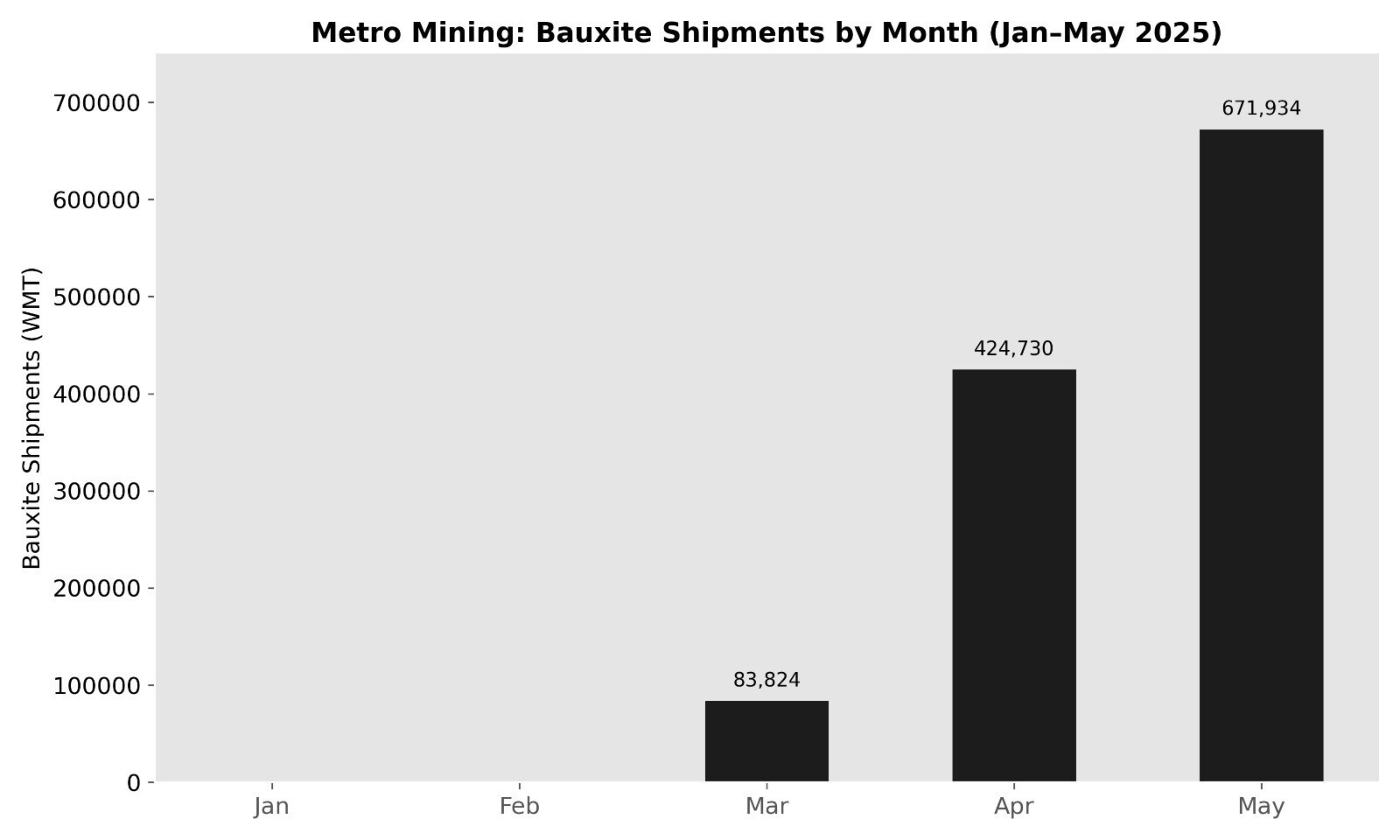

The Australian mining firm Metro Mining Limited has reported a 26 per cent year-on-year increase in monthly bauxite shipments, amounting to 671,934 wet metric tonnes (WMT) in May 2025. This increase forms part of a growth trend of increasing volumes of shipments with the company working towards its annual goal of 6.5 - 7 million WMT of bauxite. It is also worth noting this growth follows a previously reported record April with shipments of 424,730 WMT - which was a 12.2 per cent increase over the prior year (but Metro’s all-time monthly record was 720,000 WMT set in August 2024) - highlighting Metro's consistent ongoing operations against more challenging weather earlier in the year.

Strategic infrastructure upgrades and production capacity

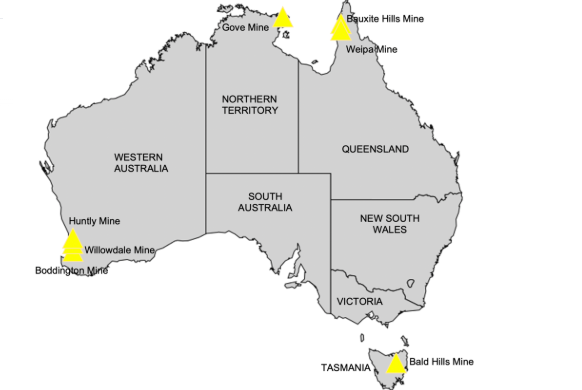

Metro Mining’s flagship Bauxite Hills Mine in Queensland holds very strong reserves of 77.7 million tonnes and total resources of 114.4 million tonnes, enabling sustainable production growth. Metro Mining also completed major changes to the infrastructure by late 2024, including improvements to the mining fleets, conveyor systems and marine loading facilities, enabling a full-year run at an increased capacity of 7 million WMT in 2025. These investments have increased operational reliability and efficiency, which is critical in ensuring we are able to maintain our shipment schedules during times of heavy rain and tropical storms.

Competitive advantages in cost and logistics

A significant strength in Metro's market position is its cost leadership driven by long term contracts that cut freight by US$3 per tonne. In stark contrast to notoriously volatile spot rates, owing to the contractual freight costs, Metro is able to supply high-quality, high-alumina bauxite (Al₂O₃ ~49.8 per cent) at highly competitive prices to large customers in China, with around ~7 to 10 days shipping time. Metro's ability to lock in freight (cost) and achieve supply chain resilience amidst global shipping disruption drives the cost leadership.

Image source: Wikipedia

Market outlook and growth

Metro Mining's growth is driven by global demand for bauxite, particularly from China's aluminium industry. The company's focus on sustainability and operational resilience, coupled with a strong contract coverage of 6.9 million WMT for 2025, ensures revenue certainty in a volatile commodity market.

Metro Mining's 26 per cent improvement in May shipments is not just a metric representing monthly performance; it is indicative of a strategy that integrates the quality of the resource with an investment in infrastructure, cost management, and alignment to market. The company is clearly progressing towards its 2025 vision, and it showcases how mid-tier miners can navigate the competitive landscape of the global bauxite economy by leveraging operational excellence and efficient logistics.

Responses