Benchmark aluminium price on London Metal Exchange dropped further to close at US$2,168 per tonne on Thursday, February 8, down 0.59 per cent from the previous day’s close at US$2,181 per tonne. Thanks to the recent share market volatility, most of the components in the LME base metal complex were able to hold grounds, except aluminium.

Shanghai Metals Market predicts that LME aluminium will trade range-bound at US$2,158-2,193 per tonne range on Friday, February 9, with support at the 60-day moving average.

{alcircleadd}

As on February 8, LME official cash buyer aluminium price (Bid Price) stands at US$2,167.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,168 per tonne, 3M Bid Price is US$2,162.50 per tonne, 3M Offer Price is US$2,163 per tonne, Dec1 Bid Price is US$2,213 per tonne, and Dec1 Offer Price is US$2,218 per tonne. LME aluminium opening stock stands at 1058175 tonnes, total Live Warrants is 836950 tonnes, and Cancelled Warrants total at 221225 tonnes.

LME aluminium Asian reference price three-months ABR is given asUS$2,160.50 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has declined from at US$2,226 per tonne on February 8 to US$2,210 per tonne on February 9.

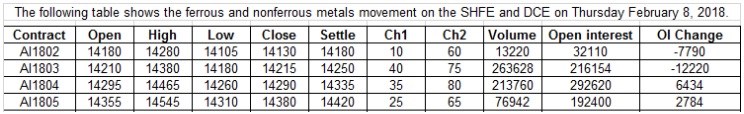

On Shanghai Futures Exchange, SHFE aluminium performed better than other non-ferrous metal contracts which registered sharp falls across the board. The movement of SHFE aluminium on February 8, as updated by SMM is as follows:

SMM foresees pressure at the five-day and ten-day moving averages, but thinks downward room for SHFE aluminium will be limited. SHFE aluminium 1804 is expected to trade at RMB 14,260-14,460 per tonne on Friday, February 9.

Discounts at the spot aluminium market are expected to narrow down at RMB 130-90 per tonne, today, SMM said.

Responses