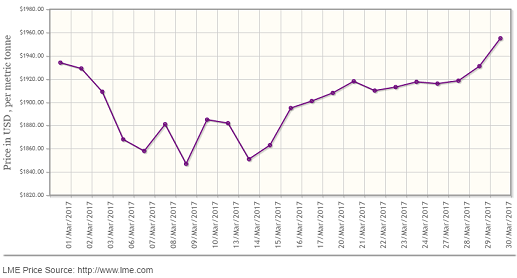

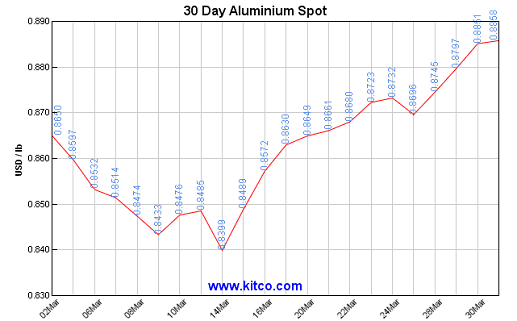

The sustained rise in LME aluminium prices met with an end-of-the-week halt as the contract came down from its yearly high at US$1,981 per tonne on Thursday, March 30 to close at US$1,946 per tonne on Friday, March 31. The day marking the end of the FY2016-17 financial year for many companies saw the contract being traded at lower volumes. However, "The March data is going to be the first 2017 data we can take at face value," said an analyst.

As Reuters puts it, gains in aluminium have been recently driven by buying from a mix of CTAs (commodity trading advisers), discretionary funds and traders. LME official on-warrant stocks fell to the lowest since mid-2008. Considering the weekly stock movement, LME official opening stock of aluminium which was estimated at 1936275 tonnes on March 27, fell to 1886400 tonnes on Friday, March 31.

Source: www.kitcometals.com

There has been no change in the LME aluminium premium this week. As on March 31, LME Aluminium US Premium remains unchanged at US$215, LME Aluminium West-Europe Premium stands at US$95, LME Aluminium East-Asia Premium is US$100 and LME Aluminium South-East Asia Premium is US$15 (per tonne).

{googleAdsense}

The benchmark aluminium price on Shanghai Metal Exchange inched higher from US$1,966 per tonne to stand at US$1967.70 per tonne on Friday, March 31.

Trading on Shanghai Futures Exchange (SHFE) remains suspended from March 31st night till April 4th the 2017 Chinese Qingming Festival falls on April 2-4. SHFE 1705 aluminium opened at RMB 13,815 per tonne on Friday and then climbed higher to close at RMB 13,995 per tonne. Shanghai Metals Market predicts the contract will move between RMB 13,800-14,200 per tonne in the coming week.

The SMM Ranking by Metal Price shows last month's average price of A00 aluminum ingot was RMB 13,657 per tonne.

Responses