Molson Coors Beverage Company rang in Q1 2025 on a challenging note, reminding investors and beverage lovers alike that even a brewing giant can feel the chill when global headwinds hit hard.

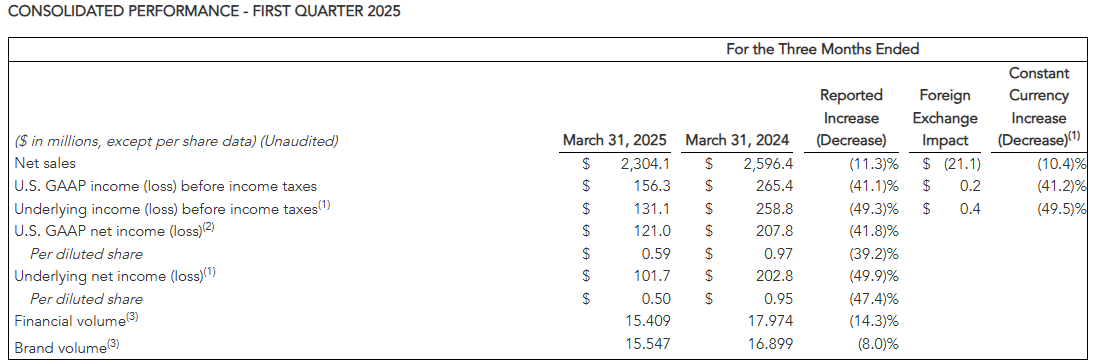

{alcircleadd}In its first-quarter earnings release (Q1 2025), the company reported an 11.3 per cent decline in net sales, down to USD 2,304.1 billion from USD 2,596.4 billion, along with a significant drop in volumes. Financial and brand volumes both saw steep declines of 14.3 per cent and 8 per cent respectively, primarily due to reduced shipments and a deliberate scale down of contract brewing across the US and Canada.

Gavin Hattersley, President and Chief Executive Officer, said, "The macroeconomic environment and its broad effects on the beer industry and consumer, as well as competitive pressures in EMEA and APAC, impacted our financial results in the first quarter. Additionally, in the quarter we saw expected headwinds, namely cycling the prior year's significant inventory build in the US, the discontinuation of our contract brewing arrangements in the Americas, and transition fees related to Fever-Tree."

The profit line took an even harder hit:

For Molson Coors, the first quarter has always been a cash-intensive period, but this time, operating cash flow dipped to USD 90.7 million, while free cash flow fell to USD 265 million, signalling the extent of financial strain.

The cost of goods sold (COGS) for Molson Coors decreased by 11 per cent on a reported basis, primarily due to lower financial volumes and favourable foreign currency impacts. COGS per hectolitre rose by 3.8 per cent, mainly driven by volume deleverage, an unfavourable product mix due to reduced contract brewing in the Americas segment, and continued premiumisation. Additionally, inflation in materials and manufacturing added pressure to production costs.

Also Read: Heineken delivers robust profit performance through US tariff headwinds and market instability

Marketing, general, and administrative (MG&A) expenses remained relatively flat, decreasing by 0.2 per cent on a reported basis. This slight decline was primarily the result of reduced marketing investment and favourable currency effects. However, it was nearly offset by an increase in general and administrative expenses, primarily due to approximately USD 30 million in integration and transition fees associated with the Fevertree USA, Inc. acquisition. These costs are expected to be recovered through future net sales revenue.

Image Source: Molson Coors website

America segment highlights-

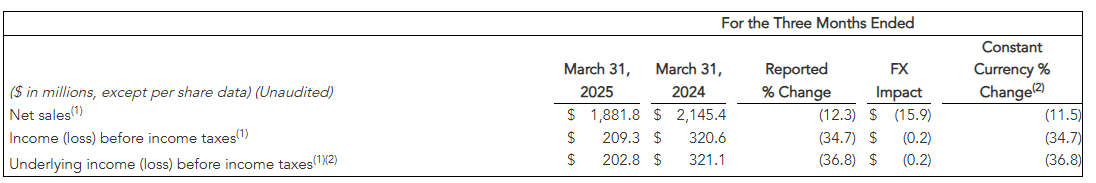

The America’s segment was particularly hit, reporting a 12.3 per cent drop in net sales from USD 2154.4 billion to USD 1881.8 billion, primarily due to lower financial volumes and adverse foreign currency effects. While EMEA & APAC followed with a 6 per cent decline, the pricing strategies managed to soften the blow somewhat, with a 4.1 per cent price/mix boost in the Americas and 4.8 per cent net sales revenue per hectolitre rise. Still, it wasn't enough to fully offset the drop in volume.

Financial volumes fell 15.6 per cent, primarily due to lower brand volumes and the impact of lapping a significant distributor inventory build in the same quarter last year, an action taken to counter the Fort Worth brewery strike that began in mid-February 2024. Additionally, the company faced an approximate 4 per cent decline due to reduced contract brewing volumes, following the exit from such arrangements in both the US and Canada.

In terms of brand performance, America's brand volumes declined 7.4 per cent. The US market saw a sharper 8.8 per cent drop, affected by a soft macroeconomic environment, tough comparisons against last year's double-digit growth in core power brands, and one less trading day in the current quarter.

Canada brand volumes slipped 2.7 per cent over the same period.

On the upside, price and sales mix contributed a 4.1 per cent positive impact to net sales, mainly due to a shift toward higher-margin products from lower contract brewing volumes, stronger brand mix, and net pricing increases.

Also Read: Americas fuel Ardagh’s Q2 2025 growth as European momentum slows

US GAAP income before income taxes dropped 34.7 per cent, primarily reflecting lower financial volumes, rising material and manufacturing costs, and higher other operating expenses. These included restructuring costs linked to the planned closure of certain US craft breweries. Additionally, MG&A expenses increased, mainly due to about $30 million in integration and transition fees related to the Fevertree USA, Inc. acquisition, which the company expects to recover through future sales.

These pressures were partially offset by favourable product mix, higher pricing, a positive fair value adjustment from the Fevertree Drinks plc investment, and ongoing cost-saving initiatives. Marketing expenses, meanwhile, were reduced.

Image Source: Molson Coors website

While the numbers might appear grim, there are glimmers of hope:

CEO Gavin Hattersley acknowledged the tough landscape, citing inflationary pressures, shifting consumer habits, and global trade uncertainties as key factors driving the adjustment. In response, Molson Coors is tightening discretionary spending and delaying certain capital projects to stay nimble.

Q1 2025 may have been a bitter brew for Molson Coors, but the company is not without hope. With market share gains in its core portfolio, disciplined pricing strategies, and strategic investments in growth segments, Molson Coors is actively shaping its future. If consumer sentiment improves and economic pressures ease, the company may yet toast to a stronger second half.

For now, Molson Coors is tightening its belt while keeping its eye on the tap.

Note: To feature your brand and share insights, contribute an article or interview in our forthcoming e-magazine "American ALuminium Industry: The Path Forward”.

Responses