LME aluminium opened at US$2,758 per tonne on Wednesday and closed at US$2,781.5 per tonne, an increase of US$11.5 per tonne or 0.42 per cent.

On 11th May, the LME aluminium cash bid price finally hiked by 2.24 per cent or US$60 to stop at US$2,736 per tonne. LME official settlement price trekked higher at US$2,737 per tonne, experiencing a similar change of 2.24 per cent or US$60 per tonne.

3-month bid price stopped at US$2,770 per tonne while 3-month offer price halted at US$2,772 per tonne, with a uniform escalation of 2.1 per cent or US$57 per tonne each.

On the same day, December 23 bid price and December 23 offer price settled at US$2,745 per tonne and US$2,750 per tonne, respectively, both with a 1.85 per cent or US$50 per tonne upsurge.

LME aluminium opening stock continued to decrease by 1.13 per cent or 6,350 tonnes from 560,275 tonnes to 553,925 tonnes as of 11th May.

Live warrants totalled 294,075 tonnes, falling 0.06 per cent or 175 tonnes. Cancelled warrants read 259,850 tonnes after a reduction of 6,175 tonnes or 2.32 per cent.

The LME aluminium 3-month Asian Reference Price was boosted by 1.49 per cent or US$41.05 per tonne to stop at US$2,798.94 per tonne.

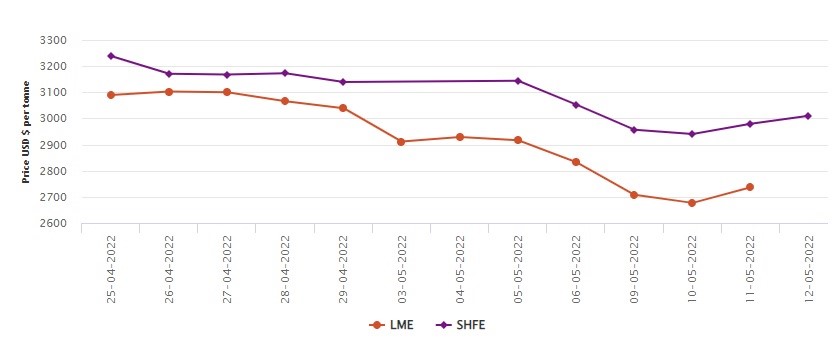

SHFE aluminium price

Today, on 12th May, the benchmark aluminium price for SHFE ascended by US$30 per tonne or 1 per cent to stand at US$3,010 per tonne if compared with data collected on Wednesday.

The most-traded SHFE 2206 aluminium contract opened at RMB 20,150 per tonne overnight and rose to RMB 20,405 per tonne before closing at RMB 20,370 per tonne, up RMB 350 per tonne or 1.75 per cent.

The most-traded SHFE 2206 aluminium closed up 2.61 per cent or RMB 515 per tonne to RMB 20,265 per tonne, with open interest down 5,189 lots to 185,366 lots.

Responses