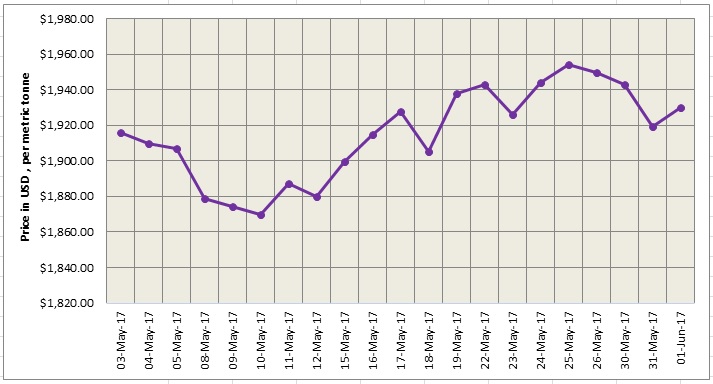

After plunging to US$ 1,919.50 per tonne on Wednesday, May 31, LME aluminium gained a little to close at US$ 1,930 per tonne on Thursday, June 1. According to an SMM analysis, LME aluminium will continue struggling around moving averages and move between USD 1,920-1,940/t today. According to Reuter’s analysis, LME aluminium may retest a support at $1,909 per tonne, as it may have completed a bounce triggered by this barrier.

As on June 1, LME official cash buyer price of aluminium stands at US$1,929 per tonne, cash seller & settlement price is US$1,930 per tonne, 3M buyer price is US$1,930 per tonne, 3M seller price is US$1,930.50 per tonne, Dec1 buyer price is US$1,955 per tonne, and Dec1 seller price is US$1,960 per tonne. The current LME official Opening Stock of aluminium is estimated at 1467375 tonnes, total Live Warrants is 993075 tonnes, and Cancelled Warrant is 474300 tonnes.

LME aluminium premiums, as on May 31, remain flat in all regions. LME Aluminium US Premium stands at US$205 per tonne and LME Aluminium West-Europe Premium stands at US$90. LME Aluminium South-East Asia Premium remains unchanged at US$15 (per tonne) and LME Aluminium East-Asia Premium stands flat at US$110.

The benchmark aluminium price at Shanghai Metal Exchange (SME) stands at US$ 2,014per tonne on Friday, June 1, up 1.1% from the benchmark aluminium price of US$ 1,991 per tonne on Thursday, June 2.

As reported by Shanghai Metals Market, SHFE 1707 met strong resistance at moving averages, during Thursday’s night session. SHFE 1707 aluminium should move within a range of RMB 13,700-13,900/t today.

In east China’s spot aluminium market, SHFE 1706 aluminium contract is expected to be traded at discounts of RMB 80-40/t.

{googleAdsense}

According to SMM, divergence will continue among base metals on Friday and upcoming US non-farm payrolls data should trigger price volatility. The market will also be driven by US’s nonfarm payrolls, unemployment, salary growth in May and balance sheet in April and eurozone’s PPI in April today.

Responses