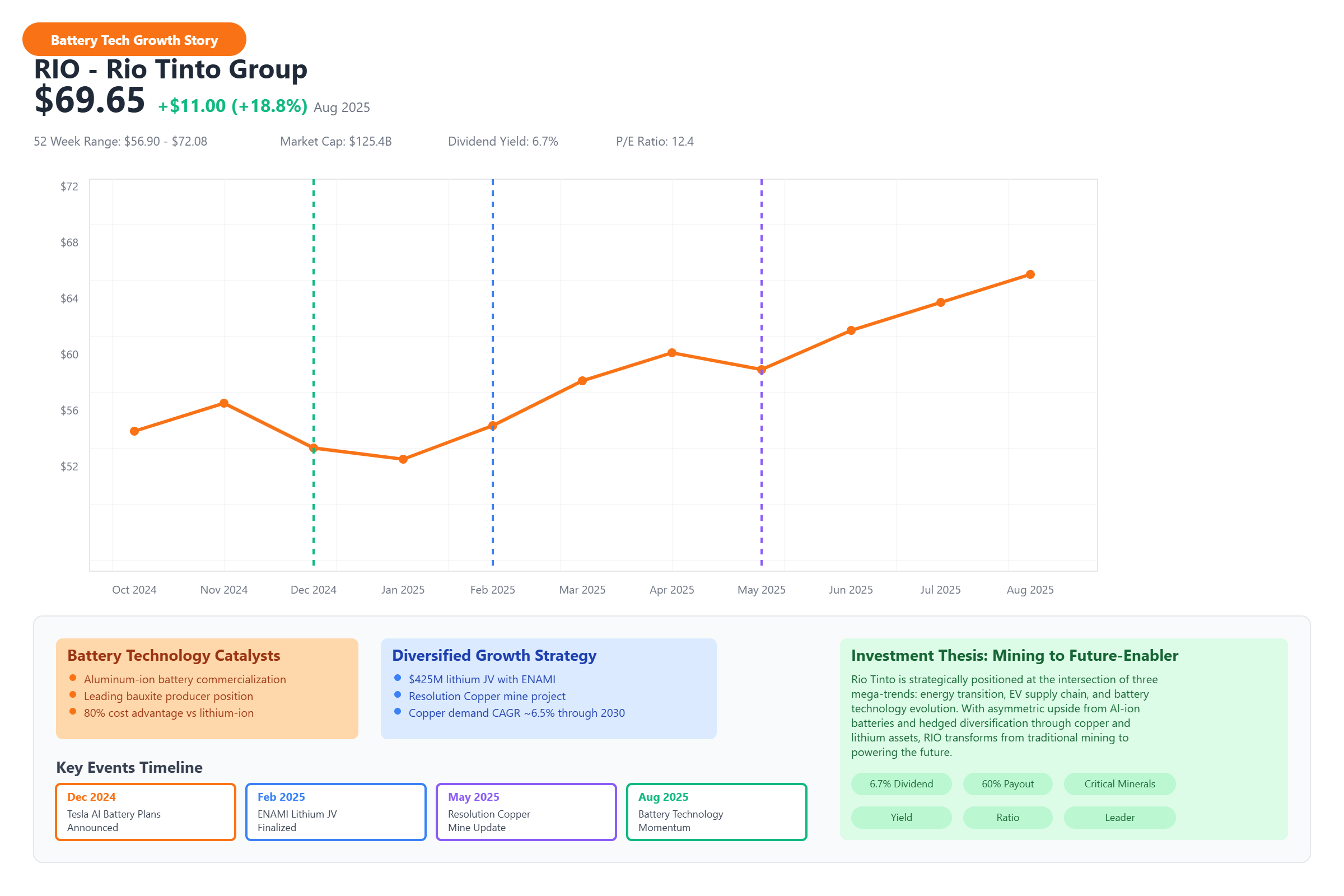

British-Australian mining firm Rio Tinto is about to set itself up for a game-changing opportunity. If aluminium-ion (Ai) batteries, supported by companies like Tesla, can create new commercialisation, then Rio Tinto could be one of the most strategic beneficiaries. With its combination of critical mineral assets, diversification, and hopes of growth in lithium and copper, Rio Tinto is making itself an integral part of the battery value chain.

Aluminium-ion: a game-changer for Rio Tinto

Aluminium-ion batteries offer many benefits over lithium-ion batteries. They are lighter, charge faster, and have a higher energy density, with much lower environmental impacts. With aluminium being relatively abundant (bauxite, the ore for aluminium, constitutes ~8 per cent of the Earth’s crust), Ai (aluminium ion) batteries may also be potentially about 80 per cent cheaper than lithium-ion batteries. For Rio Tinto, which is a leading bauxite producer, this represents a significant growth lever. Its current share price in August 2025 is USD 59.65.

If Tesla's commercialisation strategies reportedly scheduled to be announced this autumn become realised by 2026, their demand shock for bauxite and aluminium would put Rio in a first-follower supply position. This is not just a speculative tailwind. As suggested by noted news outlets, Rio's shifting strategy has already tied aluminium to a wide share of the EV value chain.

Also read: Rio Tinto’s H1 2025 net earnings fall 22% amid tariff impact and higher capex

Strategic partnership expansion in South America

Even if Ai battery technology does not pan out, Rio's exposure to copper and lithium means it won't miss the electrification boom. The recent USD 425 million joint venture with Chilean miner ENAMI to develop the Salares Altoandinos lithium project is just one example.

As Rio Tinto Minerals’ Chief Executive Sinead Kaufmann explained, “We are continuing to execute our strategy of building a world-class lithium portfolio to position Rio Tinto as a global leader in the responsible supply of critical minerals essential to the energy transition.”

Projected to commence production in 2032, the Salares Altoandinos operation aims to ramp up to 75,000 metric tonnes of lithium per year. Together with Rio's Direct Lithium Extraction (DLE) technology, the project supports an EV-connected growth strategy.

Rio Tinto’s evolution: from mining to future-enabler

While the Ai battery is speculative, the asymmetric upside for Rio Tinto is substantial. It is also at the intersection of three mega-trends: energy transition, supply of electrified vehicles, and the advanced battery evolution. Even if Ai batteries ultimately do or do not succeed, the combination of Rio Tinto's diversified supply of minerals combined with its future-facing actions through arrangements like the ENAMI deal makes it a smart bet for the long haul.

For those who are tracking structural investment themes, Rio Tinto's growth story is no longer just about mining; it's about powering the future.

Also read: Rio Tinto-backed aluminium producer to invest $1.1 billion in Canadian project

Responses