Mexico’s aluminium industry has been growing steadily at a 13 per cent annual rate since the year 2011. The country produces 1.6 per cent of the world’s global production and depends highly on imports and recycling of aluminium products as it has limited resources of bauxite. For the same reason, there is no alumina refinery in the country either.

Mexico’s aluminium value chain involves recycling of aluminium scrapped products and imports of aluminium secondary products, contributing about $7 billion to the country’s GDP and generating employment for over 120,000 workers and professionals. The industry grows following the trends of a number of industries like automotive, aerospace, electric, energy (photovoltaic) and appliance.

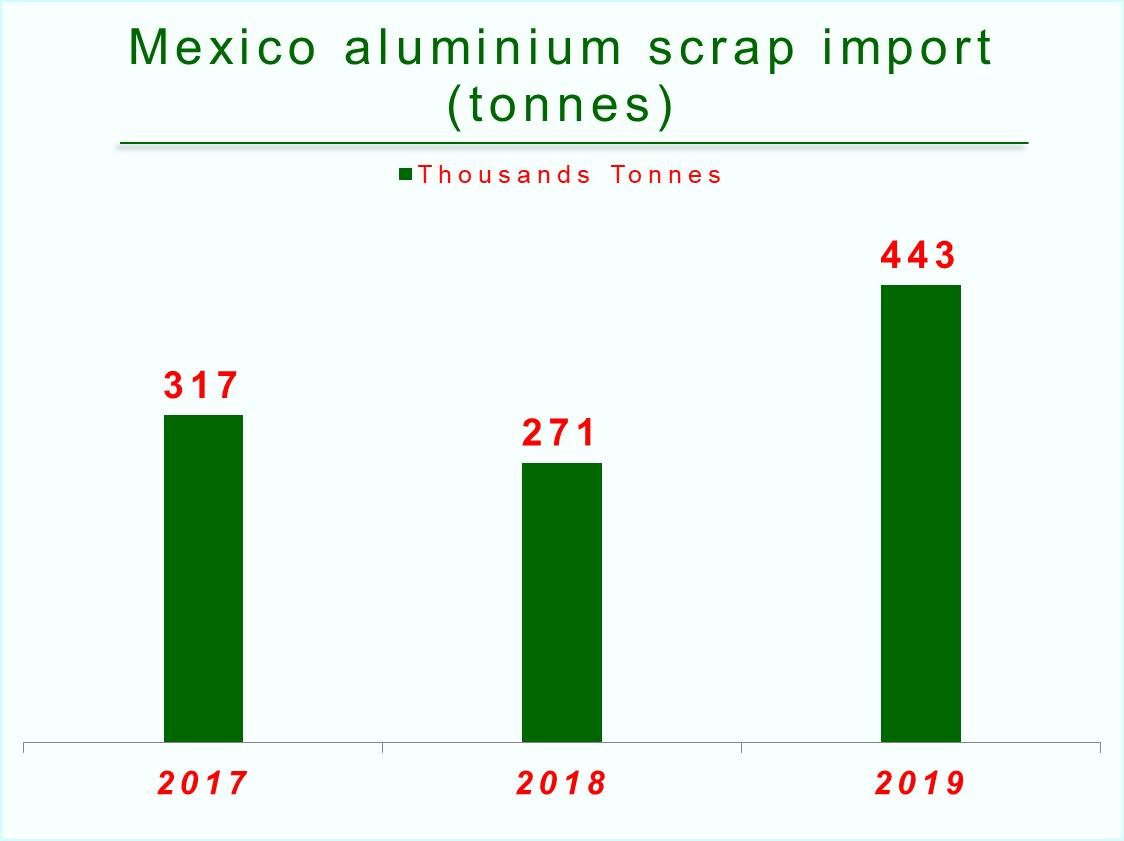

{alcircleadd}According to the global export-import data, Mexico’s estimated aluminium scrap import in 2019 is likely to stand 443,809 tonnes, compared to 271,686 tonnes in the previous year. This means the import volume would increase this year by 63 per cent from 2017. In 2016, the country’s aluminium scrap import volume was at 317,561 tonnes, in contrast, up 17 per cent from 2017 but lower 28 per cent from 2019. Hence, this year is expected to see a rise in Mexico’s aluminium scrap import after a drop in the last year.

