The US dollar index rose above 97 on Monday as an economic slowdown in Europe, weak emerging markets and the strong US job market drove investors to the safe-haven currency. LME base metals traded lower on Monday. LME aluminium closed flat.

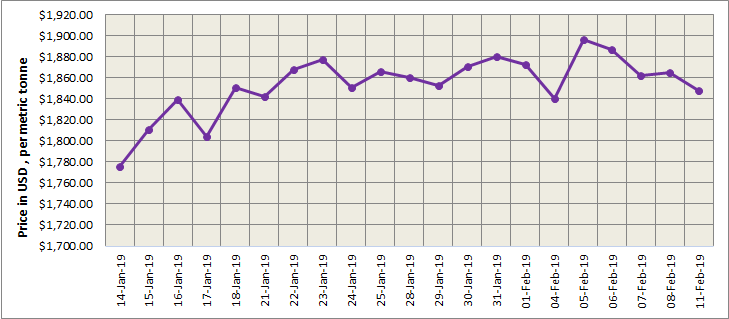

LME aluminium contract closed at US$1848 per tonne on Monday, down 0.91 per cent from US$1865 per tonne on Friday, February 8. LME aluminium is expected to trade at US$1870-1900 per tonne today.

{alcircleadd}

As on February 11, LME aluminium cash (bid) price stood at US$ 1847 per tonne, LME official settlement price stands at US$ 1848 per tonne; 3-months bid price stands at US$ 1869 per tonne, 3-months offer price is US$ 1869.50per tonne; Dec 19 bid price stands at US$ 2003 per tonne, and Dec 19 offer price stands at US$ 2008 per tonne.

The LME aluminium opening stock stood at 1292175 tonnes. Live Warrants totalled at 678950 tonnes, and Cancelled Warrants were 613225 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1871.22 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 1962 per tonne today, from US$ 1989 per tonne yesterday.

SHFE base metals traded mixed on the first trading day after the Chinese New Year break. The SHFE 1903 contract weakened 1.1% to end at RMB13,315 per tonne today. The buildup of short positions accounted for the decline in SHFE aluminium.

The SHFE 1903 contract rallied above the five-day moving average to close at RMB13,370 per tonne overnight. Shanghai Metals Market expects the contract to trade at RMB13,200-13,400 per tonne today with spot discounts at RMB110-70 per tonne.The contract is expected to see further downside room after social inventories of primary aluminium in China substantially expanded over the holiday.

Responses