The US dollar index slipped on Monday as optimism over a breakthrough in US-China trade talks drove investors to the euro and riskier currencies. LME base metals traded mixed on Monday and aluminium edged down 0.08%. SHFE base metals also closed mixed overnight while aluminium lost 0.3%.

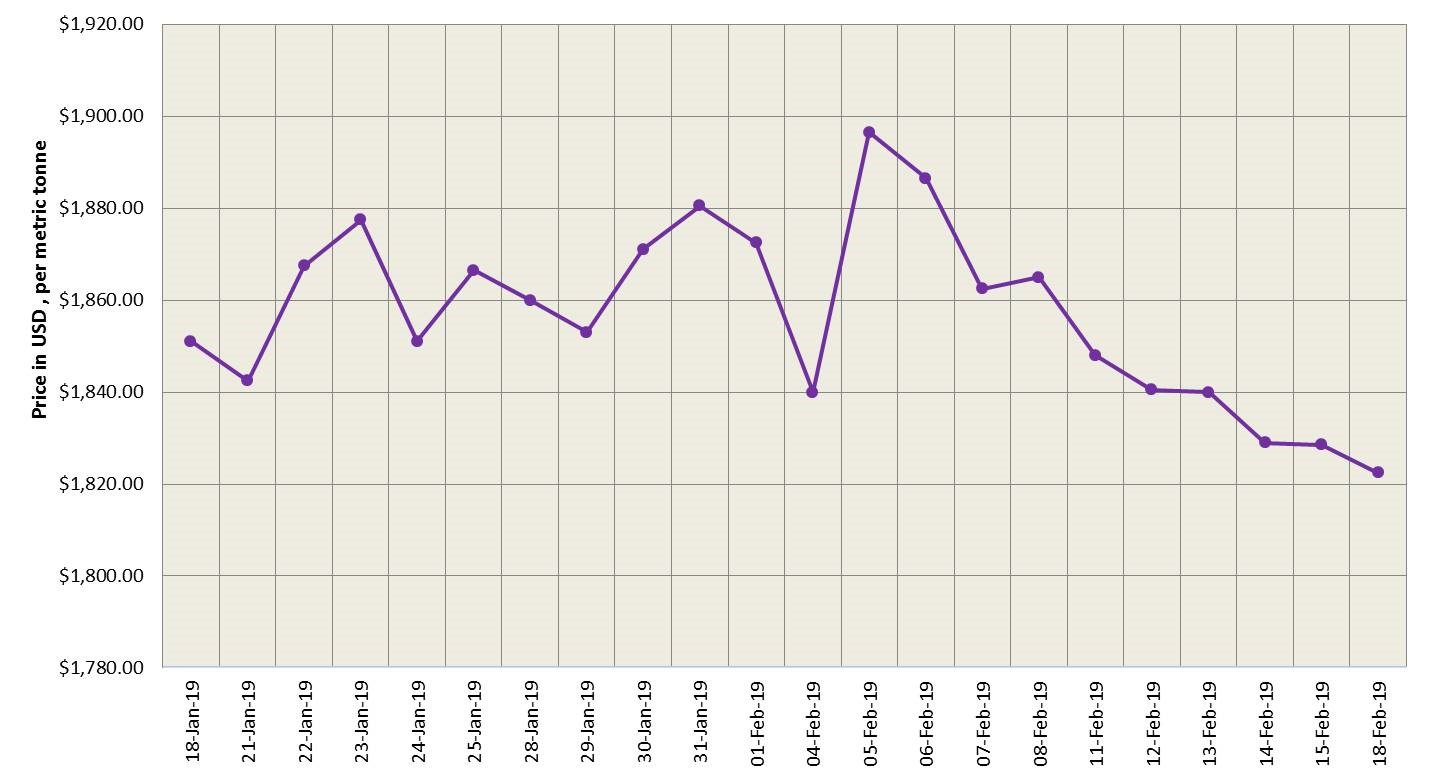

LME aluminium price dropped from last week and closed the day’s trading at US$ 1822.50 per tonne. Sharp gains in Chinese stocks boosted LME aluminium to a day-high of US$1,868 per tonne in Asian trading hours. It later lost some gains to end Monday at US$1,847 per tonne.

{alcircleadd}

As on February 18, LME aluminium cash (bid) price stood at US$ 1821.50 per tonne, LME official settlement price stands at US$ 1822.50 per tonne; 3-months bid price stands at US$ 1852 per tonne, 3-months offer price is US$ 1854 per tonne; Dec 19 bid price stands at US$ 1998 per tonne, and Dec 19 offer price stands at US$ 2003 per tonne.

The LME aluminium opening stock decreased to 1260325 tonnes. Live Warrants totalled at 668725 tonnes, and Cancelled Warrants were 591600 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1866 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 1981 per tonne today from US$ 1992 per tonne on February 18.

Improved macroeconomic sentiment lifted the SHFE 1903 contract from a low of RMB 13,420 per tonne in early trades, to an intraday high of RMB 13,475 per tonne near closing yesterday. It closed at RMB 13,460 per tonne. A lack of confidence among longs lowered the SHFE 1903 contract overnight to end at RMB 13,405 per tonne. It is expected to trade at RMB 13,300-13,500 per tonne today with spot discounts at RMB 50-10 per tonne against the March contract.

Responses