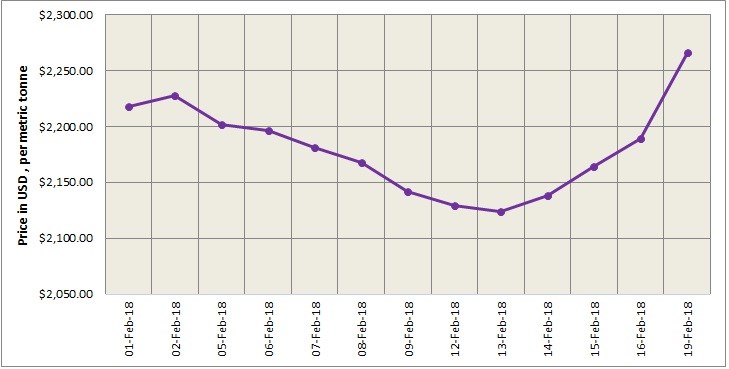

Benchmark aluminium price on London Metal Exchange surged significantly after the U.S. Commerce Department recommended implementation of a quota on aluminium imports from specific countries- a 7.7 per cent tariff on aluminium shipped from all countries, or a 23.6 per cent tariff on imports from five specific countries and territories, including China and Hong Kong. The uncertainty created drove prices up to US$2,266 per tonne on Monday, February 19.

Reuters identified support and resistance as the 38.2 per cent and 61.8 per cent retracements respectively, on the downtrend from US$2,290-US$2,112.50 per tonne.

A break below US$2,181 per tonne mark may cause LME aluminium to fall back at US$2,155 per tonne, while a break above the resistance may cause further gain, but within a limited range.

Aluminium premiums have skyrocketed across major regions since the announcement. US Midwest aluminium premium has increased from a previous point of 12.75 cents per lb to 14 cents per lb.

CME Group’s Midwest aluminium premium futures have surged as well, with the contract for April climbing from 13 cents per lb on Thursday, February 15, to 15 cents per lb on February 16, Reuters noted.

Responses