LME aluminium opened at US$2,387 per tonne on Tuesday and closed at US$2,436 per tonne, an increase of US$56 per tonne or 2.35 per cent.

On November 22, Tuesday LME aluminium cash bid price went up the graph to US$2393.50 per tonne after US$51.50 per tonne or 2.2 per cent was added to it, and the LME aluminium official settlement price escalated by US$50 per tonne or 2.13 per cent to close at US$2,394 per tonne.

The 3-month bid price and the 3-month offer price had a similar price hike of US$51 per tonne or 2.15 per cent, resting at US$2,417 per tonne and US$2,419 per tonne, respectively.

December 23 bid price and December 23 offer price both heightened by US$53 per tonne or 2.17 per cent, stopping at US$2,488 per tonne and US$2,493 per tonne.

LME aluminium opening stock dipped by 4,925 tonnes or 0.94 per cent to settle at 517,075 tonnes from 522,000 tonnes recorded the day before.

Live warrants totalled 284,525 tonnes, plummeting 11,625 tonnes or 3.92 per cent. Cancelled warrants read 232,550 tonnes, marking a rise of 6,700 tonnes or 2.97 per cent.

LME aluminium 3-month Asian Reference Price came in at US$2,373.50 per tonne after losing US$24.40 per tonne or 1.02 per cent.

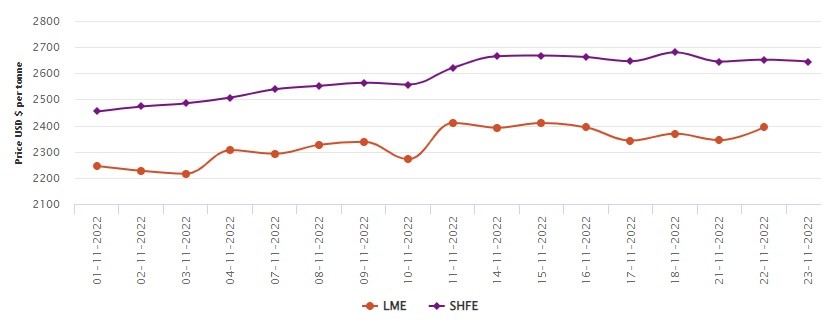

SHFE aluminium price

Today, on November 23, the SHFE benchmark aluminium price has slumped by US$7 per tonne or 0.26 per cent, closing at US$2,645 per tonne.

The most-traded SHFE 2212 aluminium contract opened at RMB 18,960 per tonne overnight and rose to RMB 19,075 per tonne before closing at RMB 19,040 per tonne, up RMB 110 per tonne or 0.58 per cent.

The most-traded SHFE 2212 aluminium closed down 0.66 per cent or RMB 125 per tonne at RMB 18,875 per tonne, with open interest down 10,829 lots to 152,960 lots.

Responses