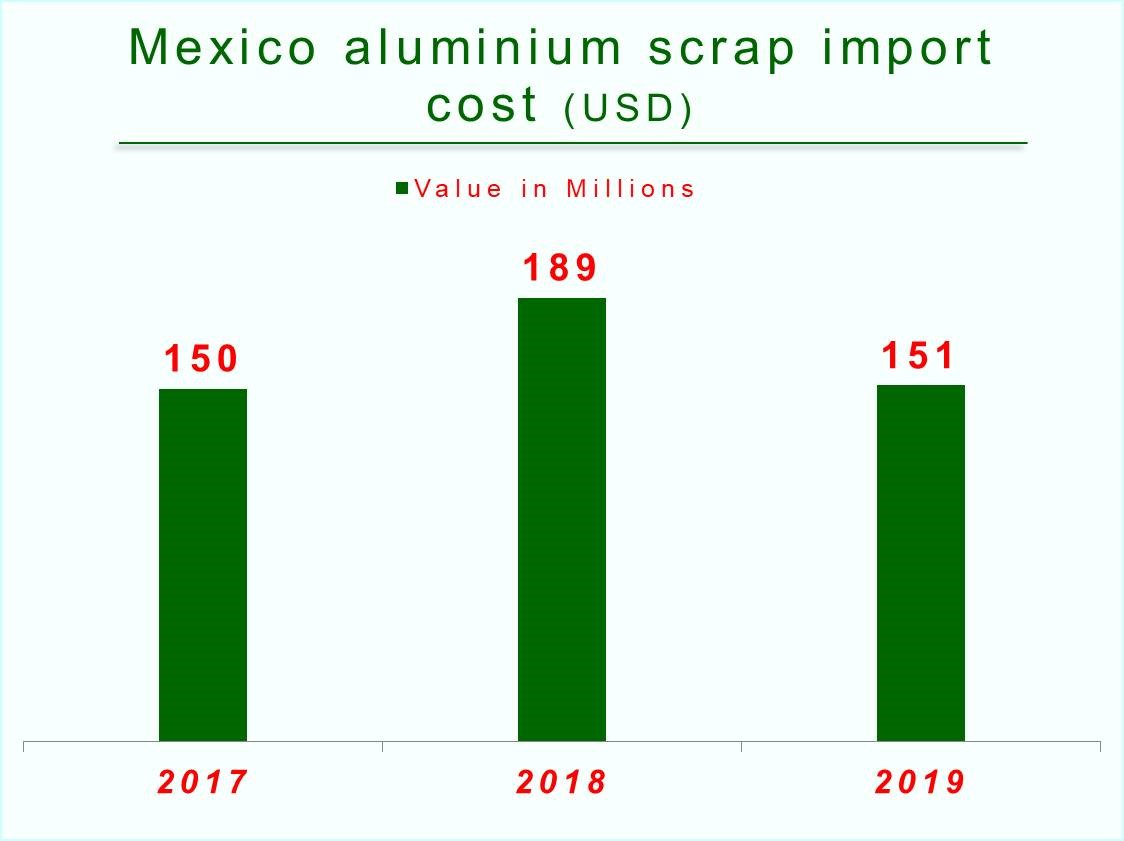

But although the import amount is likely to grow this year, the cost is expected to stand lower than the previous year. From US$189 million in 2018, Mexico’s estimated import cost is anticipated to drop 20 per cent to US$ 151 million. The cost was even lower in 2017 at US$ 150 million compared to the year 2018, despite the import volume recorded higher.

Mexico imports aluminum waste and scrap from various countries, predominantly from the United States. As per the global trade data, the country is expected to import 437,798 tonnes this year, compared to 265,756 tonnes in 2018 and 309,451 tonnes in 2017.

Responses