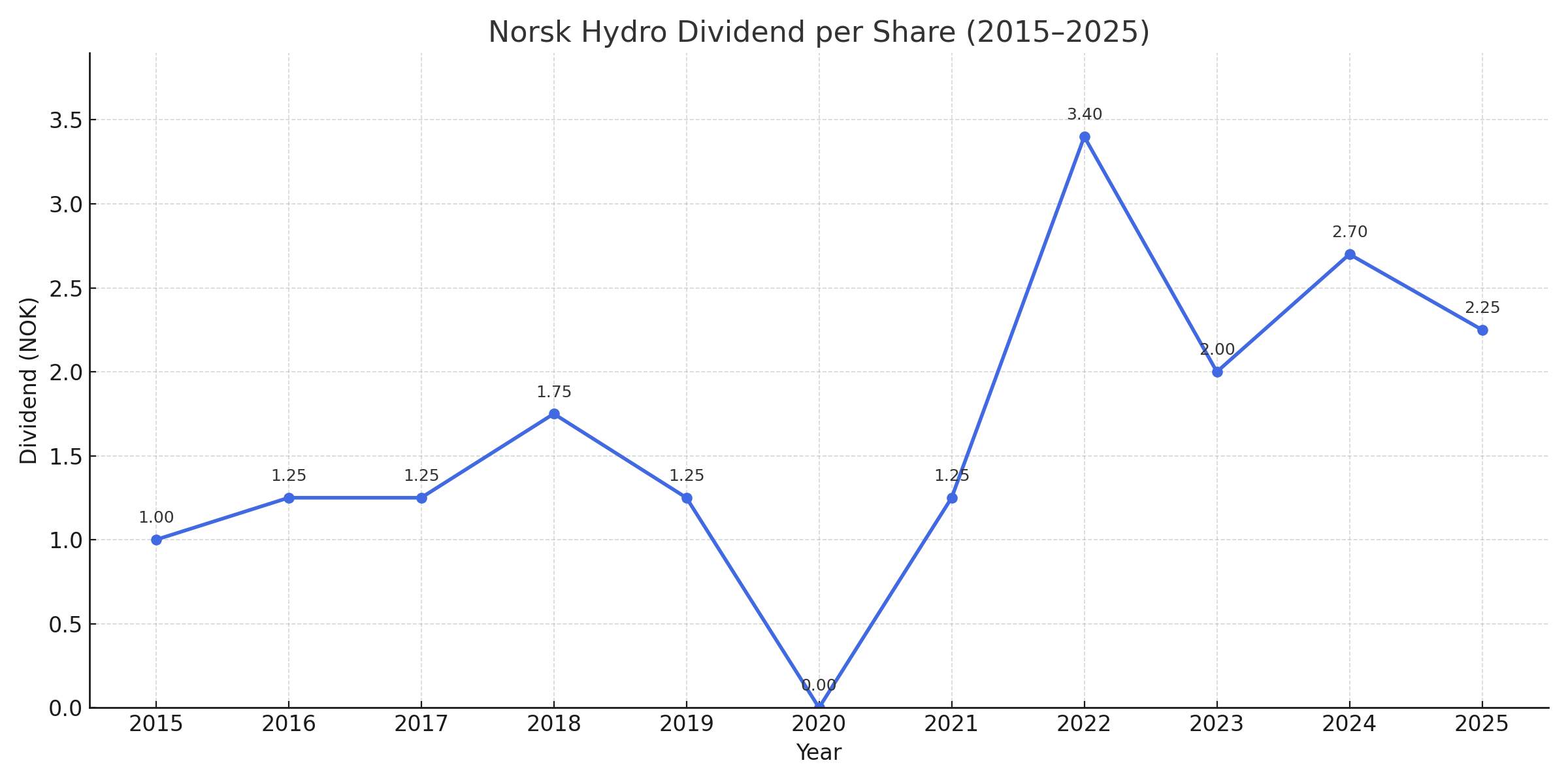

To draw perspective, Hydro paid NOK 2.00 per share in 2023 and NOK 1.25 in 2022, making the 2025 payout a marked step-up, even as the LME 3-month aluminium price hovers below the psychological USD 2,300 per tonne level.

Over the last decade, Norsk Hydro has demonstrated a dividend policy that’s both cyclical and strategic, adapting to global aluminium markets, energy shocks, and internal shifts. From a low of NOK 1.00 per share in 2015 to a record-breaking NOK 3.40 in 2022, the company’s payout history tells a story of resilience, prudence, and investor confidence.

Hydro’s dividend recovery began in 2015, with a modest NOK 1.00 per share after weathering weaker aluminium prices in previous years. In 2016, an upswing in operating EBITDA allowed the company to increase its payout to NOK 1.25, a level it maintained through 2017, supported by a firming alumina market and improved operational efficiency.

The year 2018 marked a notable milestone. With aluminium prices peaking and a vigorous financial performance, Hydro raised its dividend to NOK 1.75 per share, signalling strong shareholder returns and confidence in future cash flows. However, the momentum was interrupted in 2019, when the Alunorte operational disruptions in Brazil dented profits, pushing the dividend back to NOK 1.25.

Then came 2020, a year of global disruption. Amid the uncertainty of the COVID-19 pandemic, Hydro made the conservative call to suspend its dividend altogether, prioritising liquidity preservation and operational flexibility. This decision, though disappointing to stakeholders, was aligned with the cautious approach taken by many capital-intensive firms during that period.

In 2021, the company reinstated its dividend at NOK 1.25, reflecting a measured return to shareholder distributions as markets began to stabilise. But it was in 2022 that Hydro made headlines with its highest-ever dividend payout of NOK 3.40 per share, which included an extraordinary dividend. Buoyed by soaring energy prices and strong aluminium demand, the company generated record profits, translating into one of the most generous years for stakeholders.

By 2023, Hydro normalised its payout at NOK 2.00, striking a balance between capital returns and investment in sustainability and low-carbon solutions. The following year, in 2024, the dividend was raised again to NOK 2.70, reflecting the strength of aluminium prices and operational consistency.

Now, in 2025, the company has declared a slightly moderated dividend of NOK 2.25 per share, going ex-dividend as of May 12. While slightly lower than the previous year, the payout still reflects a solid earnings base and signals ongoing financial health amid aluminium market volatility.

The payout brings balance sheet health and perhaps a guarded optimism about demand stability in the second half of 2025.

Trading ex-dividend usually causes a mechanical drop in share price equivalent to the dividend value, reflected partially in today’s early morning trading, with Hydro opening 2.2 per cent lower on Oslo Børs. However, long-term investors are expected to hold firm, seeing the payout as a reward amid broader portfolio exposure to commodities.

More importantly, the ex-dividend milestone serves as a sentiment indicator. For institutional investors tracking ESG and green aluminium portfolios, Hydro’s dividend is viewed in conjunction with its low-carbon initiatives, particularly its expanding Hydro Havrand green hydrogen venture and the increasing rollout of Hydro CIRCAL and Hydro REDUXA in global extrusion markets.

From now on, Hydro’s dividend trajectory will be closely watched as the company continues navigating geopolitical trade tensions, evolving CBAM regulations from the EU, and raw material supply uncertainties, especially in alumina and bauxite markets.

Investors may also look for signals in Hydro’s Q2 earnings about how operational efficiencies and its renewable power strategy can buffer against ongoing inflationary input costs.

In summary, while the NOK 2.25 dividend may look like just a headline figure on a calendar, it backs a deeper narrative of a legacy producer strategically adapting to the nuances of a modern, decarbonising aluminium economy.

Responses