您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Manaksia Aluminium Company has recently reaffirmed its quality and valuation grades, indicating it has improved performance execution. The principal financial metrics suggest this view, with 5-year sales growth of 12.60 per cent and EBIT growth of 19.03 per cent, and it is making a better presentation as a participant in the non-ferrous metals industries.

In fact, the quality grade increased from below average to average grade, which suggests improved operational execution. The EBIT-to-interest coverage ratio of 1.34 does suggest fair adequacy of ability to manage its financing obligations. The valuation grade increased from very attractive to attractive with a P/E of 28.87, a price-to-book of 1.47, and an EV/EBITDA of 9.16. The overall assessment of initial attractiveness from a valuation perspective in the Indian non-ferrous metals space is more favourable.

Stock performance: from volatility to stability

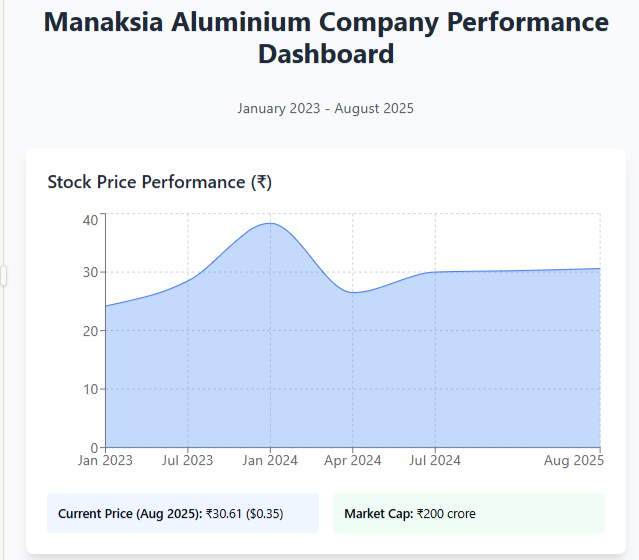

As of August 12, 2025, Manaksia Aluminium Company Ltd. (NSE: MANAKALUCO) is trading at approximately INR 30.61 (USD 0.35) on NSE and INR 30.84 (USD 0.35) on BSE. The stock began 2023 at about INR 24.20 (USD 0.28), rose sharply to INR 38.35 (USD 0.44) in January 2024 and slowly corrected back into the INR 26-27 (USD 0.30 to 0.31) range in April 2024. Since mid-2024, the stock has started consolidating around INR 30 (USD 0.34), which seems to signify that investors are moderately confident, despite lingering macro concerns in the economy.

With a current P/E ratio of approximately 29.06 and a market capitalisation of around INR 200 crore (USD 22.85 million), there is cautious optimism among investors, especially for a mid-cap player in the aluminium sector. The trajectory reflects the influences of the sector, disclosures by corporates, and a market that appears to be balancing short-term optimism with long-term caution.

Also read: Soaring scrap costs, tariffs cut Novelis Q1 profit— what’s behind the 13% sales rise?

Technical momentum vs. long-term strain

The last six months have shown a 25.15 per cent rise in net sales and a strong profit operating-to-interest ratio for Manaksia Aluminium. It, however, still has a debt to EBITDA ratio of 5.25, which remains a structural challenge.

The technical indicators are mixed – MACD denotes a bullish week-on-week trend, but the month-on-month sentiment remains somewhat bearish. Bollinger Bands have a bullish bias on both timeframes. In H1 FY2025, net sales totalled INR 276.81 crore (USD 33.34 million), the profit-to-interest was 1.69 times, and pre-tax profit was INR 2.47 crore (USD 297,590).

Historical trends indicate revenue growth from INR 271.63 crore (USD 32.72 million) in FY2021 to INR 509.15 crore (USD 61.34 million) in FY2025; however, growing raw material costs burden pre-tax profits. In FY2025 profit after tax rose to INR 6.05 crore (USD 728,916), which indicates that despite inflation in input costs, they were more efficient in overall operations.

Overall outlook: cautious optimism in a competitive market

Although operational improvements and increased public market valuation hold positive sentiment, the relatively high leverage ratios and unpredictable profitability imply their growth will depend on disciplined use of leverage and debt level management in the future.

Also read: Southern states powering India’s aluminium extrusion boom

Responses