您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

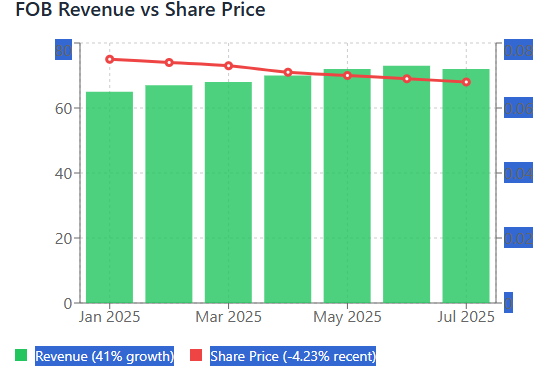

Australian mining firm Metro Mining has announced its performance result for Q2 FY2025, posting record bauxite shipments as well as solid growth in revenue and margin. The total volume of shipment increased by 19 per cent year-on-year, supported by a 41 per cent increase in FOB net unit revenue to USD 72 per tonne, showing an ever-improving operational profile at its flagship Bauxite Hills mine despite the challenges of market and weather effects. In May 2025, Metro Mining had shown a 26 per cent year-on-year increase in monthly bauxite shipments, amounting to 671,934 wet metric tonnes (WMT).

Despite these great numbers, Metro's share price dipped 4.23 per cent to USD 0.068, but appears more consistent with overall market motion than any fundamental weakness related to the company. Per InvestingPro, the miner still has a trailing twelve-month revenue growth of 14.79 per cent, and with a market cap of USD 1.21 billion.

“We’re going to be net cash in terms of the balance sheet. So that’s a pretty exciting place to be as a junior,” said CEO Simon Finnis during the Q2 earnings call, highlighting the company’s improving financial strength.

Operational highs and stormy lows

During the three months, production was scaled to an annualised 7 million tonne rate, notwithstanding tropical storms that affected barge operations in May and June. CEO Finnis candidly addressed the challenges, noting how a late-season storm “damaged quite significantly our channel” and limited tonnage throughput. However, the company took the opportunity to advance maintenance activities, setting the stage for smoother operations in Q3.

A significant milestone was accomplished, the payment of USD 9 million in deferred royalties, Metro's first clean slate in several periods. With a cash balance and a much improved situation with working capital flows Metro is now in a stable position after working through its Q3 targets.

Metro Mining’s CFO Nathan Quinlan emphasised operational cost efficiency, “We would like to see mid-25s once we’re fully up in Q3,” indicating expectations of reduced site costs as throughput normalises.

Market dynamics and strategic positioning

Bauxite market dynamics remain volatile, particularly with changing policy in Guinea limiting as much as 70 million tonnes of global supply. Finnis said this could lead to “dissonance in the market”, but Metro is equally strategically aligned with quality-focused, integrated customers in China, many of whom are now turning to imported ore because of structural changes in sourcing at the refinery.

Further, Finnis noted that the Chinese had innovated considerably and showed a clear preference for the high level of gypsitic aluminium present in Metro’s bauxite.

Metro is also investing in future growth by exploring new initiatives on both sides of the Skarden River, and through tenements near Aracunae. These two initiatives will help de-risk long-term supply and add potential value to resources.

What lies ahead?

While some legacy contracts from 2022-23 at lower fixed prices will continue to weigh on near-term earnings, the company expects to see stronger pricing in Q3 and full-year output at the top end of guidance. The company is also continuing long-term dredging options that will reduce risks related to recurring silt build-up in its shipping channels.

Responses